- Switzerland

- /

- Real Estate

- /

- SWX:PSPN

How Higher Nine-Month Net Income Amid Flat Sales May Shift PSP Swiss Property’s (SWX:PSPN) Investment Story

Reviewed by Sasha Jovanovic

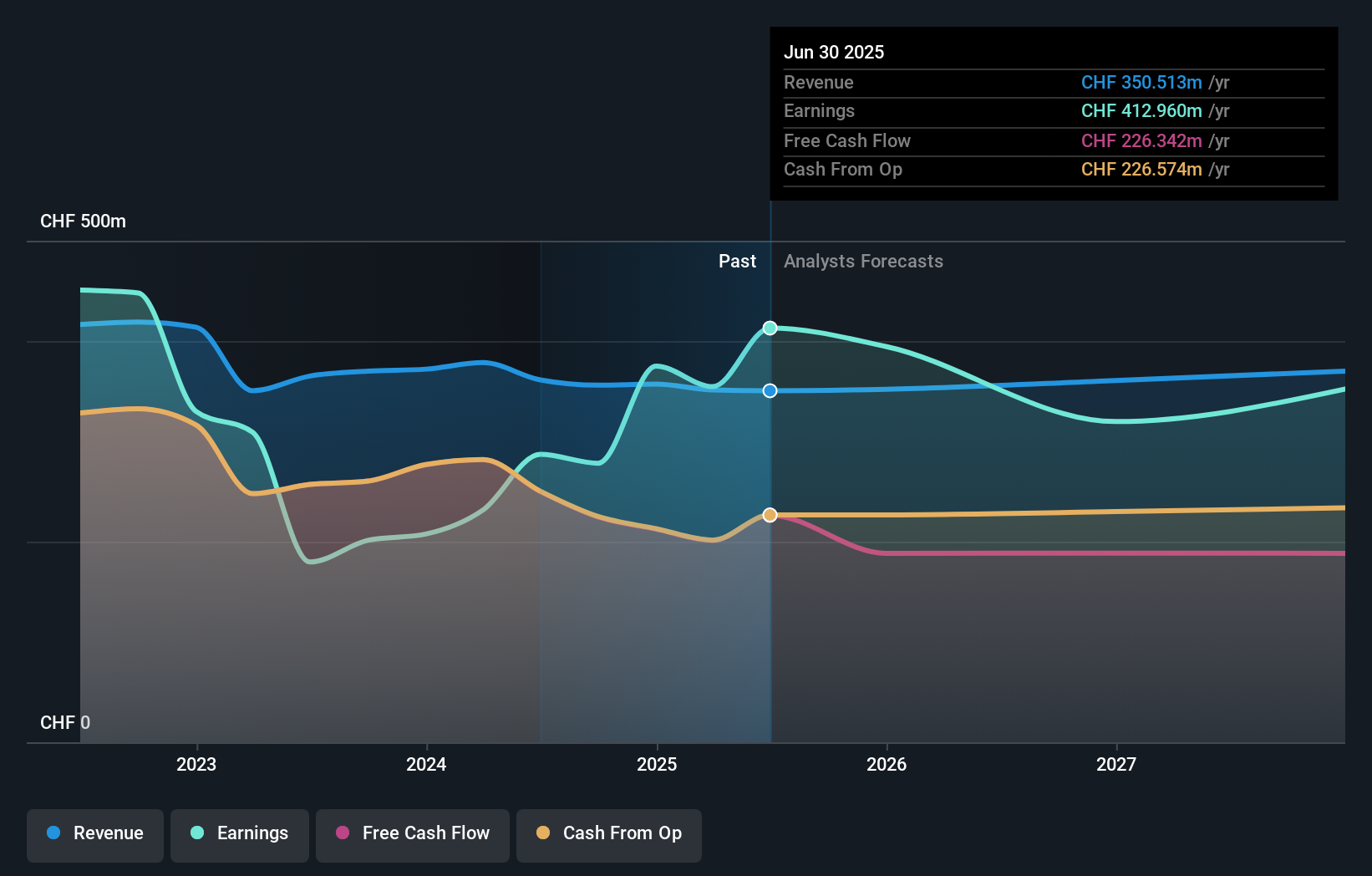

- PSP Swiss Property AG recently released third quarter and nine-month earnings, reporting sales of CHF 87.48 million for the quarter and CHF 261.39 million over the nine months ended September 30, 2025, with respective net incomes of CHF 65.14 million and CHF 259.48 million.

- While quarterly net income declined compared to the previous year, the company achieved a higher cumulative net income over nine months despite stable sales, highlighting nuanced changes in operational efficiency and cost control.

- We will consider how the year-on-year increase in nine-month net income influences the outlook for PSP Swiss Property’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PSP Swiss Property Investment Narrative Recap

At its core, PSP Swiss Property appeals to those who believe in the resilience of prime Swiss commercial real estate, particularly in Zurich and Geneva, underpinned by strict cost control and stable rental demand. The latest earnings update showed nine-month net income rising against a backdrop of flat sales, indicating improved cost efficiency, but this does not materially shift the ongoing short-term risk: a potential oversupply of office space in core markets as large tenants release more properties in coming years.

Among recent announcements, the July 2024 acquisition of a Geneva commercial property intended for conversion to a hotel stands out. While interesting in diversifying asset use and yield, it's not directly linked to the company’s critical near-term catalyst of maintaining high occupancy and rental income in prime office locations, which remains central after the most recent earnings.

But against stronger nine-month earnings, investors should remain watchful of the looming office oversupply risk in key districts, especially as...

Read the full narrative on PSP Swiss Property (it's free!)

PSP Swiss Property's narrative projects CHF374.5 million revenue and CHF274.3 million earnings by 2028. This requires 2.2% yearly revenue growth and a CHF138.7 million earnings decrease from CHF413.0 million.

Uncover how PSP Swiss Property's forecasts yield a CHF141.70 fair value, in line with its current price.

Exploring Other Perspectives

One Simply Wall St Community fair value estimate puts PSP Swiss Property at CHF141.70, based on a single perspective. As expectations of office space oversupply continue to circulate, it's useful to compare how different viewpoints frame the company’s prospects.

Explore another fair value estimate on PSP Swiss Property - why the stock might be worth just CHF141.70!

Build Your Own PSP Swiss Property Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PSP Swiss Property research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PSP Swiss Property research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PSP Swiss Property's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PSPN

PSP Swiss Property

Owns and manages real estate properties in Switzerland.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives