- Switzerland

- /

- Real Estate

- /

- SWX:NREN

We Think Shareholders Are Less Likely To Approve A Pay Rise For Novavest Real Estate AG's (VTX:NREN) CEO For Now

Key Insights

- Novavest Real Estate to hold its Annual General Meeting on 24th of March

- Total pay for CEO Peter Mettler includes CHF500.0k salary

- The overall pay is comparable to the industry average

- Novavest Real Estate's three-year loss to shareholders was 8.6% while its EPS was down 22% over the past three years

As many shareholders of Novavest Real Estate AG (VTX:NREN) will be aware, they have not made a gain on their investment in the past three years. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 24th of March will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Novavest Real Estate

How Does Total Compensation For Peter Mettler Compare With Other Companies In The Industry?

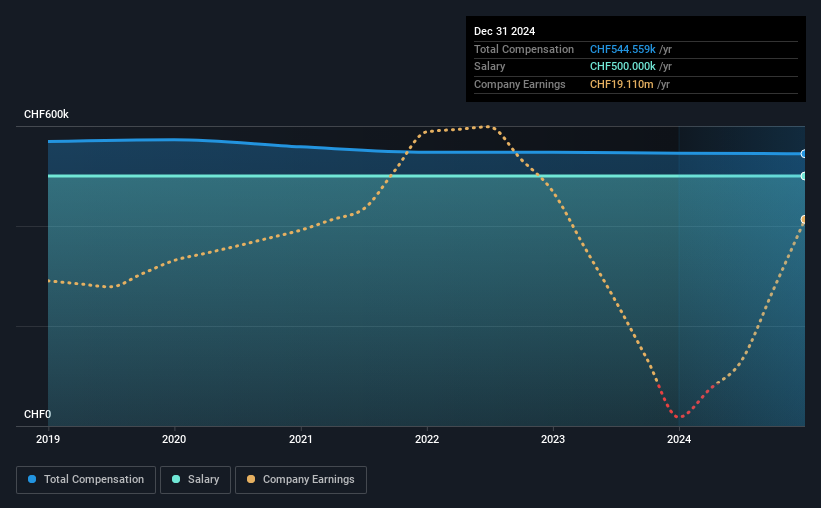

According to our data, Novavest Real Estate AG has a market capitalization of CHF382m, and paid its CEO total annual compensation worth CHF545k over the year to December 2024. That is, the compensation was roughly the same as last year. Notably, the salary which is CHF500.0k, represents most of the total compensation being paid.

For comparison, other companies in the Swiss Real Estate industry with market capitalizations ranging between CHF176m and CHF704m had a median total CEO compensation of CHF545k. This suggests that Novavest Real Estate remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF500k | CHF500k | 92% |

| Other | CHF45k | CHF45k | 8% |

| Total Compensation | CHF545k | CHF545k | 100% |

On an industry level, roughly 51% of total compensation represents salary and 49% is other remuneration. It's interesting to note that Novavest Real Estate pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Novavest Real Estate AG's Growth Numbers

Novavest Real Estate AG has reduced its earnings per share by 22% a year over the last three years. It achieved revenue growth of 23% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Novavest Real Estate AG Been A Good Investment?

Given the total shareholder loss of 8.6% over three years, many shareholders in Novavest Real Estate AG are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Novavest Real Estate (of which 3 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Important note: Novavest Real Estate is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Novavest Real Estate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:NREN

Novavest Real Estate

Engages in the real estate activities in Switzerland.

Slight risk with acceptable track record.

Market Insights

Community Narratives