- Switzerland

- /

- Real Estate

- /

- SWX:IREN

Steer Clear Of Investis Holding And Explore This One Attractive Dividend Stock Instead

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often sought after for their potential to provide investors with a steady income stream. However, caution is warranted when a company like Investis Holding exhibits an excessively high payout ratio, which may indicate that its dividends are not sustainable over the long term. In this article, we will explore why such financial metrics are crucial in assessing the viability of dividend investments and highlight another Swiss stock that presents a more attractive opportunity.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Vontobel Holding (SWX:VONN) | 5.56% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.36% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.36% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.90% | ★★★★★☆ |

| CPH Group (SWX:CPHN) | 5.88% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.72% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.15% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Below we spotlight one of our favorites from our exclusive screener and one you might the flick.

Top Pick

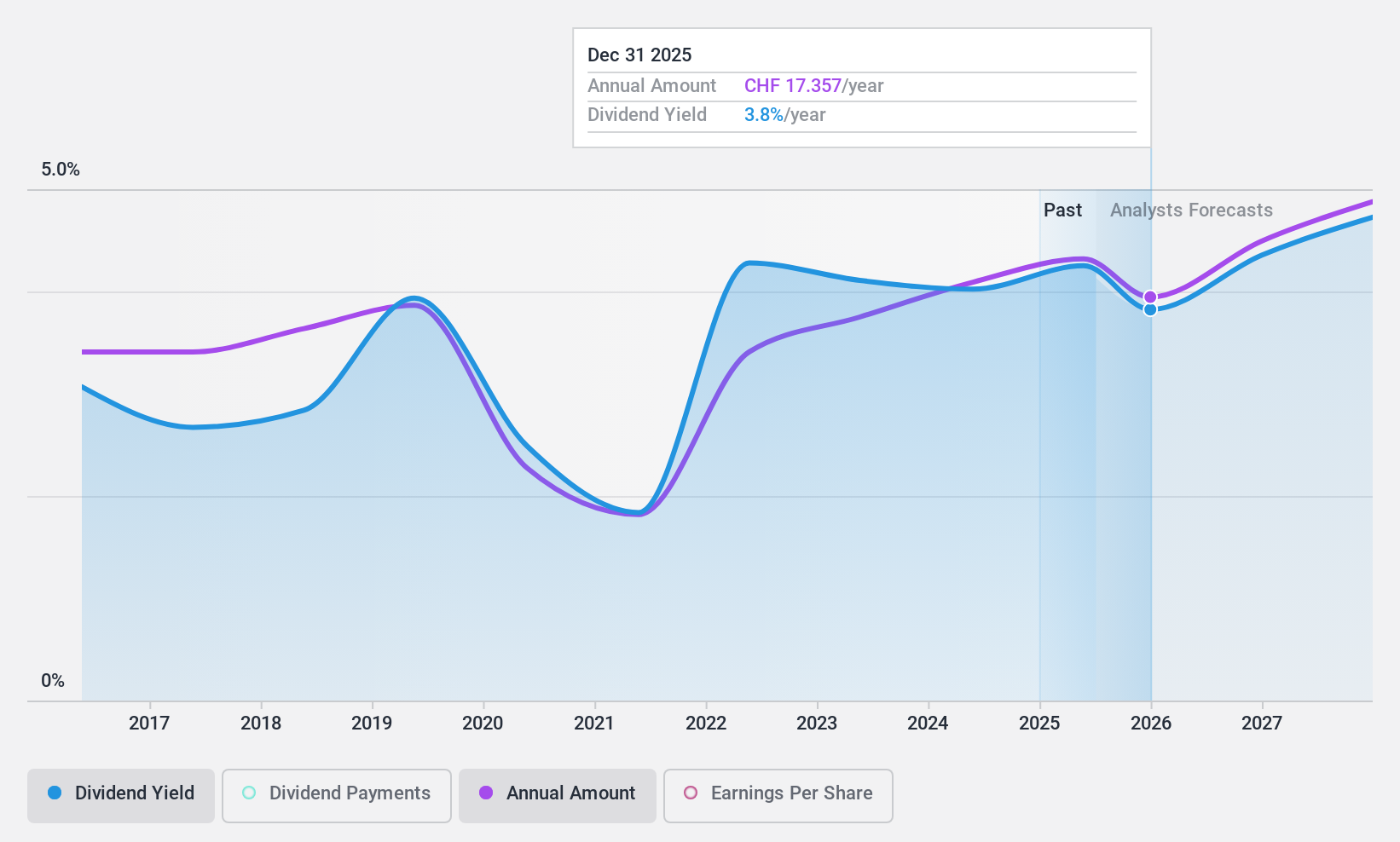

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Phoenix Mecano AG operates globally, manufacturing and selling components for industrial customers with a market capitalization of CHF 466.06 million.

Operations: The company's revenue is primarily generated from three segments: Enclosure Systems (€231.16 million), Industrial Components (€223.58 million), and Dewertokin Technology Group (€335.80 million).

Dividend Yield: 6%

Phoenix Mecano AG, with a solid dividend yield of 6.09%, stands out in the Swiss market. Recent approvals at their AGM include a special dividend and an ordinary increase, reflecting a robust payout strategy. Despite some volatility in its dividend history, the current earnings cover (68.4%) and cash flow cover (58.1%) ensure sustainability, contrasting sharply with firms showing strained payout ratios. Trading at 25.4% below estimated fair value also suggests an attractive entry point for value-oriented investors.

- Get an in-depth perspective on Phoenix Mecano's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Phoenix Mecano is priced lower than what may be justified by its financials.

One To Reconsider

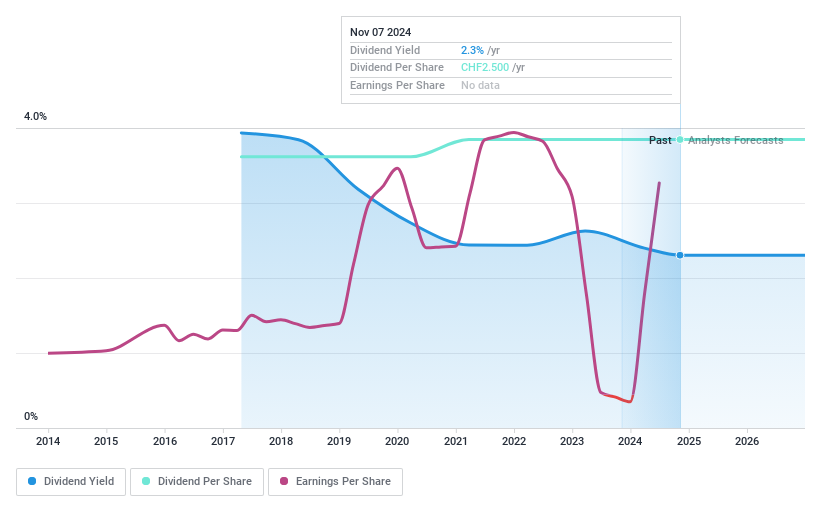

Investis Holding (SWX:IREN)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Investis Holding SA is a residential real estate company based in Switzerland, with a market capitalization of approximately CHF 1.29 billion.

Operations: The company generates revenue through two main segments: Properties, which brought in CHF 53.08 million, and Real Estate Services, contributing CHF 181.70 million.

Dividend Yield: 2.5%

Investis Holding SA, despite a recent dividend affirmation of CHF 2.50 per share, presents concerns for dividend-focused investors due to its unsustainable payout practices. The company's dividend yield of 2.45% falls below the Swiss market's top quartile average of 4.22%. Notably, dividends are not well-covered by earnings or profitable operations, indicating potential risk in sustained payouts. Recent activities include a presentation at the ROTH MKM conference and discussions on M&A with PHM Group Oy, highlighting strategic moves yet overshadowed by fundamental financial weaknesses.

- Click here to discover the nuances of Investis Holding with our detailed analytical dividend report.

Where To Now?

- Delve into our full catalog of 26 Top Dividend Stocks here.

- Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:IREN

Investis Holding

Operates as a residential real estate company in Switzerland.

Fair value with acceptable track record.