- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

Why SKAN Group (SWX:SKAN) Is Down 6.9% After Cutting 2025 Guidance on Project Delays

Reviewed by Sasha Jovanovic

- Earlier this month, SKAN Group AG issued a profit warning for 2025 after a portfolio review revealed several project delays, resulting in lowered earnings and sales guidance for the current financial year.

- Despite the near-term challenges, SKAN reiterated its medium-term targets and highlighted a robust order intake that is expected to drive a strong rebound in 2026.

- We’ll examine how SKAN’s revised 2025 outlook and order backlog developments impact the longer-term investment case for the company.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SKAN Group Investment Narrative Recap

To be a SKAN Group shareholder, you need to believe in the company’s long-term structural growth opportunity in pharmaceutical isolators and cleanroom technology, as well as management’s ability to convert a growing order intake into sustainable sales and profit. The recent profit warning, driven by project delays, materially impacts near-term earnings visibility and elevates the risk that further postponements could disrupt future guidance, making successful project execution the primary short-term catalyst and risk for the business.

One of the most relevant recent announcements is SKAN’s confirmation of its medium-term targets, even in the face of lowered 2025 guidance. Management citing continued strong order intake and an unchanged ambition for mid- to upper-teen sales growth reflects confidence in underlying demand, but places even greater emphasis on converting backlog into revenue and avoiding further project slips to support a more robust recovery in 2026.

Yet, investors should be especially mindful that if project delays persist, there is not much room before guidance could be impacted again...

Read the full narrative on SKAN Group (it's free!)

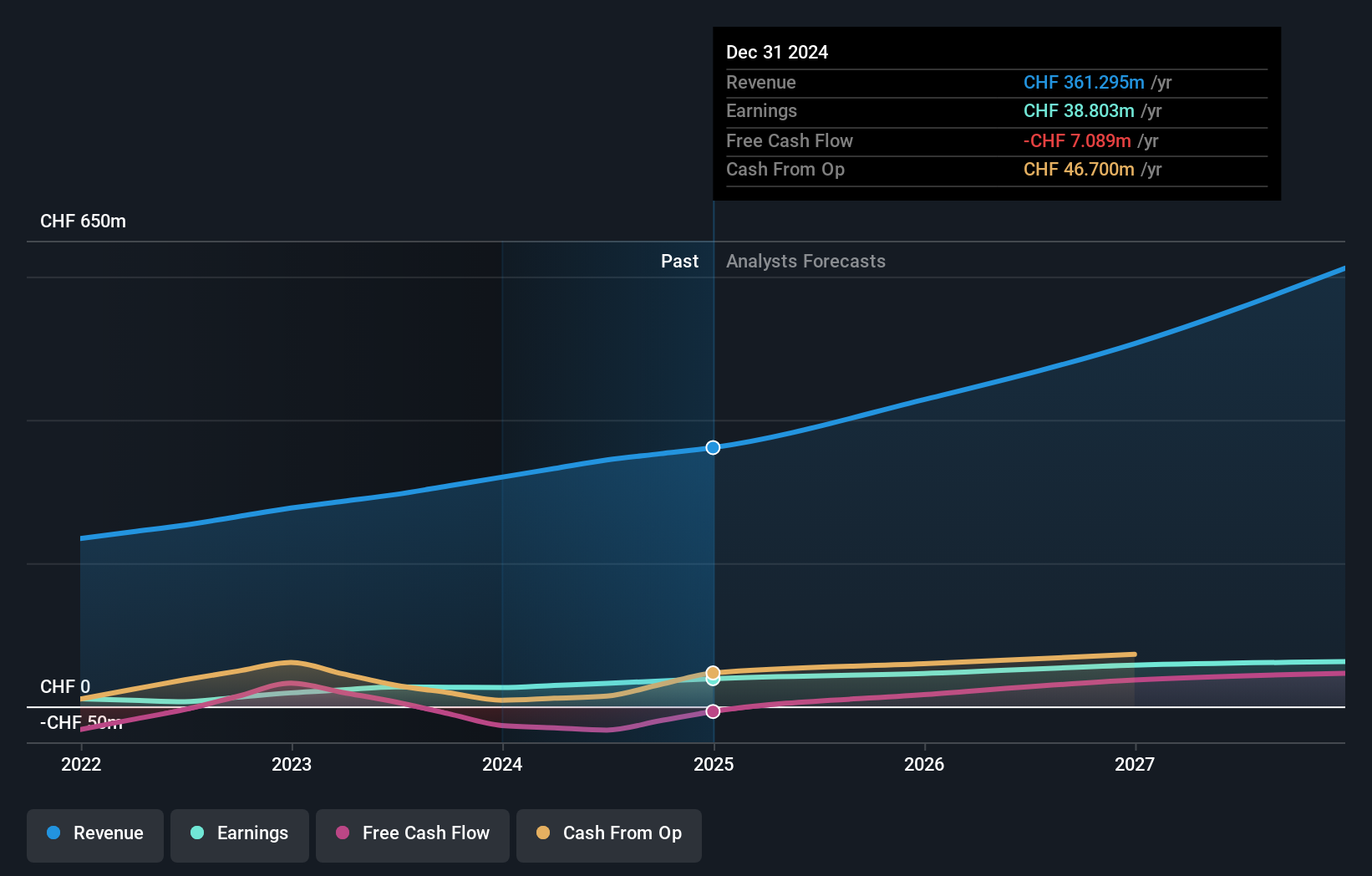

SKAN Group's outlook forecasts CHF616.9 million in revenue and CHF72.8 million in earnings by 2028. This implies a 22.9% annual revenue growth and a CHF56.6 million increase in earnings from the current CHF16.2 million.

Uncover how SKAN Group's forecasts yield a CHF78.33 fair value, a 69% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate SKAN Group’s fair value between CHF61.31 and CHF78.33, with just two perspectives driving that span. Even with bullish order backlog signals, recurring project delays raise questions about SKAN’s future results and make it crucial to compare these differing viewpoints before deciding.

Explore 2 other fair value estimates on SKAN Group - why the stock might be worth just CHF61.31!

Build Your Own SKAN Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SKAN Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SKAN Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SKAN Group's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Europe, the Americas, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives