- Switzerland

- /

- Pharma

- /

- SWX:NWRN

Take Care Before Diving Into The Deep End On Newron Pharmaceuticals S.p.A. (VTX:NWRN)

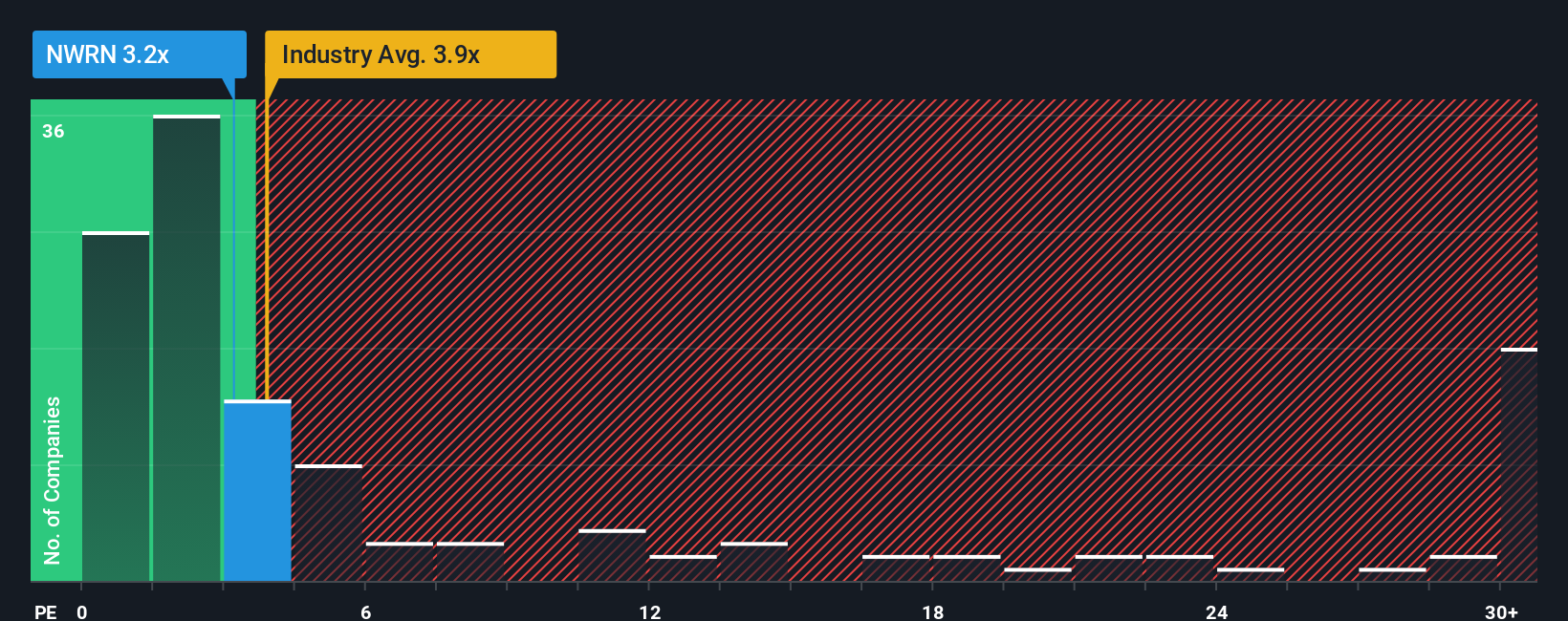

Newron Pharmaceuticals S.p.A.'s (VTX:NWRN) price-to-sales (or "P/S") ratio of 3.2x might make it look like a strong buy right now compared to the Pharmaceuticals industry in Switzerland, where around half of the companies have P/S ratios above 6.7x and even P/S above 14x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Newron Pharmaceuticals

What Does Newron Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Newron Pharmaceuticals has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Newron Pharmaceuticals.Do Revenue Forecasts Match The Low P/S Ratio?

Newron Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 16% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 3.5% each year, which is noticeably less attractive.

In light of this, it's peculiar that Newron Pharmaceuticals' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Newron Pharmaceuticals' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Newron Pharmaceuticals you should know about.

If these risks are making you reconsider your opinion on Newron Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Newron Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:NWRN

Newron Pharmaceuticals

A biopharmaceutical company, discovers and develops novel therapies for patients with diseases of the central and peripheral nervous system in Italy and the United States.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives