- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Is Novartis Trading Below Fair Value After Recent Price Swings in 2025?

Reviewed by Bailey Pemberton

- Wondering if Novartis is still a smart buy, especially as markets search for true value in giant pharma stocks?

- While shares have climbed 14.5% year-to-date and are up 13.5% over the last year, price swings like the recent 3.1% gain this week and 3.1% dip last month signal shifting investor moods.

- This volatility comes as Novartis moves ahead with strategic initiatives, including its focus on innovative medicines and ongoing restructuring to sharpen its business. Headlines continue to highlight portfolio streamlining and new therapy approvals, both of which provide meaningful context to those recent price moves.

- When we run Novartis through our valuation checks, it scores a strong 5 out of 6 for undervaluation. However, the real story goes beyond just numbers. Let’s dig into the popular ways to assess Novartis’s value, then explore what might be an even better approach for today’s market.

Approach 1: Novartis Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting those projections back to today's value, providing a view of the stock’s intrinsic worth based on its earnings power over time.

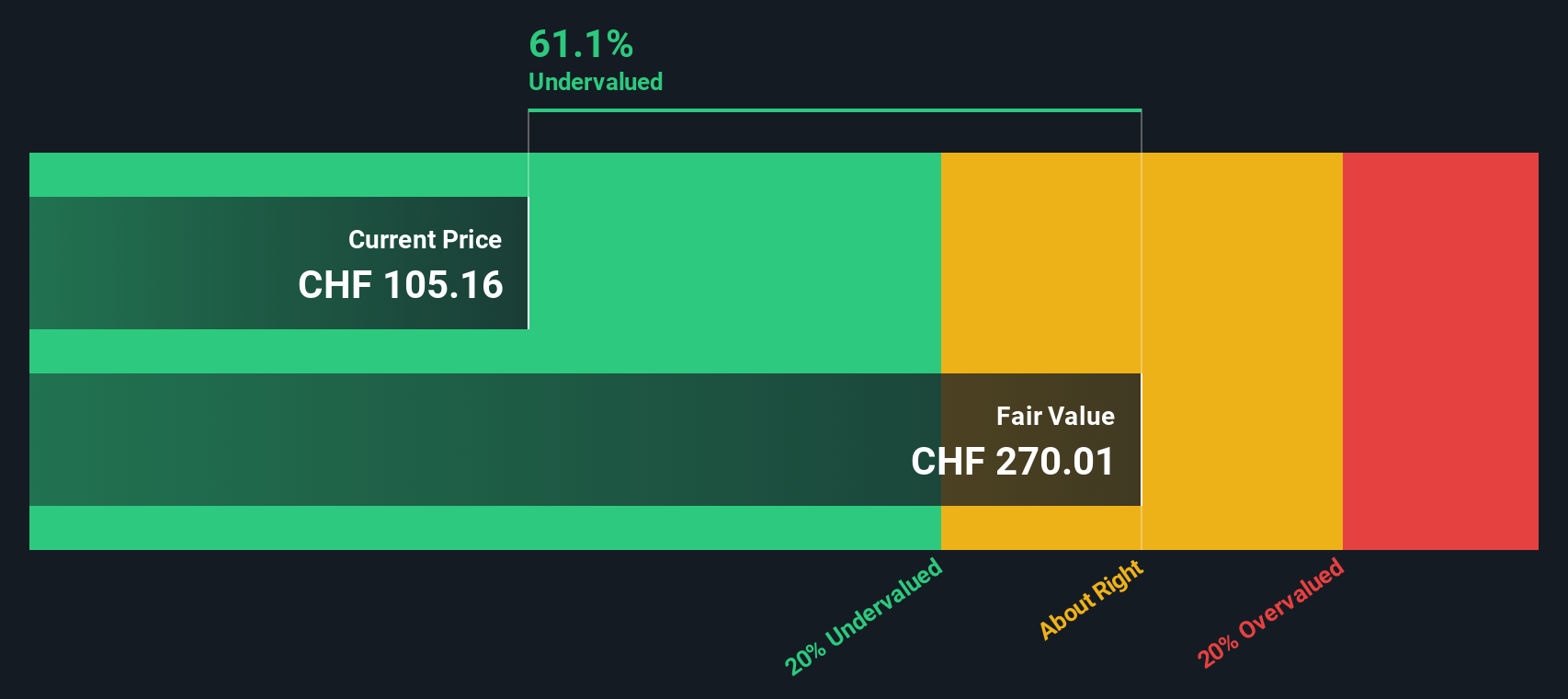

For Novartis, the current Free Cash Flow stands at $18.2 Billion, reflecting a solid foundation for future growth. Analyst forecasts suggest Free Cash Flow will rise steadily, reaching $20.8 Billion by the end of 2029. Since analysts generally provide projections up to five years, any estimates beyond that, such as ten-year forecasts, are calculated using long-term growth assumptions from Simply Wall St.

This approach currently produces an estimated intrinsic value for Novartis of $274.88 per share. This amount suggests the stock is trading at a sizable 62.9% discount to its DCF-based fair value. In other words, Novartis shares appear significantly undervalued based on this widely respected valuation method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novartis is undervalued by 62.9%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

Approach 2: Novartis Price vs Earnings

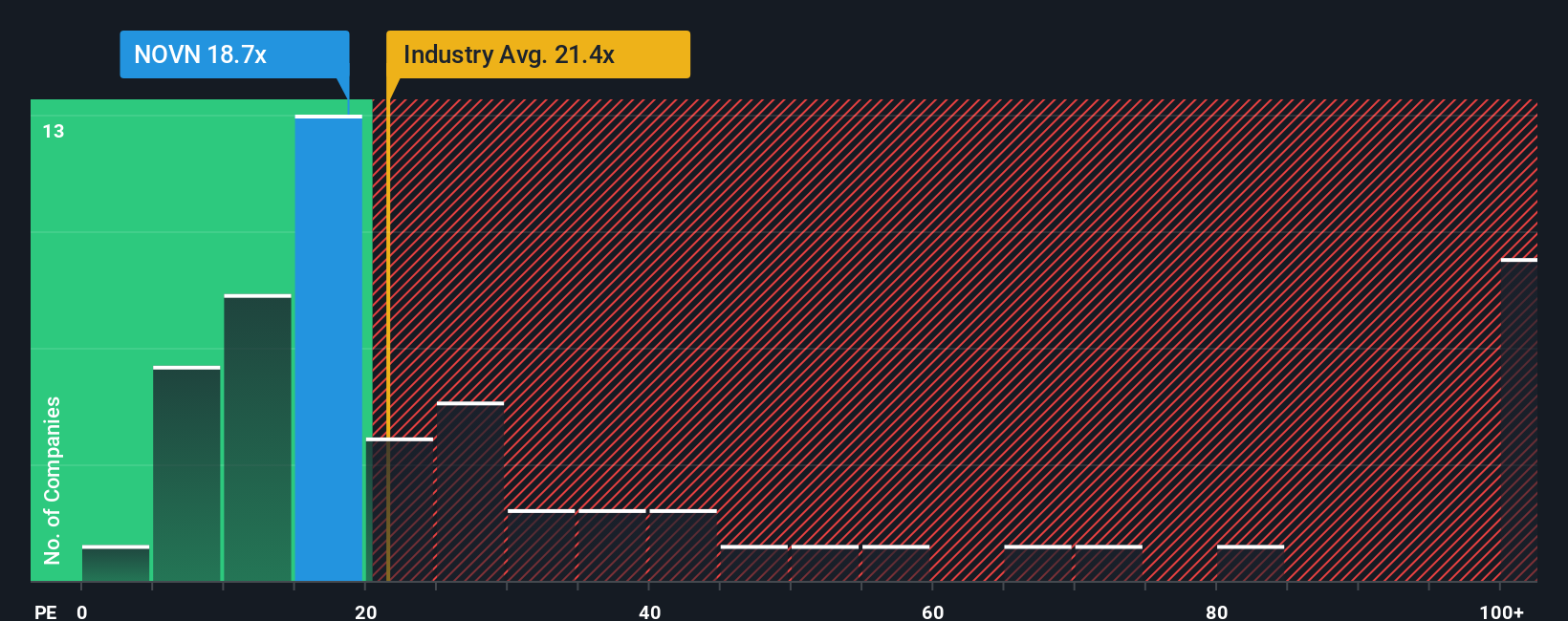

The Price-to-Earnings (PE) ratio is a widely used way to value strong, profitable companies like Novartis because it directly compares the price investors are willing to pay for each dollar of current earnings. For established firms with steady profits, this multiple gives a clear, apples-to-apples measure against industry standards or other large peers.

What counts as a “normal” or “fair” PE ratio, however, depends on what investors expect for future growth and how much risk is involved. Companies expected to grow quickly or with more stable earnings will usually command a higher PE, while those facing more uncertainty tend to trade at a discount.

Novartis is currently trading at a PE ratio of 16.84x. For context, the average PE across the Pharmaceuticals industry sits at 23.36x, and key peers trade at an average of 76.67x. On first glance, Novartis appears attractively priced compared to both its industry and competitors.

Simply Wall St’s “Fair Ratio” for Novartis is 30.86x. Unlike basic comparisons with industry or peers, the Fair Ratio factors in the company’s growth outlook, profit margins, market cap, and relevant risks to provide a more tailored benchmark. This approach recognizes that what’s fair for a giant, well-established business with a strong profit base can differ meaningfully from smaller or riskier players in the same sector.

Right now, Novartis’s actual PE is well below its Fair Ratio. This indicates the stock is undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novartis Narrative

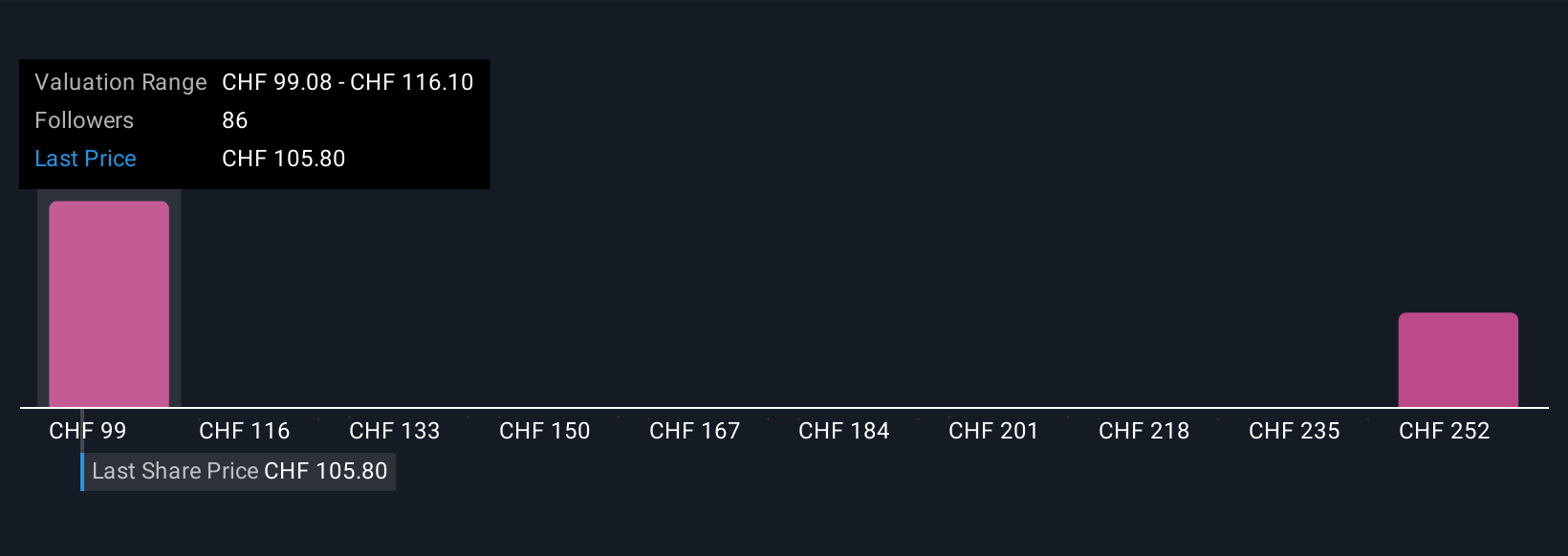

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives offer a simple yet powerful framework for making investment decisions by allowing you to build and share your own view of a company, connecting the story you see behind Novartis to specific financial forecasts and estimated fair value.

Rather than relying solely on traditional metrics, Narratives empower you to articulate your expectations about Novartis’s future revenue, earnings, margins, and risks, and then translate those beliefs into a personalized fair value for the stock. They bridge the gap between numbers and real-world context, helping you quickly see whether the current price is aligned with your outlook or if it presents an opportunity to buy or sell.

Accessible to everyone on Simply Wall St’s Community page, Narratives are used by millions of investors and update dynamically when new data or news arises, ensuring your viewpoint always stays current. For example, within the Novartis Community, you may see some Narratives valuing the stock as high as CHF120.06, driven by optimism about advanced therapies and market expansion, while others are more cautious, suggesting values as low as CHF79.67 due to patent expirations and pricing pressures.

Do you think there's more to the story for Novartis? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives