Stock Analysis

- Switzerland

- /

- Life Sciences

- /

- SWX:LONN

As Lonza Group (VTX:LONN) lifts 7.3% this past week, investors may now be noticing the company's three-year earnings growth

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Lonza Group AG (VTX:LONN) shareholders, since the share price is down 37% in the last three years, falling well short of the market decline of around 8.9%. And over the last year the share price fell 25%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 14% in the last three months.

On a more encouraging note the company has added CHF1.9b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Lonza Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Lonza Group actually managed to grow EPS by 17% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

With a rather small yield of just 1.0% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 20% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Lonza Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

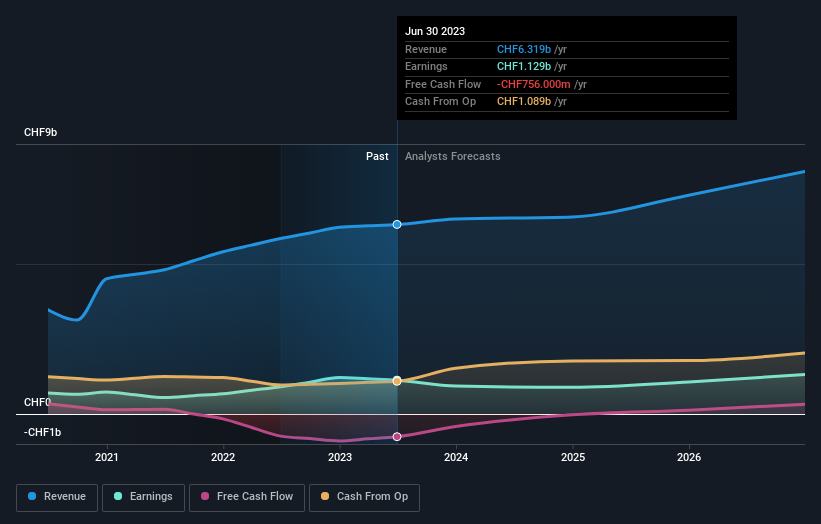

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Lonza Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 1.0% in the last year, Lonza Group shareholders lost 24% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Lonza Group is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Lonza Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LONN

Lonza Group

Lonza Group AG, together with its subsidiaries, supplies various products and services for pharmaceutical, biotech, and nutrition markets in Europe, North and Central America, Latin America, Asia, Australia, New Zealand, and internationally.

Flawless balance sheet and fair value.