- Switzerland

- /

- Biotech

- /

- SWX:KURN

Why Investors Shouldn't Be Surprised By Kuros Biosciences AG's (VTX:KURN) 35% Share Price Surge

Kuros Biosciences AG (VTX:KURN) shares have continued their recent momentum with a 35% gain in the last month alone. The last 30 days were the cherry on top of the stock's 481% gain in the last year, which is nothing short of spectacular.

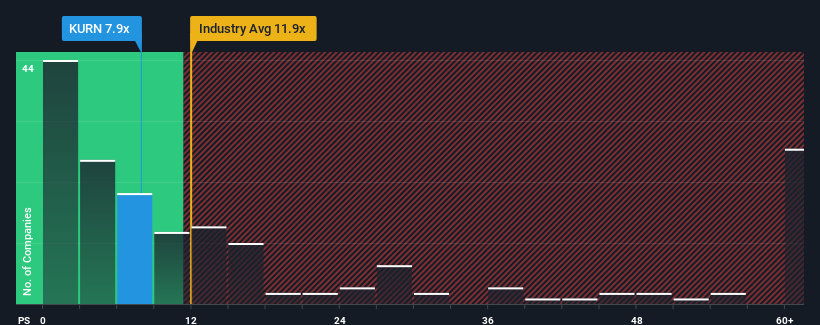

After such a large jump in price, Kuros Biosciences may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 7.9x, since almost half of all companies in the Biotechs industry in Switzerland have P/S ratios under 5x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kuros Biosciences

What Does Kuros Biosciences' Recent Performance Look Like?

Kuros Biosciences certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kuros Biosciences' earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Kuros Biosciences' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 87%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 44%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Kuros Biosciences' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Shares in Kuros Biosciences have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Kuros Biosciences maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Kuros Biosciences that you need to be mindful of.

If you're unsure about the strength of Kuros Biosciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kuros Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:KURN

Kuros Biosciences

Engages in the commercialization and development of biologic technologies for musculoskeletal care in the United States of America, the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives