3 European Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 48%

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed economic signals and geopolitical uncertainties, the pan-European STOXX Europe 600 Index has managed to sustain its longest streak of weekly gains since August 2012. This resilience, buoyed by encouraging company results and sector-specific performances, presents a fertile ground for identifying stocks potentially trading below their intrinsic value. In such an environment, discerning investors might focus on companies with strong fundamentals that can weather economic fluctuations while offering potential for long-term value appreciation.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €33.20 | €64.46 | 48.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.65 | €107.22 | 50% |

| Novo Nordisk (CPSE:NOVO B) | DKK631.50 | DKK1234.68 | 48.9% |

| Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO) | €32.60 | €63.35 | 48.5% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.62 | €7.05 | 48.6% |

| Storytel (OM:STORY B) | SEK89.55 | SEK177.35 | 49.5% |

| Fnac Darty (ENXTPA:FNAC) | €28.00 | €55.38 | 49.4% |

| Star7 (BIT:STAR7) | €6.20 | €12.29 | 49.5% |

| Vestas Wind Systems (CPSE:VWS) | DKK103.35 | DKK201.53 | 48.7% |

| EKINOPS (ENXTPA:EKI) | €3.52 | €6.84 | 48.5% |

Let's explore several standout options from the results in the screener.

KB Components (OM:KBC)

Overview: KB Components AB (publ) is a company that designs, develops, manufactures, and sells polymer components for various sectors including automotive, medical, and industrial applications in Sweden and globally, with a market cap of SEK3.89 billion.

Operations: The company's revenue is primarily derived from its Plastics & Rubber segment, which generated SEK2.74 billion.

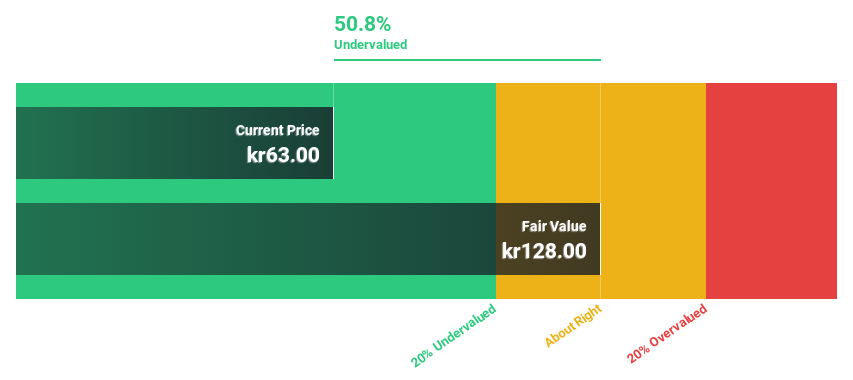

Estimated Discount To Fair Value: 48%

KB Components is currently trading at SEK 67, significantly below its estimated fair value of SEK 128.77, presenting a potential undervaluation based on discounted cash flow analysis. Despite high debt levels and a dividend yield of 2.24% not fully covered by free cash flows, the company's revenue and earnings are forecast to grow faster than the Swedish market over the next three years. Recent financial results show improved sales and reduced net losses compared to previous periods.

- Our growth report here indicates KB Components may be poised for an improving outlook.

- Get an in-depth perspective on KB Components' balance sheet by reading our health report here.

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) specializes in developing, manufacturing, and selling rugged IT solutions across various countries including Sweden, Norway, and the United States, with a market cap of SEK10.44 billion.

Operations: MilDef Group AB generates revenue from its Computer Hardware segment, amounting to SEK1.20 billion.

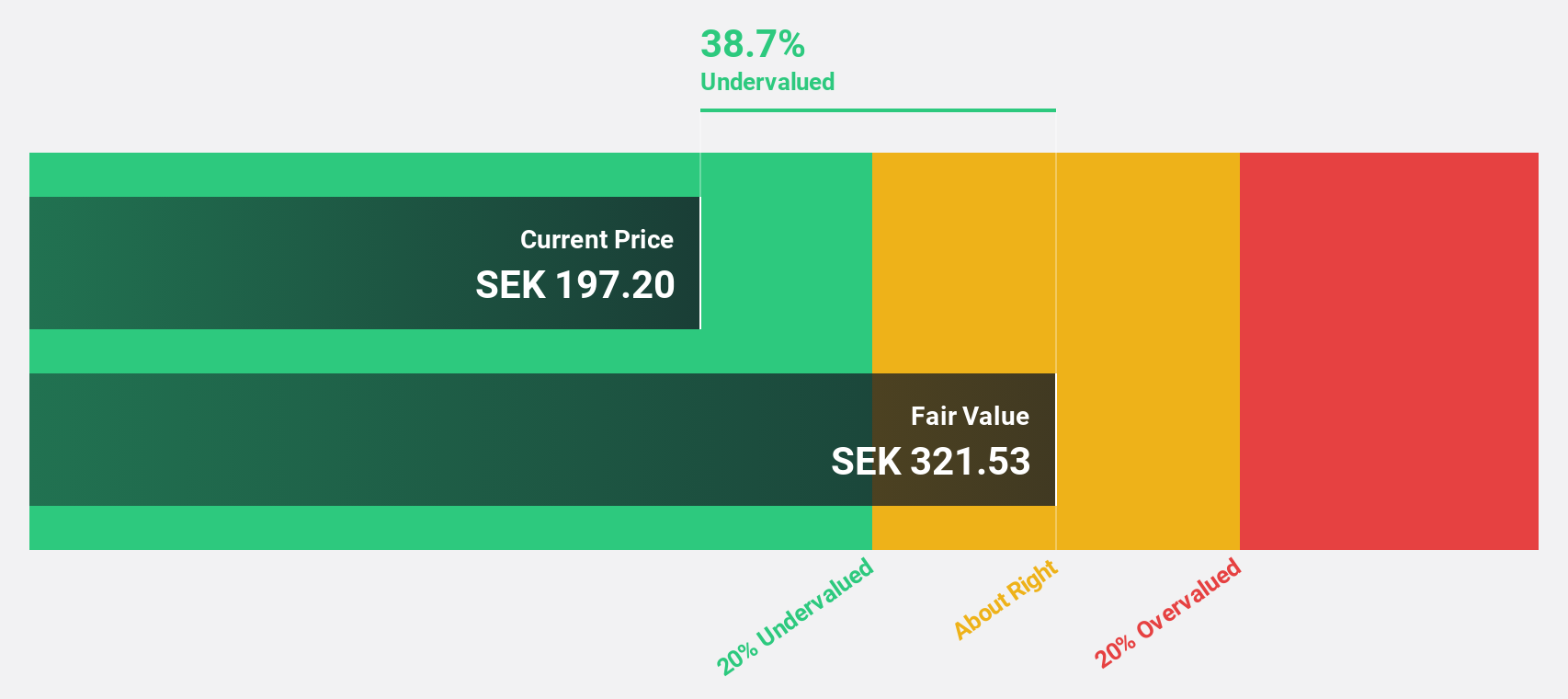

Estimated Discount To Fair Value: 46.2%

MilDef Group is trading at SEK 229, well below its estimated fair value of SEK 425.55, suggesting potential undervaluation based on cash flow analysis. Despite recent net losses, the company has secured significant contracts with the Swedish Defense and BAE Systems worth over SEK 160 million combined. MilDef's revenue is forecast to grow rapidly at 33.5% annually, outpacing the market, with profitability expected within three years despite a volatile share price recently.

- The growth report we've compiled suggests that MilDef Group's future prospects could be on the up.

- Navigate through the intricacies of MilDef Group with our comprehensive financial health report here.

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market capitalization of CHF26.66 billion.

Operations: The company generates revenue primarily from its dermatology segment, amounting to $4.32 billion.

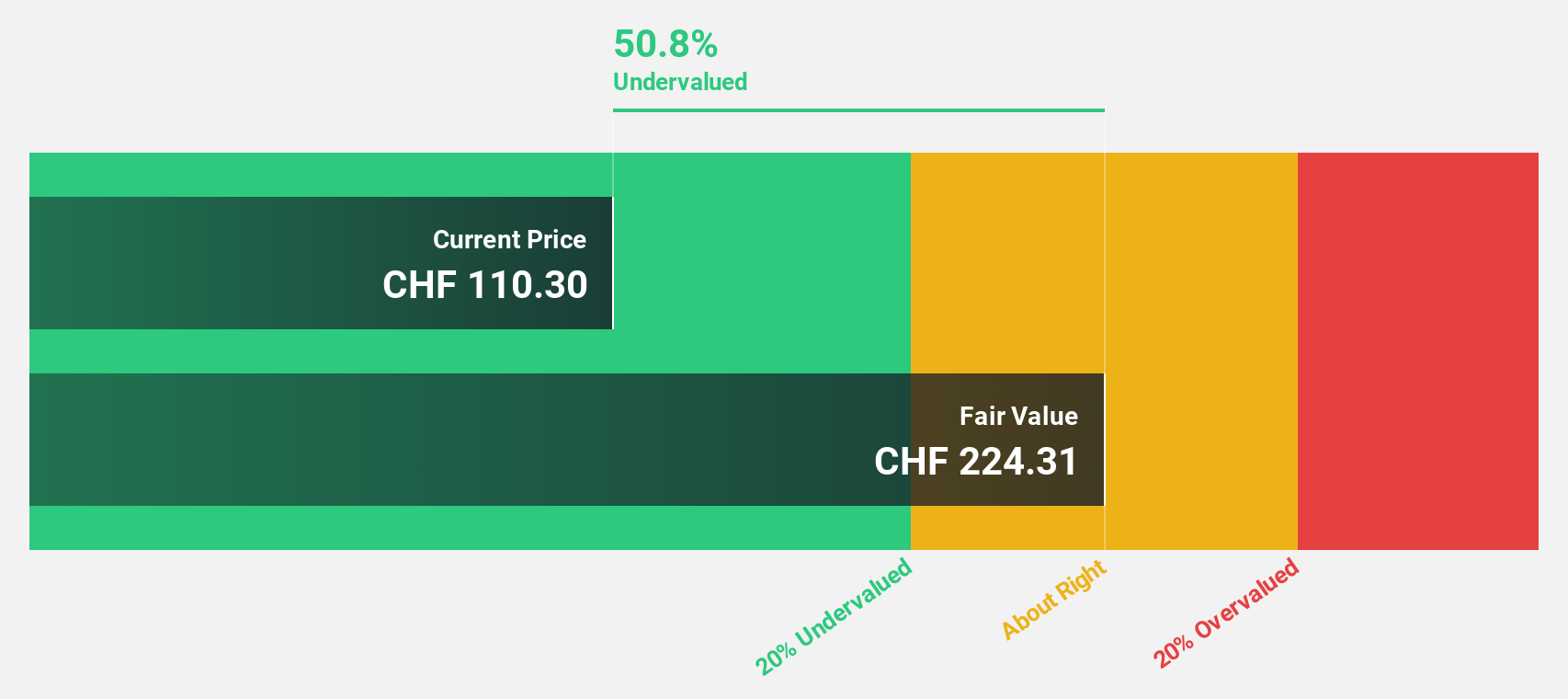

Estimated Discount To Fair Value: 46.8%

Galderma Group, trading at CHF112.24, is significantly undervalued compared to its estimated fair value of CHF210.98, based on cash flow analysis. The company anticipates profitability within three years and has achieved recent regulatory approvals for nemolizumab in the UK and Switzerland, enhancing its dermatology portfolio. Despite a forecasted low return on equity of 10.1%, Galderma expects revenue growth of 11.1% annually, surpassing the Swiss market average growth rate.

- Our expertly prepared growth report on Galderma Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Galderma Group here with our thorough financial health report.

Summing It All Up

- Discover the full array of 202 Undervalued European Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KBC

KB Components

Designs, develops, manufactures, and sells polymer components for light vehicles, heavy vehicles, medical, furniture, lighting, chrome plating, and industrial applications in Sweden and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives