- Switzerland

- /

- Pharma

- /

- SWX:COPN

Increases to CEO Compensation Might Be Put On Hold For Now at Cosmo Pharmaceuticals N.V. (VTX:COPN)

Shareholders of Cosmo Pharmaceuticals N.V. (VTX:COPN) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 28 May 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Cosmo Pharmaceuticals

Comparing Cosmo Pharmaceuticals N.V.'s CEO Compensation With the industry

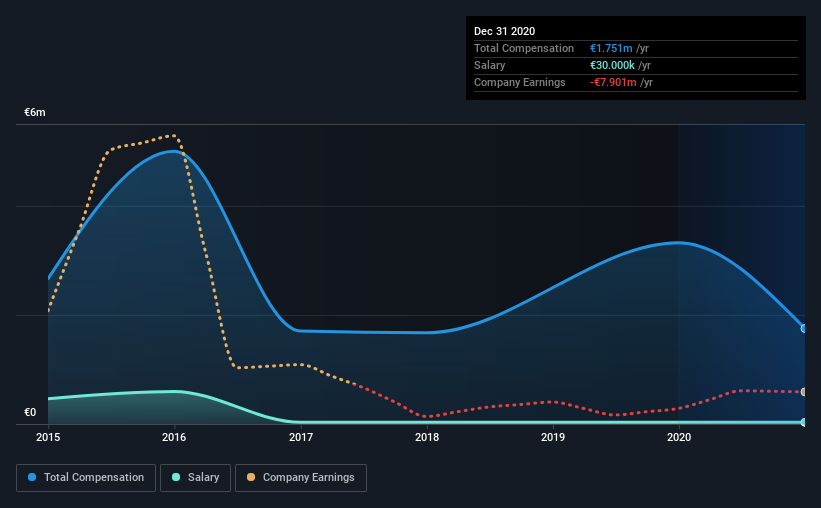

Our data indicates that Cosmo Pharmaceuticals N.V. has a market capitalization of CHF1.2b, and total annual CEO compensation was reported as €1.8m for the year to December 2020. Notably, that's a decrease of 47% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at €30k.

For comparison, other companies in the same industry with market capitalizations ranging between CHF900m and CHF2.9b had a median total CEO compensation of €818k. This suggests that Alessandro Della Cha is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €30k | €30k | 2% |

| Other | €1.7m | €3.3m | 98% |

| Total Compensation | €1.8m | €3.3m | 100% |

Talking in terms of the industry, salary represented approximately 33% of total compensation out of all the companies we analyzed, while other remuneration made up 67% of the pie. A high-salary is usually a no-brainer when it comes to attracting the best executives, but Cosmo Pharmaceuticals paid Alessandro Della Cha a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Cosmo Pharmaceuticals N.V.'s Growth

Cosmo Pharmaceuticals N.V. has seen its earnings per share (EPS) increase by 33% a year over the past three years. Its revenue is down 2.5% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cosmo Pharmaceuticals N.V. Been A Good Investment?

Since shareholders would have lost about 21% over three years, some Cosmo Pharmaceuticals N.V. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Cosmo Pharmaceuticals primarily uses non-salary benefits to reward its CEO. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Cosmo Pharmaceuticals that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Cosmo Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:COPN

Cosmo Pharmaceuticals

Focuses on the development and commercialization products for gastroenterology, dermatology, and healthtech worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026