Stock Analysis

- Switzerland

- /

- Media

- /

- SWX:TXGN

Exploring Undiscovered Swiss Stocks In July 2024

Reviewed by Simply Wall St

Amidst a general downturn in the Switzerland stock market, with the SMI index falling notably due to global economic uncertainties and weak earnings reports from major corporations, investors might find it prudent to look for potential opportunities in less explored areas of the market. In such times, focusing on smaller-cap stocks could offer unique advantages as these companies may have different growth potentials and risks compared to their larger counterparts.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| StarragTornos Group | 12.77% | -2.98% | 29.42% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| SKAN Group | 3.57% | 40.44% | 22.38% | ★★★★★☆ |

| naturenergie holding | 9.95% | 16.32% | 40.54% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★★

Overview: APG|SGA SA specializes in offering advertising solutions, focusing mainly on the Swiss and Serbian markets, with a market capitalization of CHF 611.00 million.

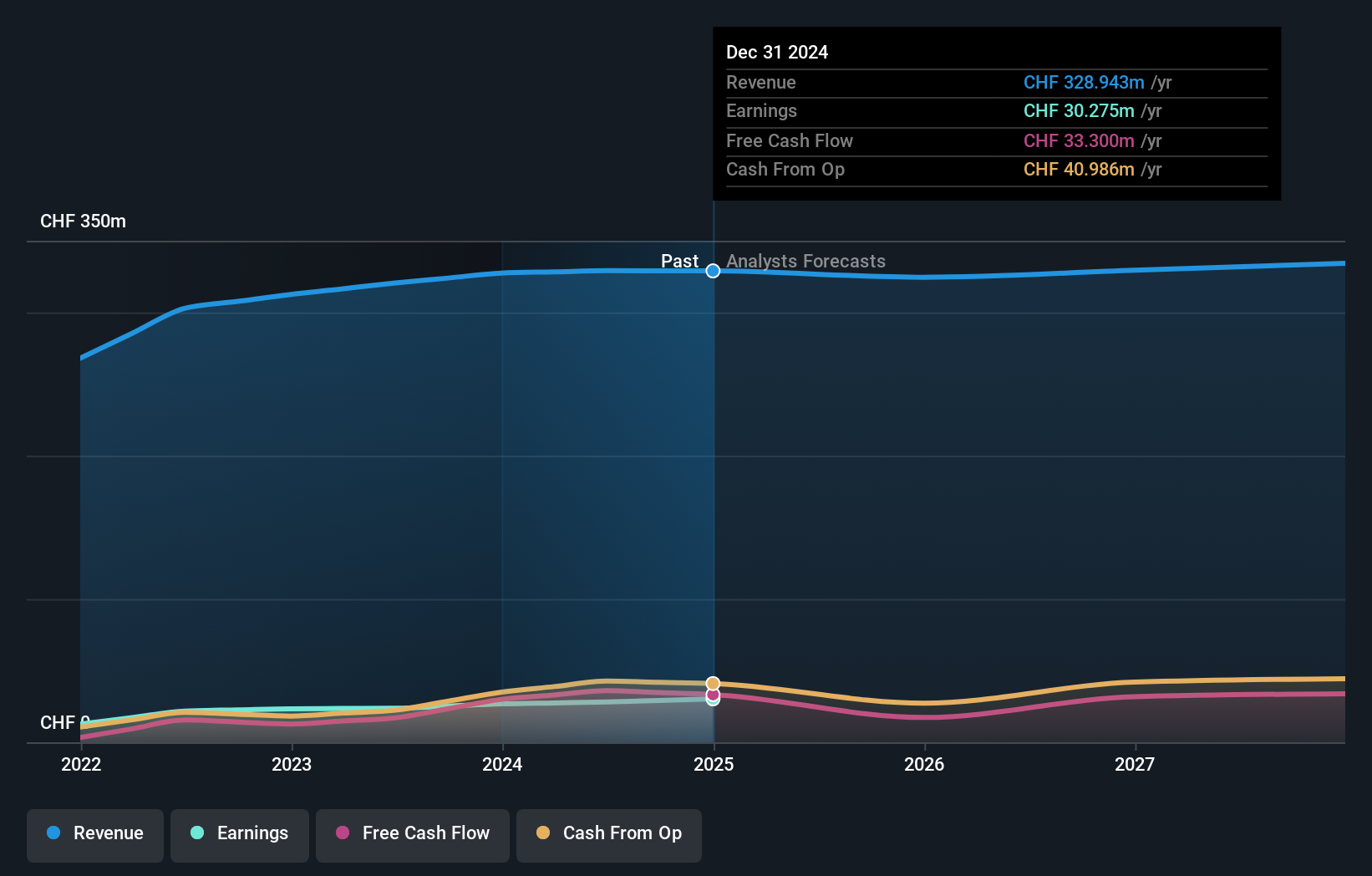

Operations: The company primarily generates its revenue through the acquisition, sale, and management of advertising spaces, with a recent reported revenue of CHF 327.46 million. It incurs costs predominantly from the cost of goods sold (COGS) and operating expenses, which for the latest period were CHF 254.79 million and CHF 42.18 million respectively.

APG|SGA, a standout in the Swiss market, has demonstrated robust financial health with no debt for the past five years and a positive free cash flow. Recently, it outpaced its industry with a 14.6% earnings growth compared to the media sector's 11.7%. Despite an average annual earnings decline of 16.1% over five years, APG|SGa trades at 53.1% below its estimated fair value—a potential indicator of undervaluation. The company's strategic maneuvers include a notable M&A transaction where Neue ZüRcher Zeitung AG acquired a significant stake, enhancing APG|SGA’s market position and shareholder base.

- Click here to discover the nuances of APG|SGA with our detailed analytical health report.

Understand APG|SGA's track record by examining our Past report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG is a Swiss multimedia company engaged in operating a diverse network of digital platforms and holdings, offering services ranging from information delivery to entertainment, with a market capitalization of CHF 1.75 billion.

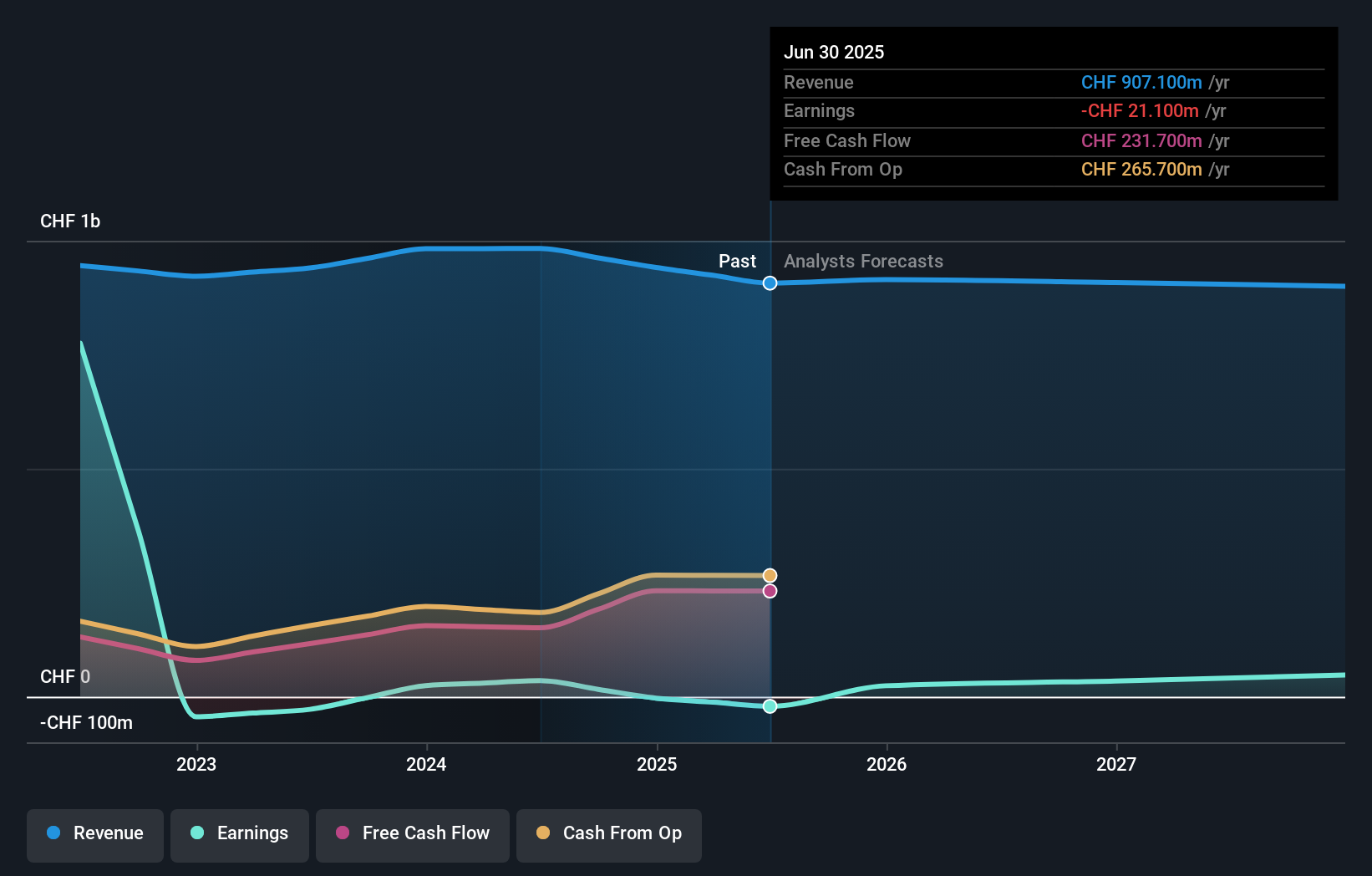

Operations: TX Group operates in diverse media sectors, generating revenue through segments like Tamedia, Goldbach, and 20 Minutes, among others. The company's financial operations reflect a consistent focus on managing costs related to goods sold and operational expenses while navigating non-operating expenses that impact net income.

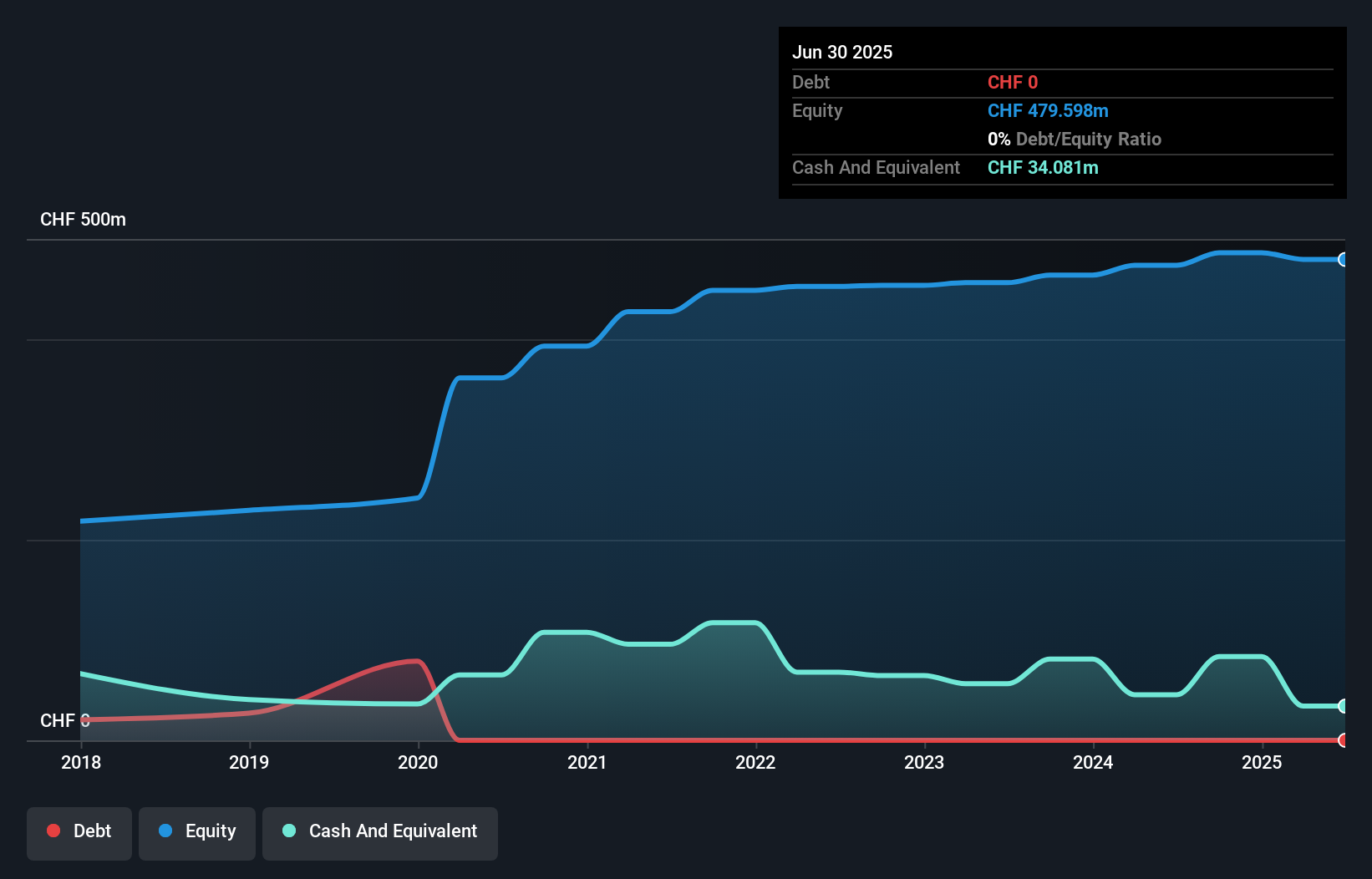

TX Group, a lesser-known Swiss entity, has recently turned profitable and is trading at 73.3% below its estimated fair value, signaling potential undervalued status. With a debt reduction from 7.6% to 1% over five years and more cash than total debt, TX Group's financial health appears robust. The company's earnings are expected to grow by approximately 23% annually, outpacing the media industry's growth of 11.7%. This combination of profitability, low debt levels, and significant growth potential makes TX Group an intriguing prospect for investors seeking hidden gems in the Swiss market.

- Get an in-depth perspective on TX Group's performance by reading our health report here.

Examine TX Group's past performance report to understand how it has performed in the past.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is a Swiss company specializing in the design, production, and distribution of kitchen and laundry appliances for private households, operating both domestically and globally with a market capitalization of CHF 350.10 million.

Operations: V-ZUG Holding primarily generates revenue through the sale of household appliances, with recent figures showing a revenue of CHF 571.35 million. The company has experienced fluctuations in its gross profit margin, which most recently stood at approximately 35.43%.

V-ZUG Holding AG, a lesser-known yet robust player in the Consumer Durables sector, demonstrated an impressive performance with a year-over-year earnings growth of 89.2%, significantly outpacing the industry's decline of 1.2%. With no debt and earnings forecasted to grow by 36.47% annually, V-ZUG trades at 79.8% below its estimated fair value, suggesting substantial upside potential. Recent financials reveal sales of CHF 284 million and a net income increase to CHF 8.73 million, underscoring its operational strength amidst challenging markets.

- Click here and access our complete health analysis report to understand the dynamics of V-ZUG Holding.

Review our historical performance report to gain insights into V-ZUG Holding's's past performance.

Summing It All Up

- Unlock more gems! Our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals screener has unearthed 15 more companies for you to explore.Click here to unveil our expertly curated list of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland.

Flawless balance sheet average dividend payer.