It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like TX Group (VTX:TXGN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for TX Group

TX Group's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that TX Group grew its EPS from CHF1.25 to CHF73.17, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that TX Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. It was a year of stability for TX Group as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

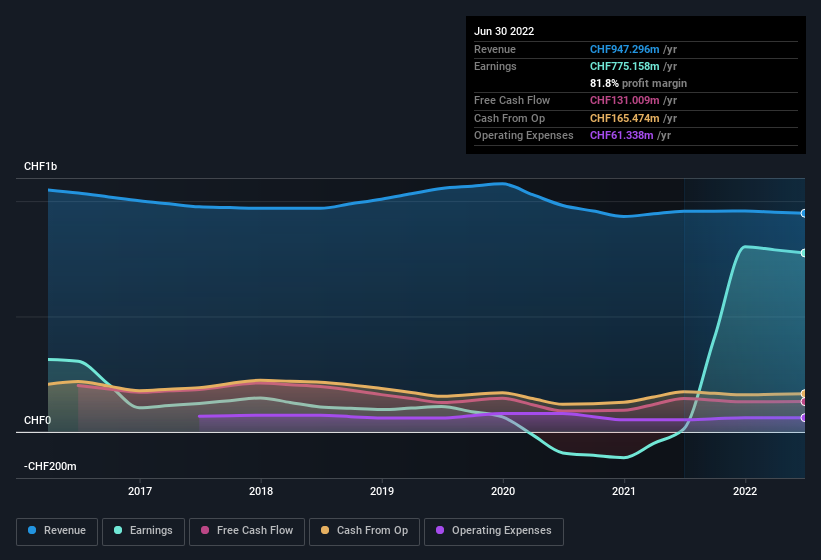

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of TX Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are TX Group Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that TX Group insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 55%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. At the current share price, that insider holding is worth a staggering CHF843m. That level of investment from insiders is nothing to sneeze at.

Should You Add TX Group To Your Watchlist?

TX Group's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering TX Group for a spot on your watchlist. You still need to take note of risks, for example - TX Group has 3 warning signs (and 2 which are potentially serious) we think you should know about.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and other services in Switzerland.

Excellent balance sheet and fair value.

Market Insights

Community Narratives