- Switzerland

- /

- Food

- /

- SWX:BARN

Barry Callebaut And Two More Stocks That Could Be Undervalued On The SIX Swiss Exchange

Reviewed by Simply Wall St

The Swiss market recently exhibited a mixed performance, with an initial rise in investor confidence due to improved consumer sentiment metrics, only to retreat under selling pressure influenced by external political events. In such a fluctuating environment, identifying stocks that may be undervalued could offer interesting opportunities for investors seeking potential in the midst of uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF134.40 | CHF222.37 | 39.6% |

| COLTENE Holding (SWX:CLTN) | CHF47.80 | CHF77.52 | 38.3% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF609.00 | CHF860.88 | 29.3% |

| Temenos (SWX:TEMN) | CHF64.00 | CHF84.88 | 24.6% |

| Julius Bär Gruppe (SWX:BAER) | CHF52.10 | CHF96.62 | 46.1% |

| Sonova Holding (SWX:SOON) | CHF275.80 | CHF468.73 | 41.2% |

| SGS (SWX:SGSN) | CHF80.68 | CHF124.93 | 35.4% |

| Comet Holding (SWX:COTN) | CHF376.00 | CHF590.34 | 36.3% |

| Medartis Holding (SWX:MED) | CHF70.30 | CHF131.36 | 46.5% |

| Sika (SWX:SIKA) | CHF259.20 | CHF335.24 | 22.7% |

Here we highlight a subset of our preferred stocks from the screener

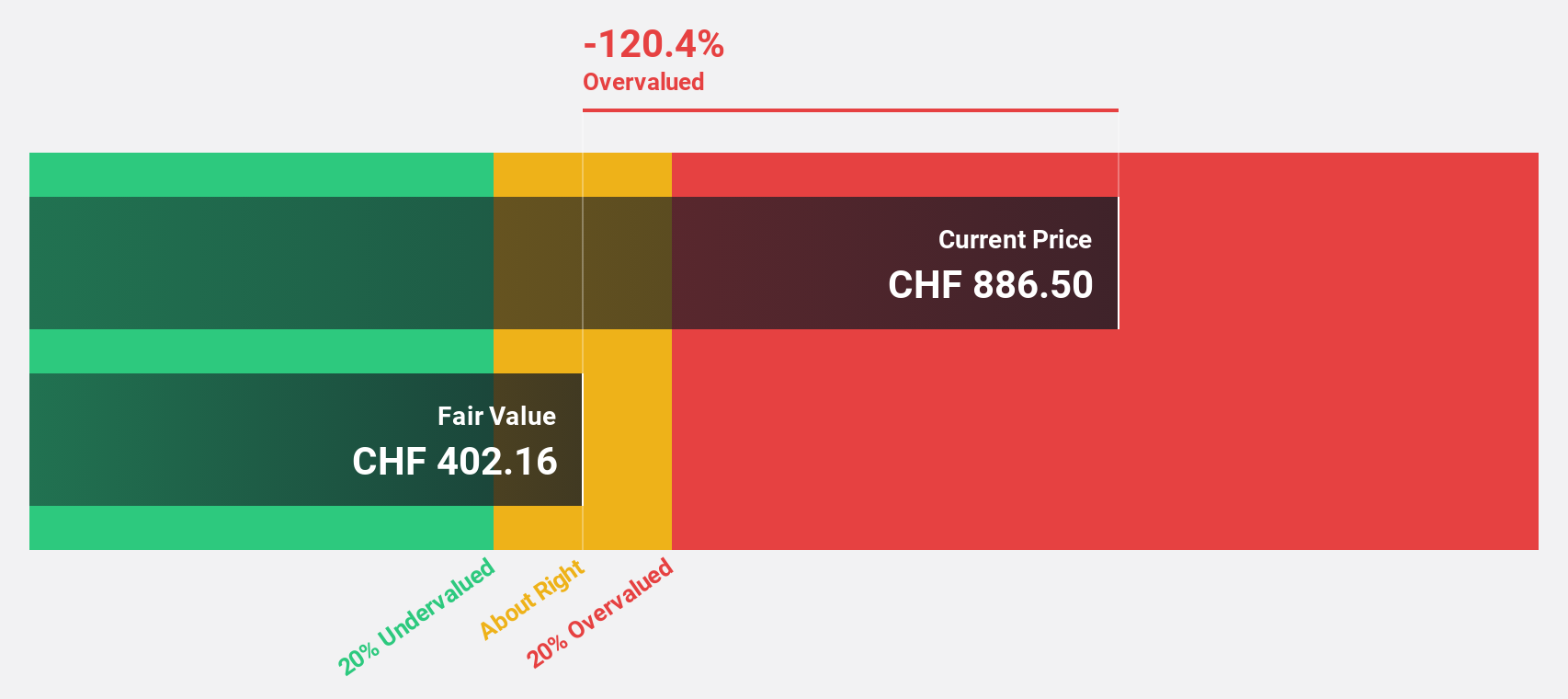

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG operates in the production and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.40 billion.

Operations: The company's revenue is derived from its Global Cocoa segment, which generated CHF 5.31 billion.

Estimated Discount To Fair Value: 15%

Barry Callebaut, priced at CHF1534, is positioned below its estimated fair value of CHF1804.13, marking a 15% undervaluation. Despite this discount, the company's debt is poorly covered by operating cash flow and it has experienced high share price volatility recently. On a positive note, Barry Callebaut's earnings are expected to grow by 25.07% annually, outpacing the Swiss market growth of 8.3%. Additionally, its recent half-year earnings report showed a significant drop in net income and EPS from the previous year.

- Our expertly prepared growth report on Barry Callebaut implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Barry Callebaut's balance sheet health report.

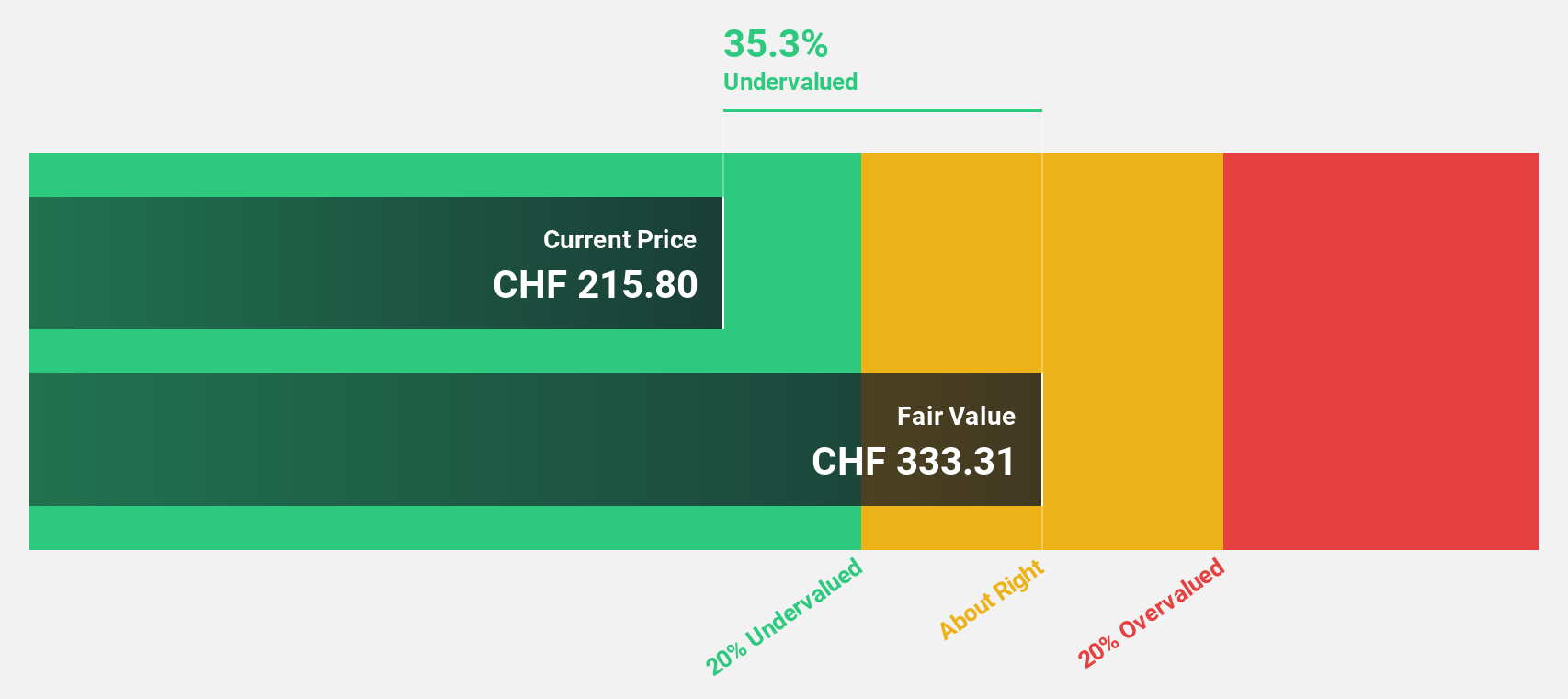

Sika (SWX:SIKA)

Overview: Sika AG is a specialty chemicals company engaged in developing and selling systems and products for bonding, sealing, damping, reinforcing, and protecting in the building sector and automotive industry globally, with a market capitalization of CHF 41.58 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 22.7%

Sika, with a current price of CHF259.2, is considered undervalued by over 20%, trading below the estimated fair value of CHF335.24. Recent expansions in China and Peru underscore its strategic growth initiatives, despite a forecasted revenue growth rate (6.1% per year) that trails high market expectations but still outpaces the Swiss market's 4.5%. However, concerns include high debt levels and shareholder dilution over the past year, even as earnings are expected to grow by 12.71% annually.

- In light of our recent growth report, it seems possible that Sika's financial performance will exceed current levels.

- Get an in-depth perspective on Sika's balance sheet by reading our health report here.

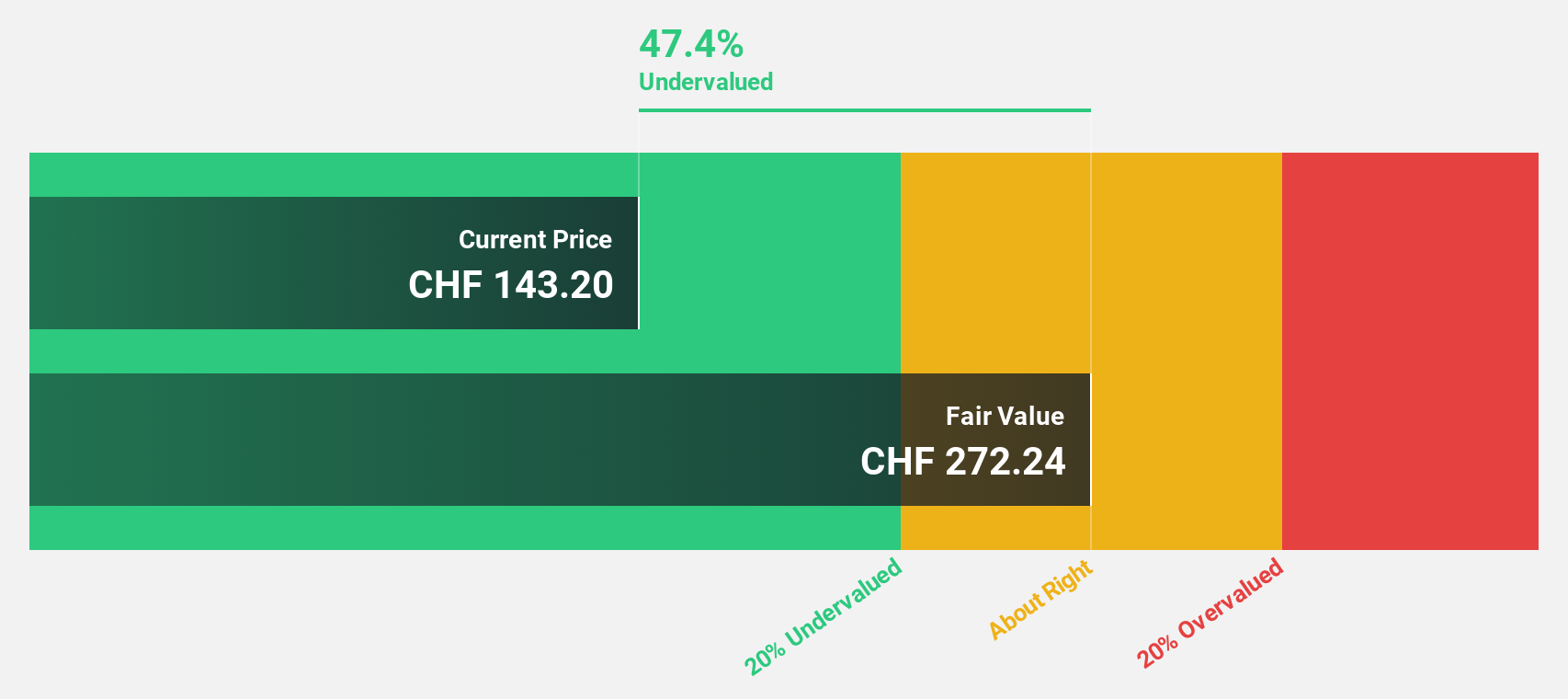

Sulzer (SWX:SUN)

Overview: Sulzer Ltd specializes in fluid engineering and chemical processing solutions globally, with a market capitalization of approximately CHF 4.54 billion.

Operations: The company's revenue is divided into three main segments: Chemtech at CHF 772.50 million, Services at CHF 1.15 billion, and Flow Equipment at CHF 1.35 billion.

Estimated Discount To Fair Value: 39.6%

Sulzer, priced at CHF134.4, is valued below our fair value estimate of CHF222.37, indicating a significant undervaluation based on discounted cash flows. Despite an unstable dividend track record, the company's earnings have surged by a very large amount over the past year and are expected to grow annually by 9.66%. This growth rate surpasses the Swiss market's average. Recent presentations at industry events highlight Sulzer’s active engagement in expanding its market presence and sharing strategic insights.

- Our earnings growth report unveils the potential for significant increases in Sulzer's future results.

- Click here to discover the nuances of Sulzer with our detailed financial health report.

Summing It All Up

- Dive into all 13 of the Undervalued SIX Swiss Exchange Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products.

Reasonable growth potential with adequate balance sheet.