Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Evolva Holding SA (VTX:EVE) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Evolva Holding

What Is Evolva Holding's Debt?

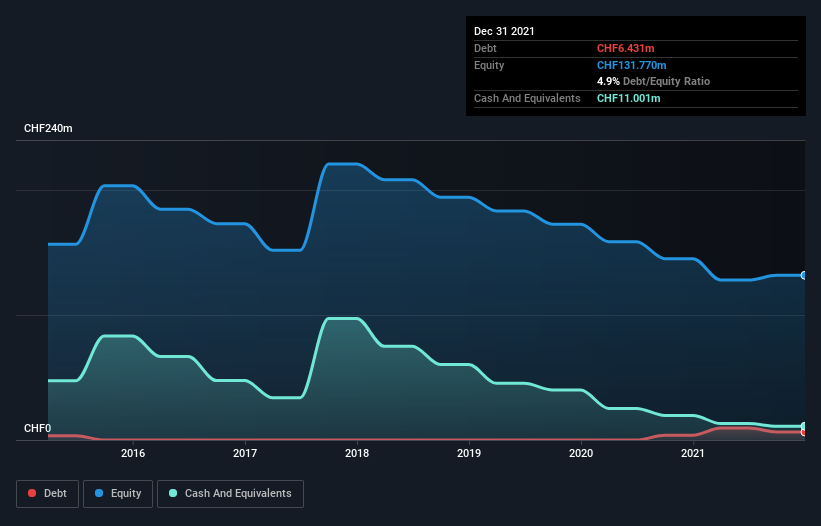

You can click the graphic below for the historical numbers, but it shows that as of December 2021 Evolva Holding had CHF6.43m of debt, an increase on CHF3.79m, over one year. However, it does have CHF11.0m in cash offsetting this, leading to net cash of CHF4.57m.

A Look At Evolva Holding's Liabilities

The latest balance sheet data shows that Evolva Holding had liabilities of CHF15.2m due within a year, and liabilities of CHF9.18m falling due after that. On the other hand, it had cash of CHF11.0m and CHF4.50m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CHF8.90m.

Of course, Evolva Holding has a market capitalization of CHF110.6m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Evolva Holding also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Evolva Holding's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Evolva Holding wasn't profitable at an EBIT level, but managed to grow its revenue by 31%, to CHF9.9m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Evolva Holding?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Evolva Holding had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of CHF34m and booked a CHF41m accounting loss. But at least it has CHF4.57m on the balance sheet to spend on growth, near-term. Evolva Holding's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Evolva Holding has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Evolva Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:EVE

Evolva Holding

Evolva Holding SA discovers, researches, develops, and commercializes nature-based ingredients for use in flavor and fragrances, health ingredients, health protection, and other sectors in Switzerland, the United States, and internationally.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives