3 Swiss Stocks On SIX Swiss Exchange Estimated To Be Up To 41.2% Below Intrinsic Value

Reviewed by Simply Wall St

The Swiss market showed modest gains recently, despite a cautious atmosphere influenced by geopolitical tensions and anticipation of upcoming inflation data. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities, as these stocks may offer potential value when the broader market struggles for clear direction.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1334.00 | CHF1829.62 | 27.1% |

| Swissquote Group Holding (SWX:SQN) | CHF303.60 | CHF569.57 | 46.7% |

| Georg Fischer (SWX:GF) | CHF63.15 | CHF112.20 | 43.7% |

| lastminute.com (SWX:LMN) | CHF17.90 | CHF29.59 | 39.5% |

| Clariant (SWX:CLN) | CHF12.66 | CHF21.52 | 41.2% |

| Comet Holding (SWX:COTN) | CHF323.50 | CHF529.76 | 38.9% |

| Barry Callebaut (SWX:BARN) | CHF1559.00 | CHF2287.69 | 31.9% |

| Dätwyler Holding (SWX:DAE) | CHF167.40 | CHF241.19 | 30.6% |

| SGS (SWX:SGSN) | CHF94.80 | CHF150.68 | 37.1% |

| Sensirion Holding (SWX:SENS) | CHF71.80 | CHF118.11 | 39.2% |

Let's explore several standout options from the results in the screener.

Clariant (SWX:CLN)

Overview: Clariant AG is a global company involved in the development, manufacture, distribution, and sale of specialty chemicals with a market cap of CHF4.16 billion.

Operations: The company's revenue segments consist of Catalysis at CHF927 million, Care Chemicals at CHF2.22 billion, and Adsorbents & Additives at CHF1.02 billion.

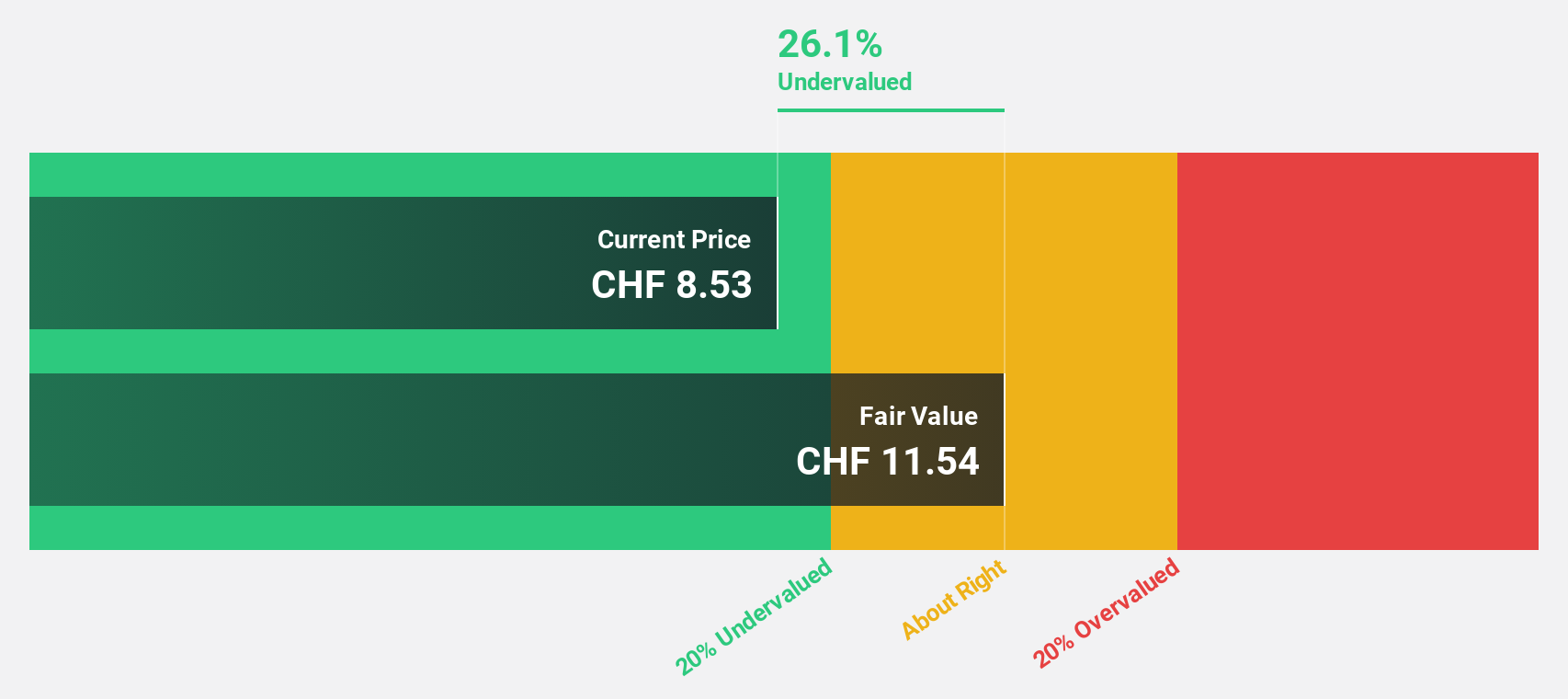

Estimated Discount To Fair Value: 41.2%

Clariant is trading at CHF12.66, significantly below its estimated fair value of CHF21.52, indicating undervaluation based on cash flows. Despite high debt levels and recent declines in sales and net income for the first half of 2024, earnings are forecast to grow substantially at 30.3% annually, outpacing the Swiss market's growth rate. However, its dividend yield of 3.32% is not well-covered by earnings, suggesting potential sustainability concerns amidst expected modest revenue growth this year.

- Our growth report here indicates Clariant may be poised for an improving outlook.

- Take a closer look at Clariant's balance sheet health here in our report.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF2.51 billion, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company's revenue is derived from three main segments: X-Ray Systems (IXS) at CHF115.34 million, Industrial X-Ray Modules (IXM) at CHF95.90 million, and Plasma Control Technologies (PCT) at CHF180.62 million.

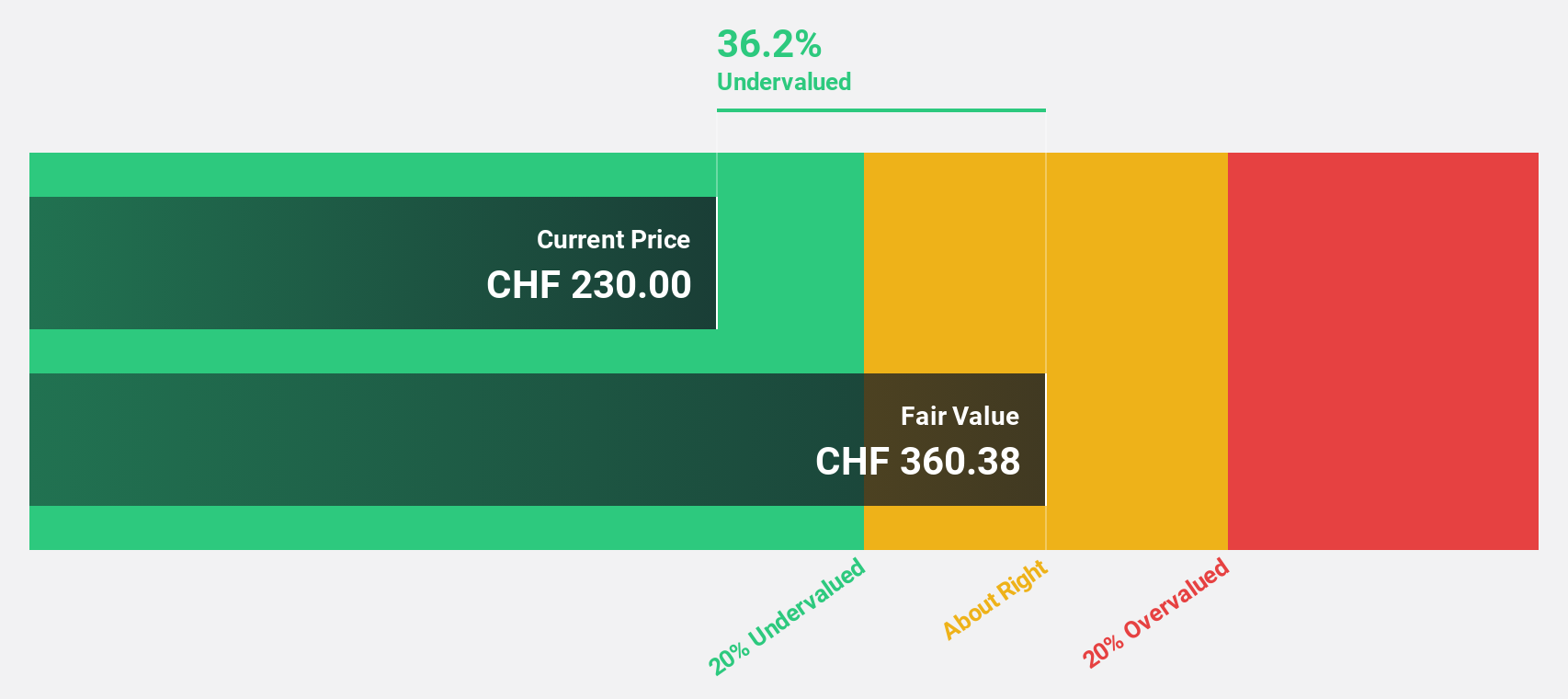

Estimated Discount To Fair Value: 38.9%

Comet Holding is trading at CHF323.5, well below its estimated fair value of CHF529.76, highlighting its undervaluation based on cash flows. Despite a drop in sales to CHF189.32 million for the first half of 2024, net income rose to CHF4.06 million from the previous year, and earnings per share doubled to CHF0.52. Earnings are projected to grow significantly at 47.8% annually, surpassing Swiss market expectations despite recent profit margin declines and share price volatility.

- Upon reviewing our latest growth report, Comet Holding's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Comet Holding's balance sheet by reading our health report here.

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF12.83 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland and various international markets including Europe, the United States, Japan, Korea, Singapore, China, and other parts of Asia.

Operations: The company's revenue segments include Valves generating CHF783.51 million and Global Service contributing CHF163.83 million.

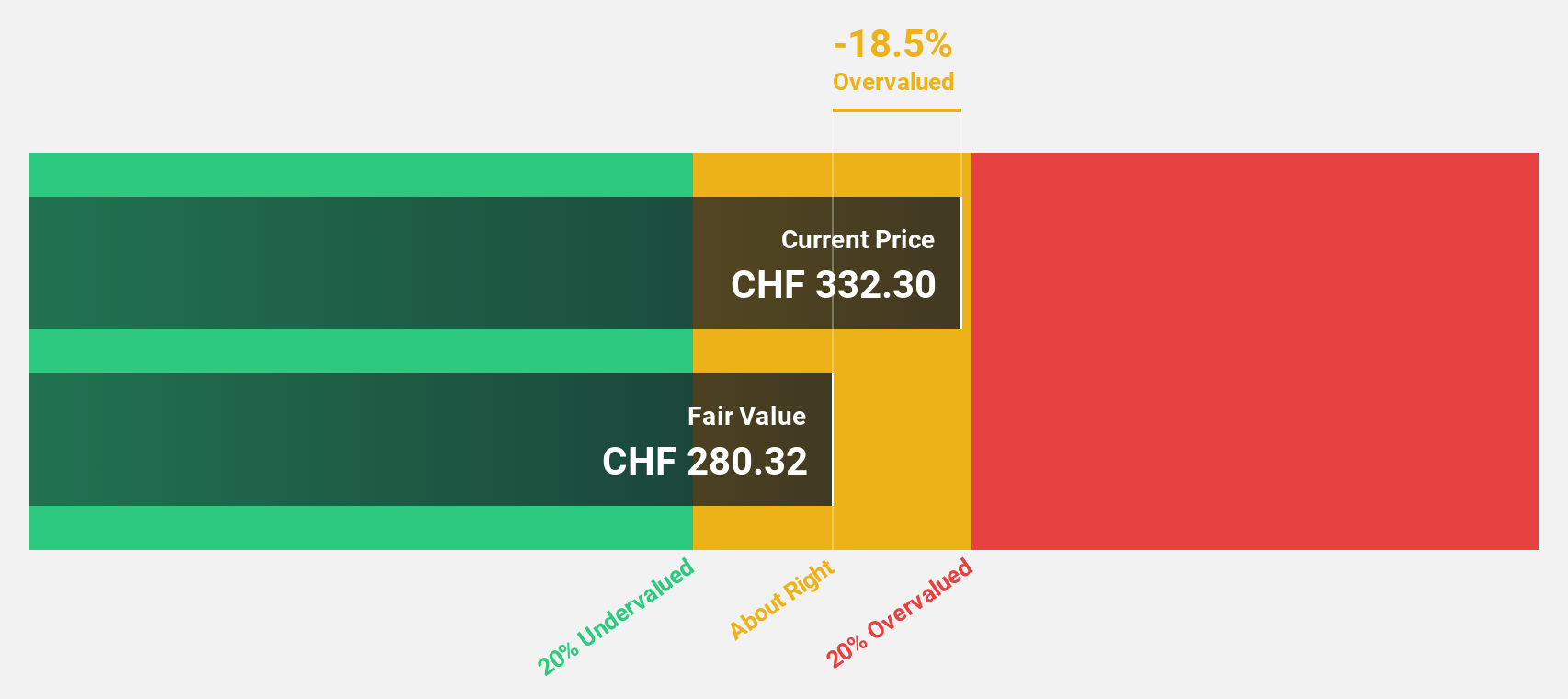

Estimated Discount To Fair Value: 23.2%

VAT Group, trading at CHF427.9, is priced below its estimated fair value of CHF557.07, suggesting undervaluation based on cash flows. Despite a slight dip in sales to CHF449.61 million for H1 2024 compared to the previous year, net income rose to CHF94 million with earnings per share increasing to CHF3.14 from CHF2.81. Projected annual earnings growth of 22.5% exceeds Swiss market forecasts, although the stock has experienced recent price volatility.

- In light of our recent growth report, it seems possible that VAT Group's financial performance will exceed current levels.

- Click here to discover the nuances of VAT Group with our detailed financial health report.

Next Steps

- Reveal the 16 hidden gems among our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COTN

Comet Holding

Provides X-ray and radio frequency (RF) power technology solutions in Europe, North America, Asia, and internationally.

Exceptional growth potential with flawless balance sheet.