- Switzerland

- /

- Insurance

- /

- SWX:SLHN

Swiss Life Holding AG's (VTX:SLHN) Business Is Trailing The Market But Its Shares Aren't

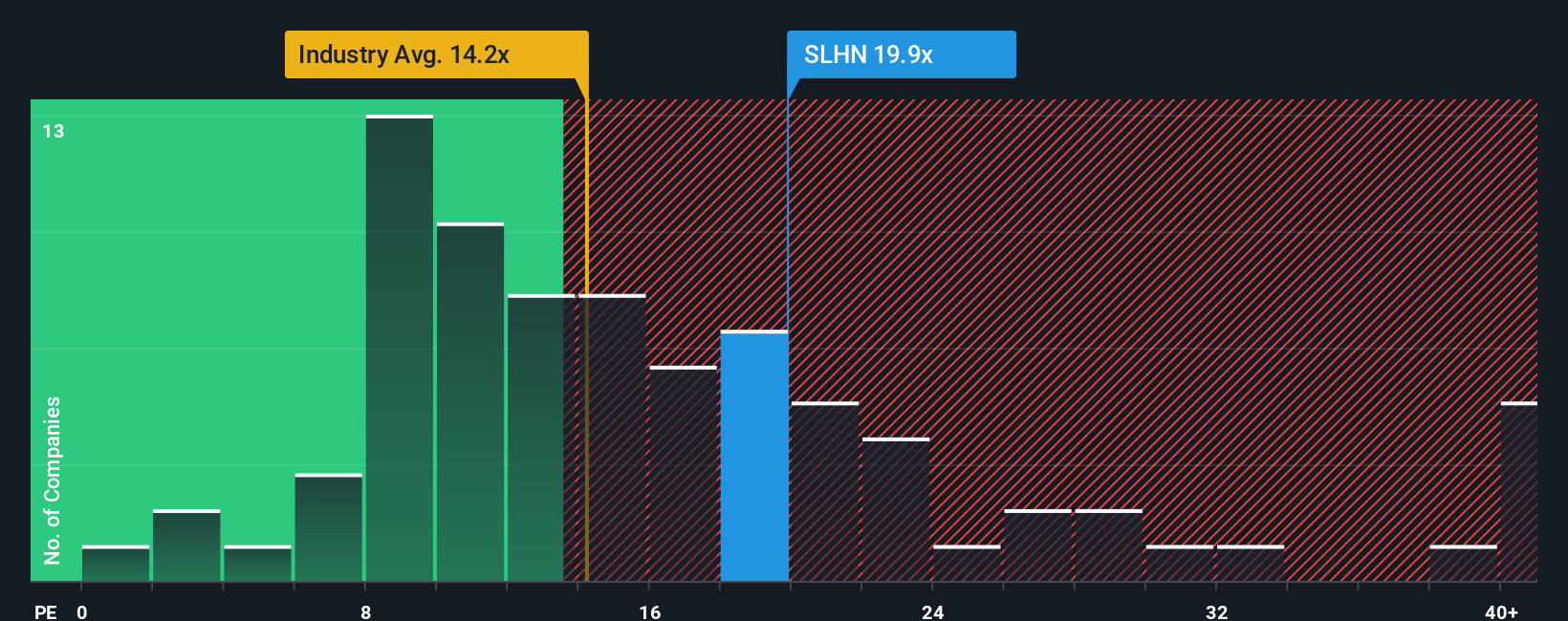

It's not a stretch to say that Swiss Life Holding AG's (VTX:SLHN) price-to-earnings (or "P/E") ratio of 19.9x right now seems quite "middle-of-the-road" compared to the market in Switzerland, where the median P/E ratio is around 20x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Swiss Life Holding as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Swiss Life Holding

How Is Swiss Life Holding's Growth Trending?

Swiss Life Holding's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. EPS has also lifted 6.2% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 6.0% per year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the market is forecast to expand by 8.5% per annum, which is noticeably more attractive.

In light of this, it's curious that Swiss Life Holding's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Swiss Life Holding's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Swiss Life Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Swiss Life Holding you should be aware of.

Of course, you might also be able to find a better stock than Swiss Life Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SLHN

Swiss Life Holding

Provides life, pensions, and financial solutions for private and corporate clients.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026