- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

Will Surging Net Income Redefine Ypsomed Holding’s (SWX:YPSN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Ypsomed Holding AG recently reported results for the half year ended September 30, 2025, revealing net income of CHF 139.09 million, up from CHF 32.6 million a year earlier, with basic and diluted earnings per share rising to CHF 10.19 from CHF 2.39.

- This sharp increase in profitability highlights the company's growing efficiency and operational momentum over the last year.

- With net income rising to CHF 139.09 million, we'll consider how this earnings surge influences Ypsomed Holding's investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ypsomed Holding Investment Narrative Recap

To be invested in Ypsomed Holding, you would need to believe in the company’s focus on expanding its B2B model and capacity to deliver growth in medical device manufacturing, especially after its move away from direct diabetes care. The recent surge in net income signals increased operating efficiency, but the core short term catalyst, successful ramp-up of new capacity, remains mostly unchanged by these results, while the biggest risk continues to be operational challenges tied to recent divestments and expansion plans.

Recent announcements about expanding production in China and Germany are particularly relevant, as the company’s increased earnings could support ongoing investments in manufacturing scale. These steps are closely linked to Ypsomed’s ability to meet future demand for its injection systems, which underpins its revenue growth prospects amid industry shifts.

Yet, despite the momentum, it’s important to remember that if the transition away from the Diabetes Care division falters, operational hurdles could still ...

Read the full narrative on Ypsomed Holding (it's free!)

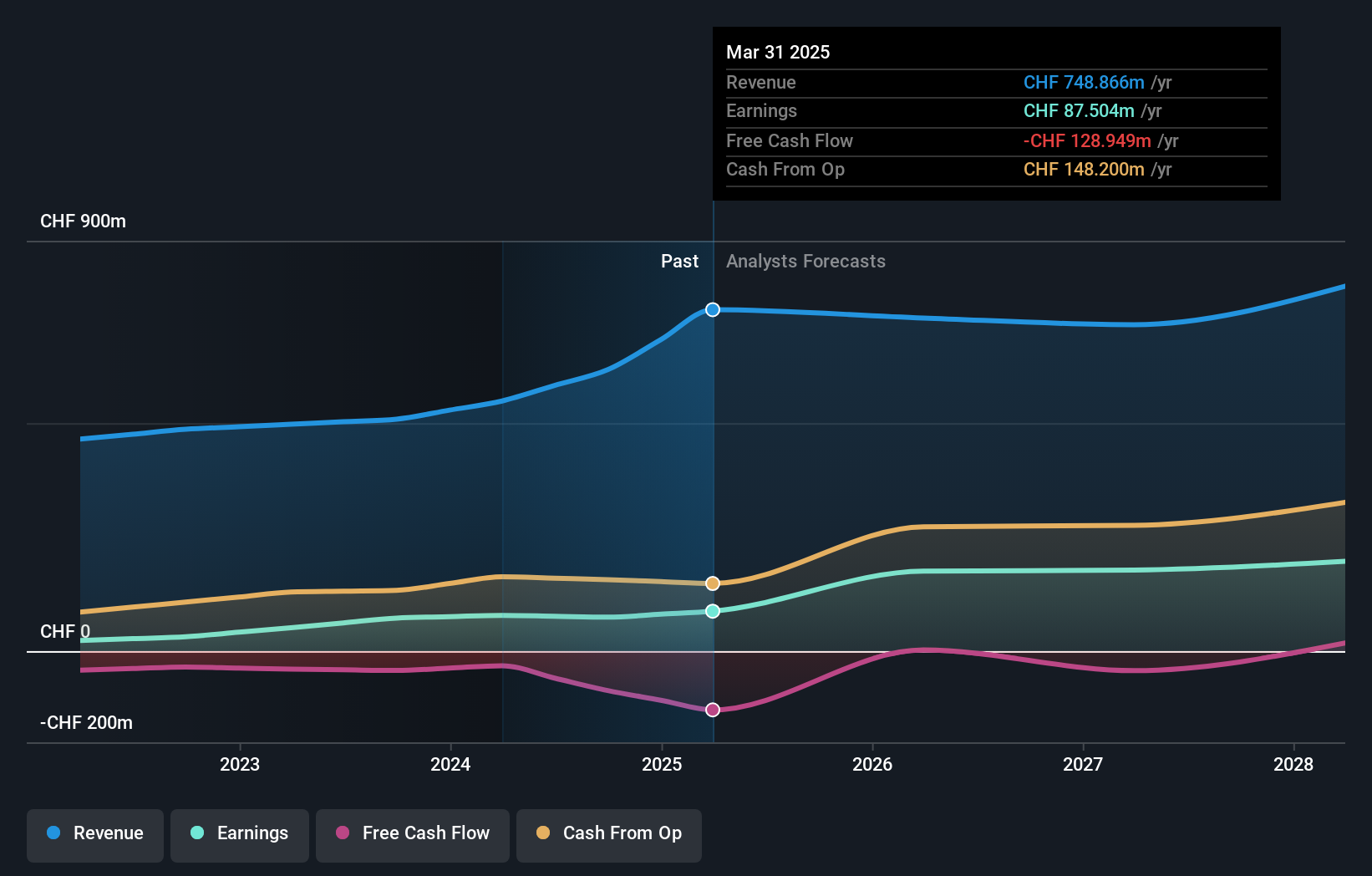

Ypsomed Holding is projected to reach CHF912.9 million in revenue and CHF248.2 million in earnings by 2028. This outlook assumes annual revenue growth of 6.8% and an increase in earnings of CHF160.7 million from the current level of CHF87.5 million.

Uncover how Ypsomed Holding's forecasts yield a CHF421.59 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community offered four fair value estimates for Ypsomed as low as CHF359.75 and as high as CHF1,291.70. Many highlight the earnings growth potential, yet recent operational changes could still introduce risk to future profits, so it pays to consider several viewpoints.

Explore 4 other fair value estimates on Ypsomed Holding - why the stock might be worth over 3x more than the current price!

Build Your Own Ypsomed Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ypsomed Holding research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ypsomed Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ypsomed Holding's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for safe and simple self-medication companies.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives