Stock Analysis

- Switzerland

- /

- Transportation

- /

- SWX:JFN

Exploring Undiscovered Swiss Stocks July 2024

Reviewed by Simply Wall St

The Switzerland market recently experienced a moderate downturn, influenced by a global IT outage stemming from cybersecurity issues, which notably impacted various industries and economic activities. Amidst these broader market challenges, identifying resilient and potentially undervalued stocks could offer intriguing opportunities for investors interested in the Swiss landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| StarragTornos Group | 12.77% | -2.98% | 29.42% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| SKAN Group | 3.57% | 40.44% | 22.38% | ★★★★★☆ |

| naturenergie holding | 9.95% | 16.32% | 40.54% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, together with its subsidiaries, operates cogwheel railway and winter sports related facilities in the Jungfrau region of Switzerland, with a market capitalization of CHF 1.13 billion.

Operations: Jungfraubahn Holding generates significant revenue from its "Jungfraujoch - TOP of Europe" segment, contributing CHF 188.24 million, alongside other key segments like "Experience Mountains" and "Winter Sports," which bring in CHF 45.94 million and CHF 41.26 million respectively. The company's business model focuses on leveraging Switzerland's alpine appeal, providing diverse tourist experiences that drive consistent visitor traffic and revenue across seasonal sports and mountain experiences.

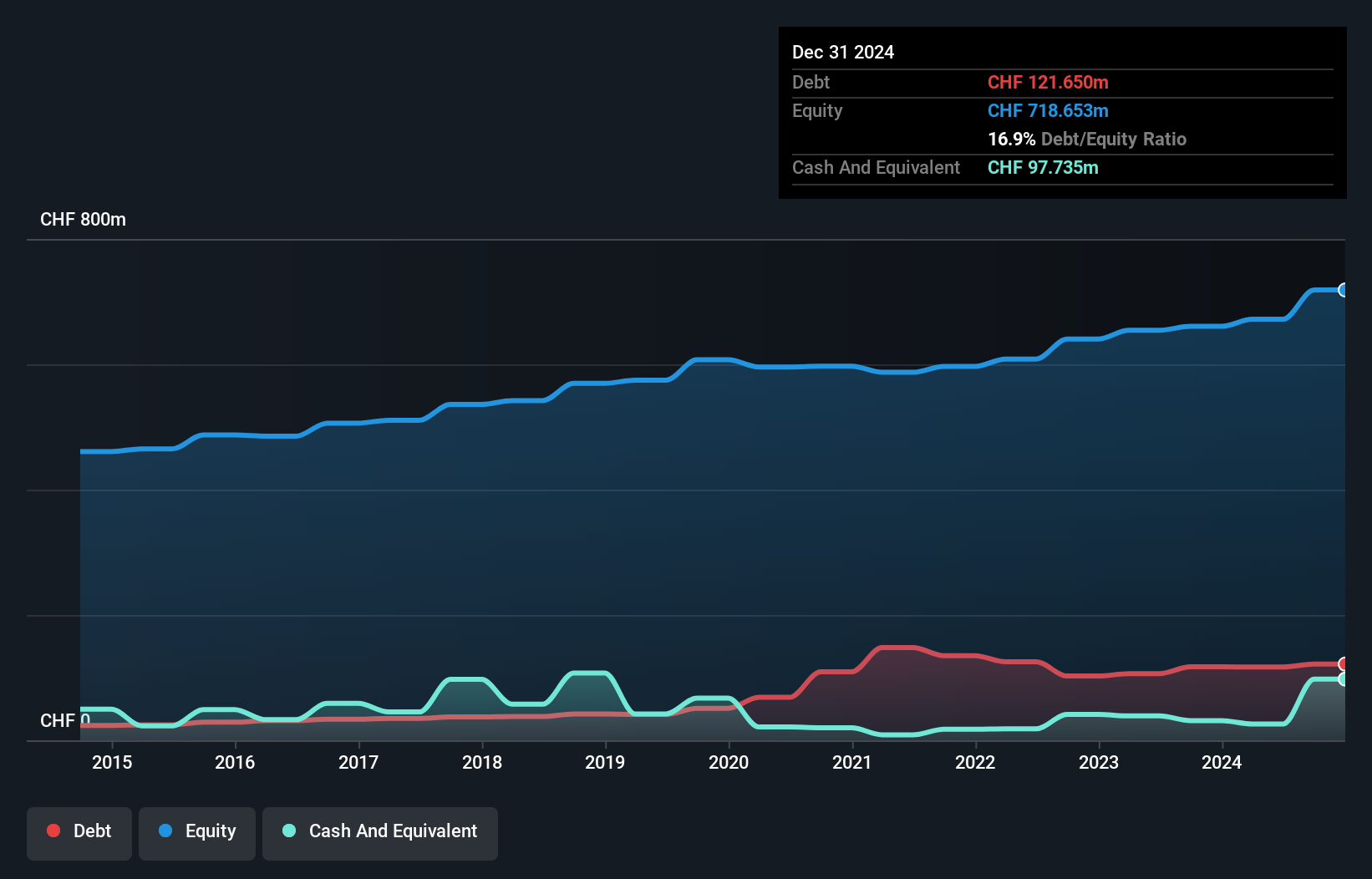

Jungfraubahn Holding AG, a gem in the Swiss market, boasts an impressive 81.6% earnings growth over the past year, outpacing the Transportation industry's -8.6%. With a net debt to equity ratio of 13%, considered satisfactory and below the threshold of concern, and a P/E ratio at 14.2x—well under Switzerland's average of 21.2x—the company presents as undervalued. Forecasted to grow earnings by 2.6% annually, Jungfraubahn combines financial health with promising growth prospects in its niche sector.

- Get an in-depth perspective on Jungfraubahn Holding's performance by reading our health report here.

Assess Jungfraubahn Holding's past performance with our detailed historical performance reports.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG is a Swiss-based company specializing in the production and distribution of medical consumer goods, serving both domestic and international markets, with a market capitalization of CHF 314.37 million.

Operations: IVF Hartmann Holding generates revenue through diverse healthcare segments including Wound Care, Infection Management, and Incontinence Management. The company's cost structure involves significant expenditures on cost of goods sold (COGS) and operating expenses, with a notable portion allocated to General & Administrative expenses.

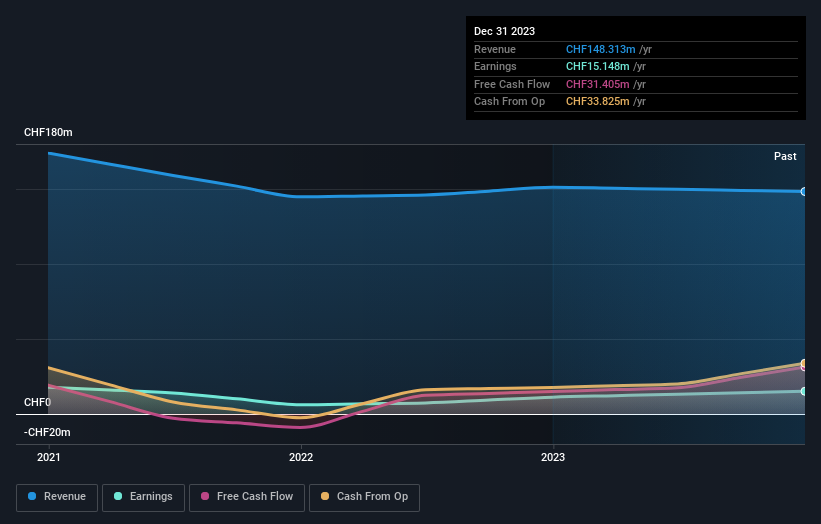

IVF Hartmann Holding, a lesser spotlighted entity in the Swiss market, showcases robust financial health with a 34.9% earnings growth outpacing its sector by over 42%. Operating debt-free for five years, the company's Price-To-Earnings ratio stands attractively at 20.8x against the broader market's 21.2x. Despite a decline in earnings at an average of 4.3% annually over five years, its strong past performance and strategic positioning hint at potential underappreciated value.

- Dive into the specifics of IVF Hartmann Holding here with our thorough health report.

Gain insights into IVF Hartmann Holding's past trends and performance with our Past report.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is a Swiss company specializing in the development, manufacturing, marketing, sale, and servicing of kitchen and laundry appliances for private households globally, with a market capitalization of CHF 340.71 million.

Operations: V-ZUG Holding primarily generates revenue through the manufacture and sale of household appliances, consistently achieving a gross profit margin above 30% in recent years. The company's cost structure is dominated by cost of goods sold (COGS), which typically accounts for over half of its revenue, followed by significant operating expenses including sales, marketing, and general administrative costs.

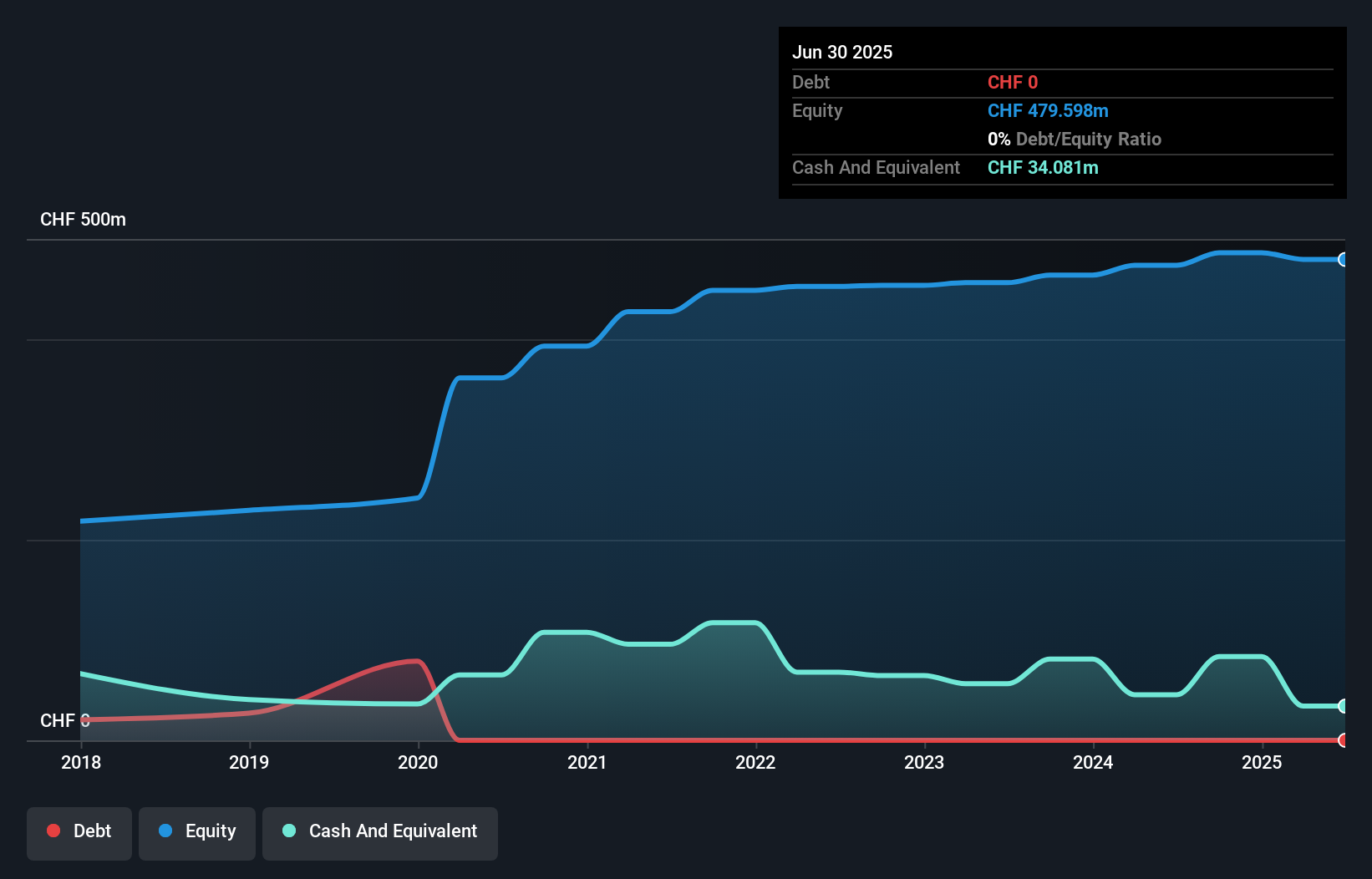

V-ZUG Holding AG, a lesser-known Swiss firm, showcased robust financial health with a 89.2% earnings growth over the past year, outpacing the Consumer Durables industry's -1.2%. With no debt and high-quality earnings, V-ZUG's recent half-year results further affirm its potential: sales reached CHF 284 million and net income doubled to CHF 8.73 million from last year. Forecasted to grow earnings by 39.43% annually, V-Zug seems well-positioned for sustained growth amidst industry challenges.

- Navigate through the intricacies of V-ZUG Holding with our comprehensive health report here.

Explore historical data to track V-ZUG Holding's performance over time in our Past section.

Make It Happen

- Reveal the 18 hidden gems among our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Solid track record with adequate balance sheet and pays a dividend.