- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

Could Straumann Holding (SWX:STMN) Redefine Its Digital Edge Through the Smartee Partnership?

Reviewed by Sasha Jovanovic

- Smartee Denti-Technology and Straumann Group recently announced a partnership to jointly develop next-generation orthodontics platforms, co-innovate clear aligner technologies, and involve a single-digit equity investment by Smartee.

- This collaboration combines Smartee's manufacturing and technology expertise in China's clear aligner market with Straumann's global brand and distribution network, aiming to meet rising global demand for high-quality orthodontic solutions more effectively.

- We'll examine how partnering with Smartee to enhance clear aligner technology could impact Straumann's growth and digital dentistry ambitions.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Straumann Holding Investment Narrative Recap

For shareholders of Straumann Holding, the investment case hinges on the group’s ability to leverage digital dentistry leadership and expand profitably in high-growth regions, especially China and Latin America. While the new Smartee partnership could support innovation and digital expansion, it does not materially shift the near-term catalyst, which remains Straumann’s execution in China amid VBP-related pricing risks and recent softness in regional sales.

Among recent announcements, the company’s confirmation of its 2025 financial outlook and focus on high single-digit organic revenue growth, together with targeted margin expansion, stands out. This commitment suggests steady underlying demand but keeps investor attention on how well Straumann can balance ongoing innovation and capital requirements with margin delivery as competition intensifies.

However, despite clear ambitions, adverse currency movements, especially Swiss franc strength, remain a persistent headwind investors should not overlook if they want to understand...

Read the full narrative on Straumann Holding (it's free!)

Straumann Holding's narrative projects CHF3.4 billion revenue and CHF712.0 million earnings by 2028. This requires 9.1% yearly revenue growth and a CHF284.0 million earnings increase from CHF428.0 million today.

Uncover how Straumann Holding's forecasts yield a CHF111.58 fair value, a 10% upside to its current price.

Exploring Other Perspectives

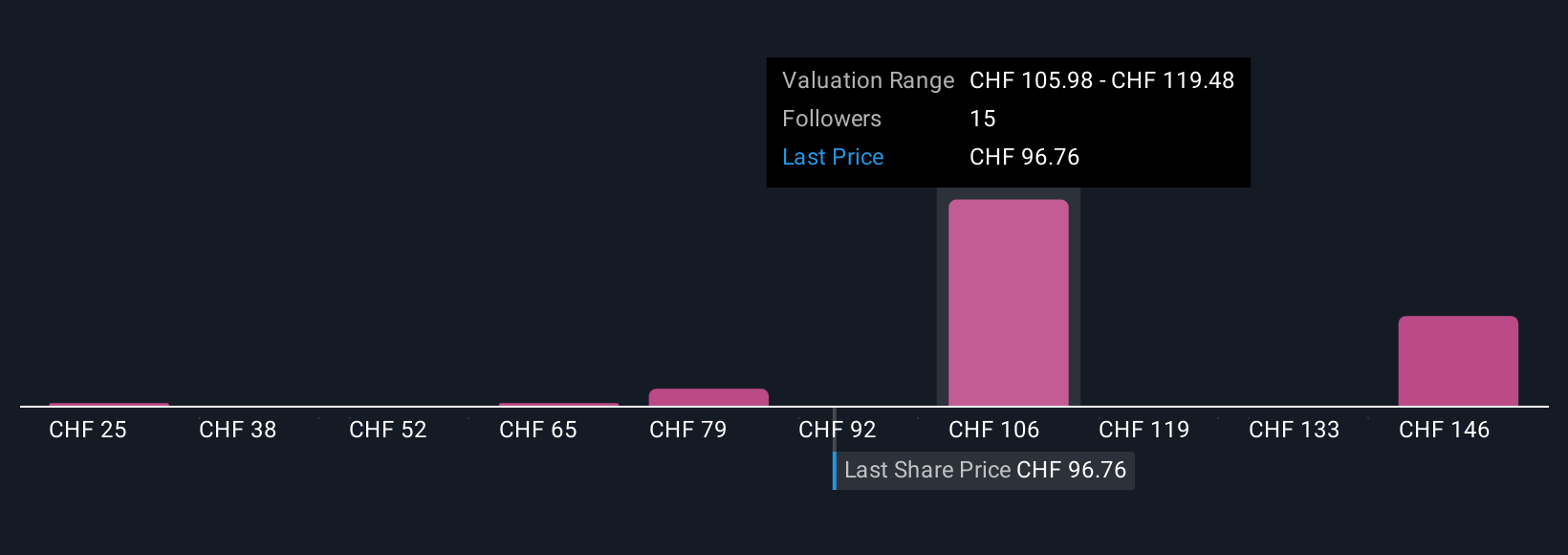

The Simply Wall St Community’s five fair value estimates for Straumann range from CHF 25 to CHF 163, with most between CHF 94 and CHF 122. With pricing competition intensifying in China, consider how these sharply different views might shape your own outlook on Straumann’s path forward.

Explore 5 other fair value estimates on Straumann Holding - why the stock might be worth as much as 62% more than the current price!

Build Your Own Straumann Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Straumann Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Straumann Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Straumann Holding's overall financial health at a glance.

No Opportunity In Straumann Holding?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives