- Switzerland

- /

- Medical Equipment

- /

- SWX:METN

Results: Metall Zug AG Beat Earnings Expectations And Analysts Now Have New Forecasts

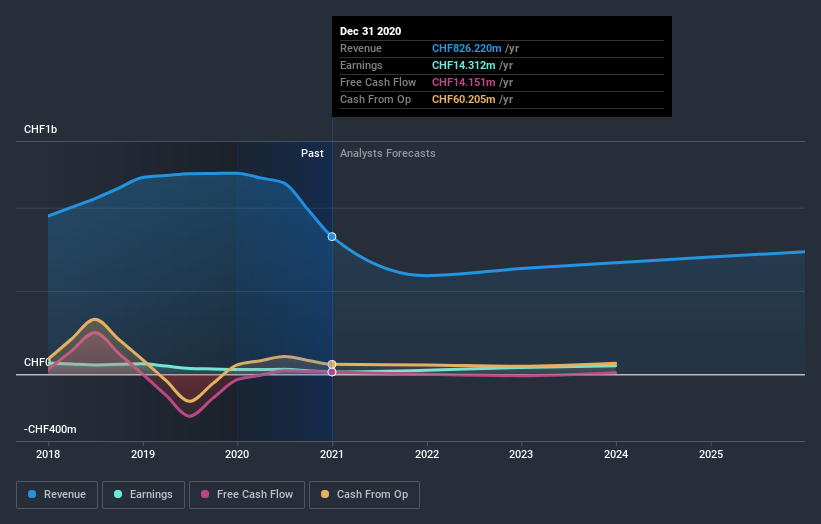

Metall Zug AG (VTX:METN) investors will be delighted, with the company turning in some strong numbers with its latest results. The company beat both earnings and revenue forecasts, with revenue of CHF826m, some 2.8% above estimates, and statutory earnings per share (EPS) coming in at CHF31.93, 779% ahead of expectations. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Metall Zug

Taking into account the latest results, the twin analysts covering Metall Zug provided consensus estimates of CHF592.0m revenue in 2021, which would reflect a painful 28% decline on its sales over the past 12 months. Statutory earnings per share are predicted to surge 71% to CHF54.75. Before this earnings report, the analysts had been forecasting revenues of CHF599.0m and earnings per share (EPS) of CHF52.65 in 2021. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target rose 40% to CHF2,100, suggesting that higher earnings estimates flow through to the stock's valuation as well.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with a forecast 28% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 4.1% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.9% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Metall Zug is expected to lag the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Metall Zug following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have analyst estimates for Metall Zug going out as far as 2025, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Metall Zug you should be aware of.

When trading Metall Zug or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:METN

Metall Zug

Through its subsidiaries, engages in the medical devices, infection control, technology cluster and infrastructure, and other businesses in Switzerland, rest of Europe, the Americas, the Asia Pacific, and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth