Stock Analysis

- Switzerland

- /

- Medical Equipment

- /

- SWX:CLTN

Don't Buy COLTENE Holding AG (VTX:CLTN) For Its Next Dividend Without Doing These Checks

COLTENE Holding AG (VTX:CLTN) is about to trade ex-dividend in the next four days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, COLTENE Holding investors that purchase the stock on or after the 19th of April will not receive the dividend, which will be paid on the 24th of April.

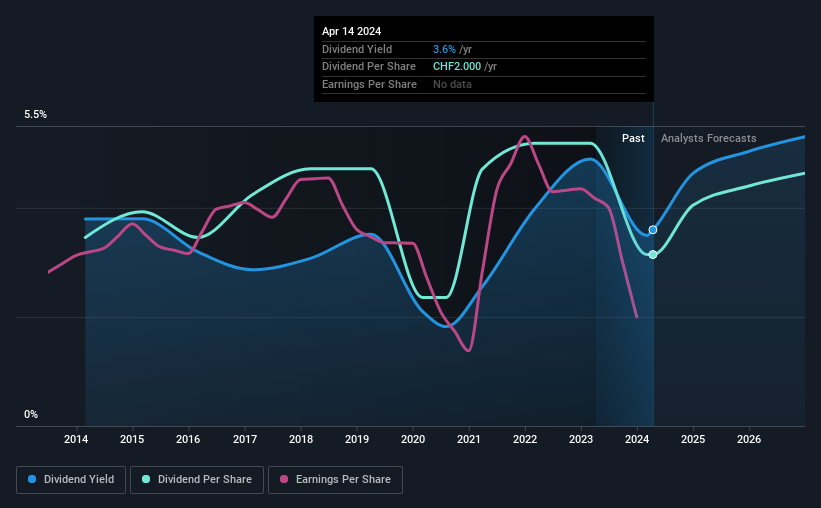

The company's next dividend payment will be CHF02.00 per share. Last year, in total, the company distributed CHF2.00 to shareholders. Calculating the last year's worth of payments shows that COLTENE Holding has a trailing yield of 3.6% on the current share price of CHF055.60. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether COLTENE Holding has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for COLTENE Holding

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. COLTENE Holding paid out 100% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. A useful secondary check can be to evaluate whether COLTENE Holding generated enough free cash flow to afford its dividend. COLTENE Holding paid out more free cash flow than it generated - 114%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

As COLTENE Holding's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're discomforted by COLTENE Holding's 11% per annum decline in earnings in the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. COLTENE Holding's dividend payments per share have declined at 0.9% per year on average over the past 10 years, which is uninspiring.

The Bottom Line

Should investors buy COLTENE Holding for the upcoming dividend? It's looking like an unattractive opportunity, with its earnings per share declining, while, paying out an uncomfortably high percentage of both its profits (100%) and cash flow as dividends. This is a starkly negative combination that often suggests a dividend cut could be in the company's near future. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of COLTENE Holding.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with COLTENE Holding. Our analysis shows 3 warning signs for COLTENE Holding and you should be aware of them before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether COLTENE Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:CLTN

COLTENE Holding

COLTENE Holding AG develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories in Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania.

Flawless balance sheet and undervalued.