- Switzerland

- /

- Food

- /

- SWX:BARN

Barry Callebaut (SWX:BARN): Evaluating Valuation After Full-Year Sales Climb but Net Income Slips

Reviewed by Simply Wall St

Barry Callebaut (SWX:BARN) released its full-year earnings, revealing sales climbed to CHF 14.8 billion, up from the previous year. However, net income dipped slightly. Investors are examining what these numbers mean for future growth.

See our latest analysis for Barry Callebaut.

Barry Callebaut’s latest earnings drop came alongside a surge in its share price, with a standout 20.1% gain over the past week and 25.5% return in the last three months. This hints at renewed optimism for the company. Despite this recent momentum, the one-year total shareholder return remains down 10.1%, so longer-term investors are still waiting for a full recovery.

If this sharp rebound piques your curiosity, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

As the numbers settle and the share price rebounds, the key question is whether Barry Callebaut’s stock offers hidden value for investors or if the recent rally means future growth is already reflected in the price.

Most Popular Narrative: 4.3% Undervalued

The prevailing narrative values Barry Callebaut at CHF 1,265.75, suggesting a modest upside from its last close at CHF 1,211. Recent price gains have narrowed the gap, intensifying the focus on whether analyst projections can fuel further upside.

Strategic investments and supply chain expansions in North America and Asia aim to enhance revenue growth and stabilize future earnings. Secured bean supply and a focus on cost efficiencies are intended to stabilize input costs and improve net margins.

What bold moves are underpinning this premium price tag? There is a hidden lever of profit expansion and revenue stability. Are you ready to uncover the full strategy? This narrative’s fair value leans heavily on assumptions that could surprise even seasoned market watchers.

Result: Fair Value of $1,265.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated cocoa price volatility or unexpected cost increases could quickly erode margins and challenge the positive profit outlook that has supported recent gains.

Find out about the key risks to this Barry Callebaut narrative.

Another View: Multiples Tell a Different Story

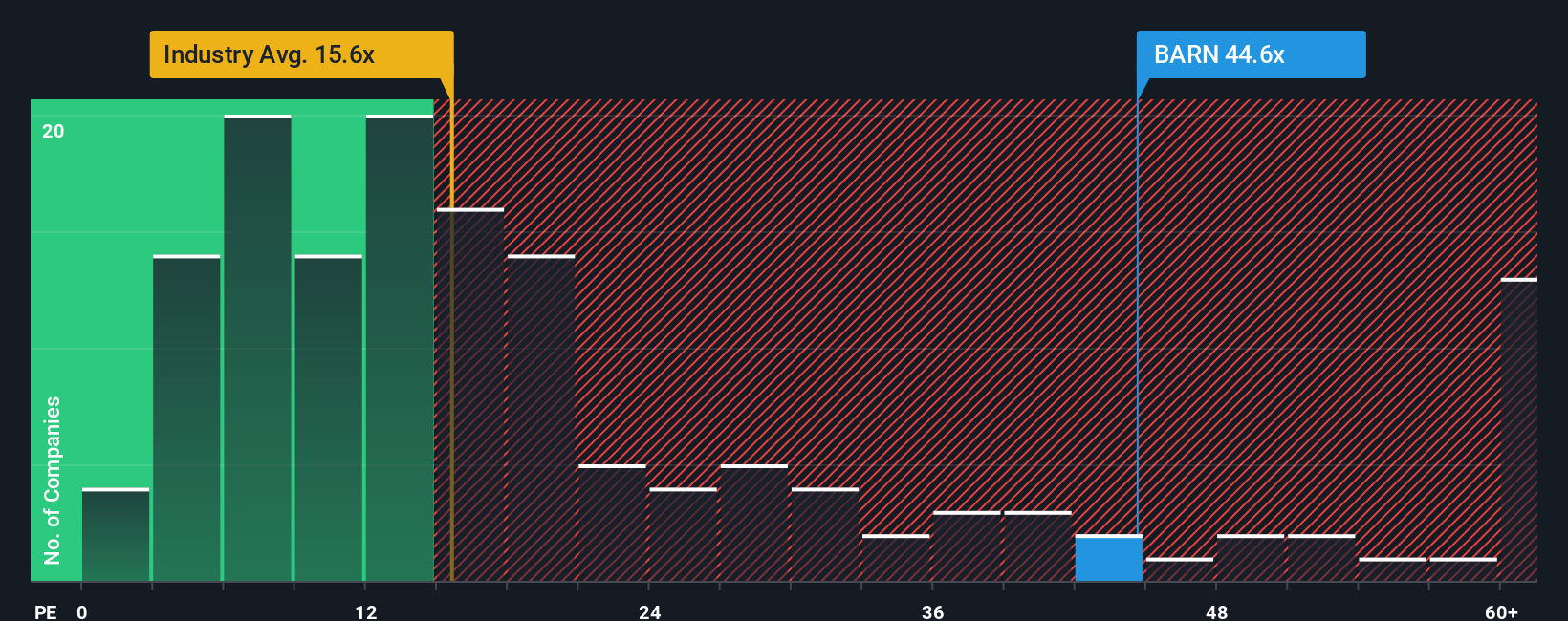

Looking beyond analyst price targets, Barry Callebaut’s current valuation looks expensive when compared to both its industry and historical averages. Its price-to-earnings ratio stands at 35.7x, which is well above the industry average of 15.5x and even its own fair ratio of 33.5x. This leaves little margin for error if growth stalls or expectations temper. Could the stock’s premium be at risk if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Barry Callebaut Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Barry Callebaut research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Eager to get ahead in the current market? Now’s your chance to seize exciting opportunities by tapping into top stock picks targeting this year’s biggest investment trends.

- Capitalize on rapid payouts and secure income by zeroing in on these 15 dividend stocks with yields > 3% for yields that outpace the average savings account.

- Ride the wave of innovation by targeting these 26 AI penny stocks. These are fueling growth in artificial intelligence and changing the tech landscape.

- Strengthen your portfolio with these 872 undervalued stocks based on cash flows, selected for their attractive price relative to true business value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products in Western Europe, North America, Central and Eastern Europe, Latin America, and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives