Stock Analysis

- Switzerland

- /

- Capital Markets

- /

- SWX:SQN

Leonteq And Two Other Growth Stocks With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland stock market recently experienced a downturn, reflecting broader European trends influenced by concerns over global economic growth and underwhelming earnings reports from key players in the U.S. and Europe. Amid such market conditions, investors might find particular interest in growth companies with high insider ownership, as these firms often demonstrate a strong alignment of interests between shareholders and management, potentially offering resilience during volatile periods.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 22.2% |

| VAT Group (SWX:VACN) | 10.2% | 22.8% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 15.4% |

| COLTENE Holding (SWX:CLTN) | 22.2% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.8% |

| Temenos (SWX:TEMN) | 17.4% | 14.1% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

We're going to check out a few of the best picks from our screener tool.

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG is a financial services provider specializing in structured investment products and long-term savings and retirement solutions across Switzerland, Europe, Asia, and the Middle East, with a market capitalization of CHF 427.90 million.

Operations: The company generates CHF 256.88 million from its brokerage services.

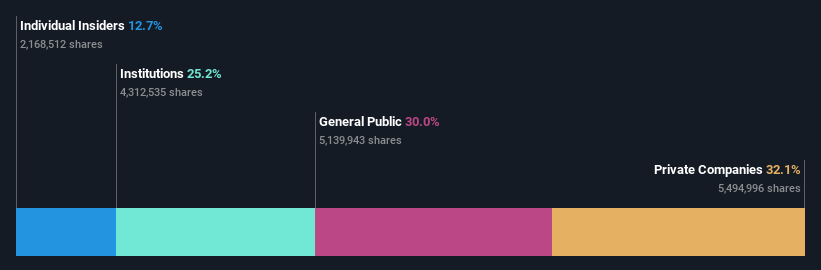

Insider Ownership: 12.7%

Leonteq, trading at CHF 77.8% below estimated fair value, is poised for substantial growth with earnings expected to increase by 32.41% annually. Despite a challenging dividend coverage, with free cash flows not adequately covering a 4% dividend yield, the company's revenue growth of 10.6% per year outpaces the Swiss market's 4.7%. However, concerns include low forecasted return on equity at 10.4%, and financial leverage where debt is poorly covered by operating cash flow.

- Navigate through the intricacies of Leonteq with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Leonteq's shares may be trading at a premium.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG operates globally, focusing on the development, production, sale, and servicing of sensor systems, modules, and components with a market capitalization of CHF 1.29 billion.

Operations: The company generates CHF 233.17 million from its sensor systems, modules, and components segment.

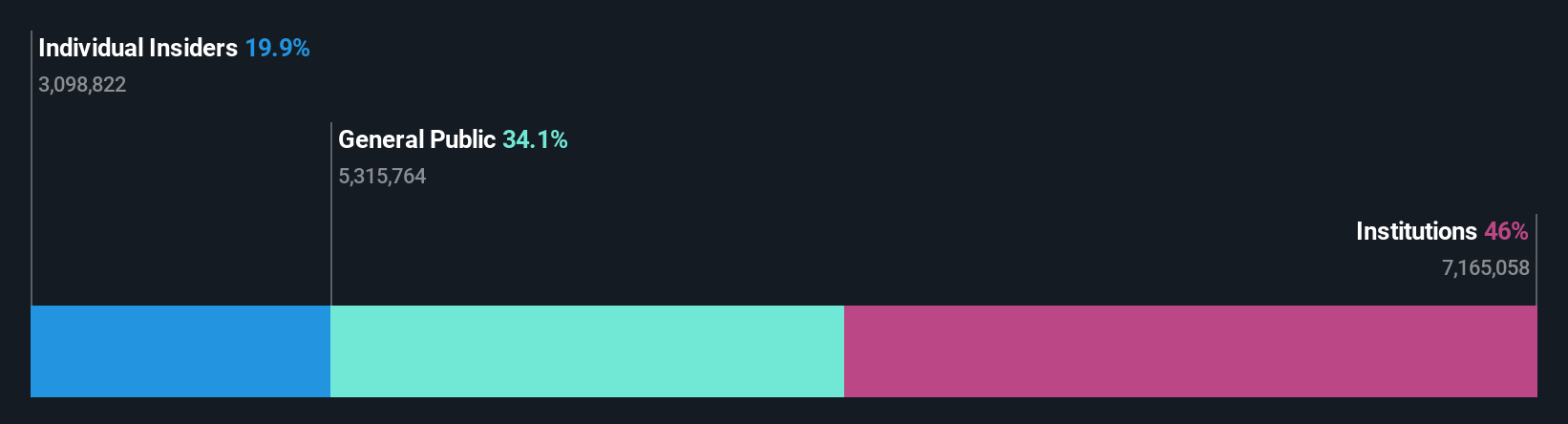

Insider Ownership: 20.7%

Sensirion Holding is set to outperform the Swiss market with its revenue projected to increase by 13.3% annually, compared to the market's 4.7%. The company is expected to turn profitable within three years, showcasing significant earnings growth at an annual rate of 79.98%. However, it faces challenges with a low forecasted return on equity of 10.7% and a highly volatile share price recently. Notably, there has been no substantial insider trading activity in the past three months.

- Click here to discover the nuances of Sensirion Holding with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sensirion Holding shares in the market.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and institutional clients with a market capitalization of CHF 4.16 billion.

Operations: The company generates revenue primarily through leveraged Forex and securities trading, totaling CHF 101.09 million and CHF 429.78 million respectively.

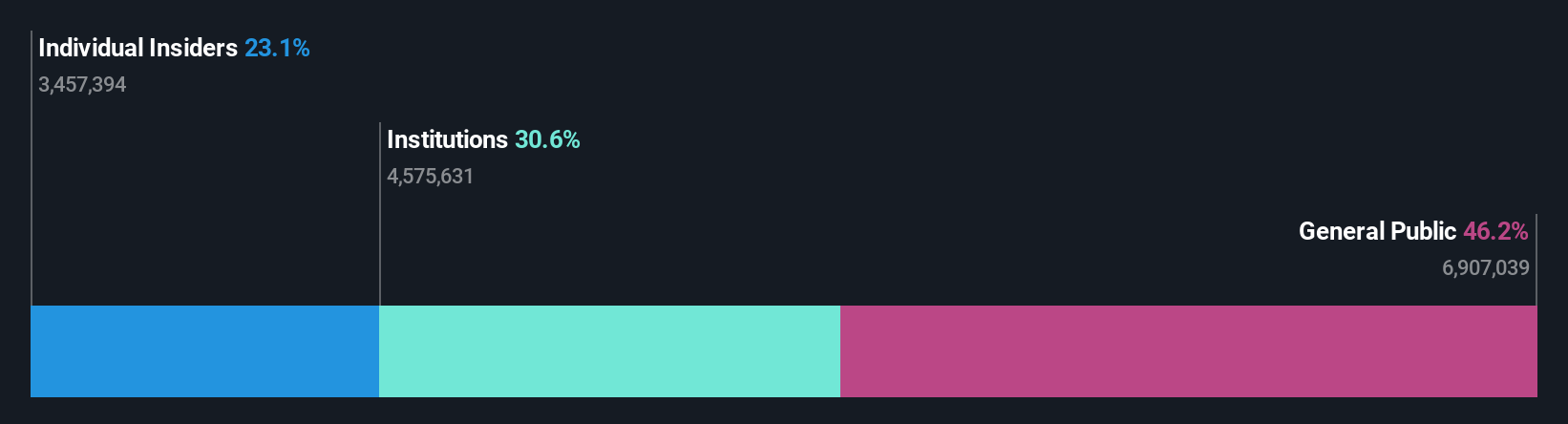

Insider Ownership: 11.4%

Swissquote Group Holding is poised for moderate growth, with earnings expected to rise by 13.8% annually, outpacing the Swiss market's 8.9%. Revenue forecasts also exceed market averages at a 9.9% annual increase. Despite trading 22.5% below its estimated fair value, offering potential upside, its revenue growth does not reach the high-growth benchmark of over 20%. Additionally, there has been no significant insider buying or selling in the last three months, indicating stable ownership interest.

- Dive into the specifics of Swissquote Group Holding here with our thorough growth forecast report.

- Our expertly prepared valuation report Swissquote Group Holding implies its share price may be too high.

Taking Advantage

- Dive into all 14 of the Fast Growing SIX Swiss Exchange Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SQN

Swissquote Group Holding

Provides a suite of online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

Outstanding track record with reasonable growth potential and pays a dividend.