Stock Analysis

July 2024 Insight Into High Insider Ownership Growth Stocks On SIX Swiss Exchange

Reviewed by Simply Wall St

Amidst a backdrop of declining performance across European markets, including a notable downturn in the Swiss stock market, investors remain cautious as global economic uncertainties and disappointing earnings reports influence sentiment. In such an environment, exploring growth companies with high insider ownership on the SIX Swiss Exchange could offer potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 22.2% |

| VAT Group (SWX:VACN) | 10.2% | 22.8% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 15.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.8% |

| Temenos (SWX:TEMN) | 17.4% | 14.1% |

| Leonteq (SWX:LEON) | 12.7% | 32.4% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's review some notable picks from our screened stocks.

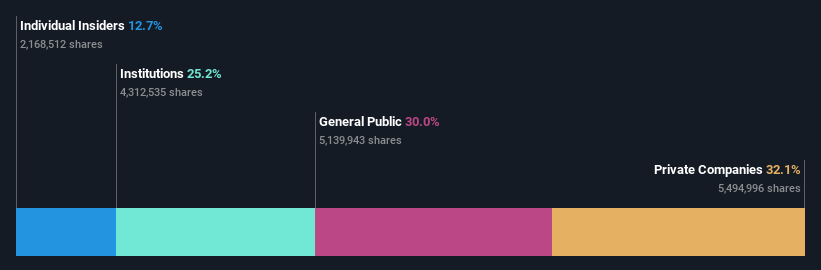

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG, with a market cap of CHF 427.90 million, operates in Switzerland, Europe, and Asia including the Middle East, specializing in structured investment products and long-term savings and retirement solutions.

Operations: The company generates CHF 256.88 million from its brokerage services.

Insider Ownership: 12.7%

Leonteq, a Swiss company, is trading at 77.8% below its estimated fair value, indicating potential undervaluation. It's poised for substantial growth with earnings expected to increase by 32.41% annually, outpacing the Swiss market's 8.6%. However, its revenue growth forecast of 10.6% yearly lags behind the ideal 20%, and its low return on equity at 10.4% raises concerns about future profitability efficiency. Additionally, financial stability is questionable as debt isn't well covered by operating cash flow.

- Unlock comprehensive insights into our analysis of Leonteq stock in this growth report.

- Our comprehensive valuation report raises the possibility that Leonteq is priced higher than what may be justified by its financials.

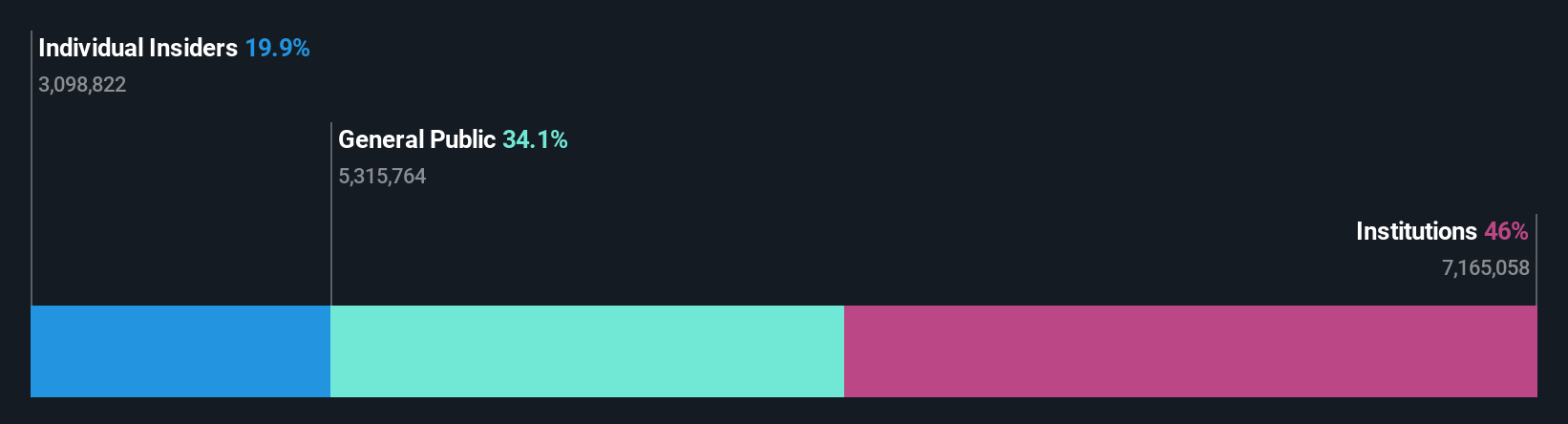

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG operates globally, specializing in the development, production, and sale of sensor systems, modules, and components with a market capitalization of approximately CHF 1.29 billion.

Operations: The company generates CHF 233.17 million from its sensor-related products.

Insider Ownership: 20.7%

Sensirion Holding, a Swiss company, is set to grow its revenue by 13.3% annually, outperforming the Swiss market's 4.7% growth rate. While its revenue growth doesn't reach the high benchmark of 20%, it's notable that earnings are expected to surge by approximately 80% per year. Sensirion is anticipated to become profitable within three years, a positive shift from current levels. However, its return on equity in three years is projected at a modest 10.7%, and recent months have shown high volatility in share price without significant insider buying or selling activity reported.

- Delve into the full analysis future growth report here for a deeper understanding of Sensirion Holding.

- In light of our recent valuation report, it seems possible that Sensirion Holding is trading beyond its estimated value.

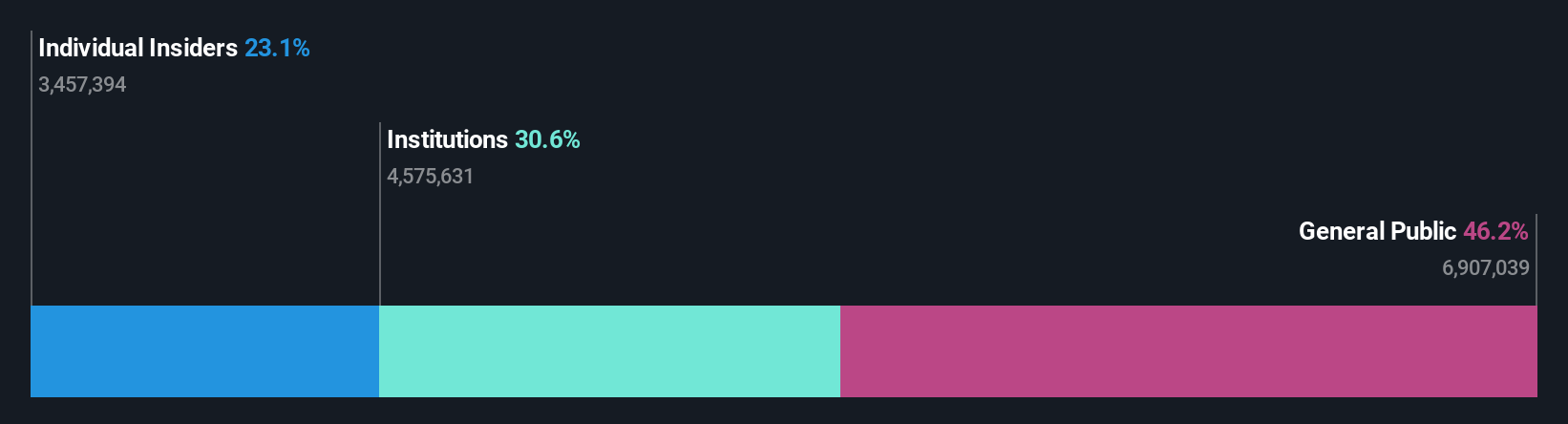

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd specializes in offering a range of online financial services to various customer groups including retail, affluent, and professional and institutional clients globally, with a market capitalization of approximately CHF 4.16 billion.

Operations: Swissquote's revenue is derived primarily from two segments: Leveraged Forex, generating CHF 101.09 million, and Securities Trading, which contributes CHF 429.78 million.

Insider Ownership: 11.4%

Swissquote Group Holding, a Swiss financial services company, is trading at CHF 22.5% below its estimated fair value, suggesting potential undervaluation. The company has experienced a robust earnings growth of 38.3% over the past year and is expected to continue this trend with earnings forecasted to grow by 13.77% annually and revenue by 9.9% per year—both rates surpassing the general Swiss market's projections of 8.6% for earnings and 4.7% for revenue growth respectively. Despite these positive indicators, there's no significant insider buying reported recently, which could raise concerns about insider confidence levels.

- Dive into the specifics of Swissquote Group Holding here with our thorough growth forecast report.

- Our valuation report here indicates Swissquote Group Holding may be overvalued.

Key Takeaways

- Click this link to deep-dive into the 14 companies within our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.