- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

What Do Recent Private Markets Shifts Mean for Partners Group Shareholders in 2025?

Reviewed by Bailey Pemberton

Are you sitting on the fence about what to do with Partners Group Holding stock? You are not alone. With shares at CHF 1057.5, recent market action has been a bag of mixed signals. The stock bounced up 2.0% in the past week, maybe reflecting some renewed optimism, but over the last month, it dipped by 1.0%, and the year-to-date story is even less cheerful, showing a 15.1% drop. While that might look concerning, it is important to zoom out. The 3-year and 5-year returns are still strongly positive, up 45.8% and 42.8% respectively. This suggests longer-term investors have still come out ahead, despite the recent bouts of volatility.

A lot of this movement seems to track broader shifts in the European private markets scene. Investor sentiment has been swinging between risk aversion and selective optimism as global macro factors weigh in. For Partners Group, most valuation models pick up on these shifting expectations about growth and risk, which is why it currently notches just a 1 out of 6 on our undervaluation scorecard. In other words, only one valuation metric suggests this stock is undervalued right now.

So, how do all the traditional valuation approaches stack up here? More importantly, what might actually give you an edge in understanding the true value of Partners Group? We will break that down in detail and hint at a smarter take you will not want to miss at the end.

Partners Group Holding scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Partners Group Holding Excess Returns Analysis

The Excess Returns model assesses a company by looking at how much profit it generates above and beyond the cost of its equity capital. In simple terms, it checks whether Partners Group makes enough from its investments to justify the risk shareholders take on. A higher excess return signals stronger value creation and hints at pricing power or an economic moat.

For Partners Group Holding, the core metrics are clear:

- Book Value: CHF64.70 per share

- Stable EPS: CHF57.67 per share

(Source: Weighted future Return on Equity estimates from 9 analysts.) - Cost of Equity: CHF5.63 per share

- Excess Return: CHF52.04 per share

- Average Return on Equity: 54.33%

- Stable Book Value: CHF106.15 per share

(Source: Weighted future Book Value estimates from 5 analysts.)

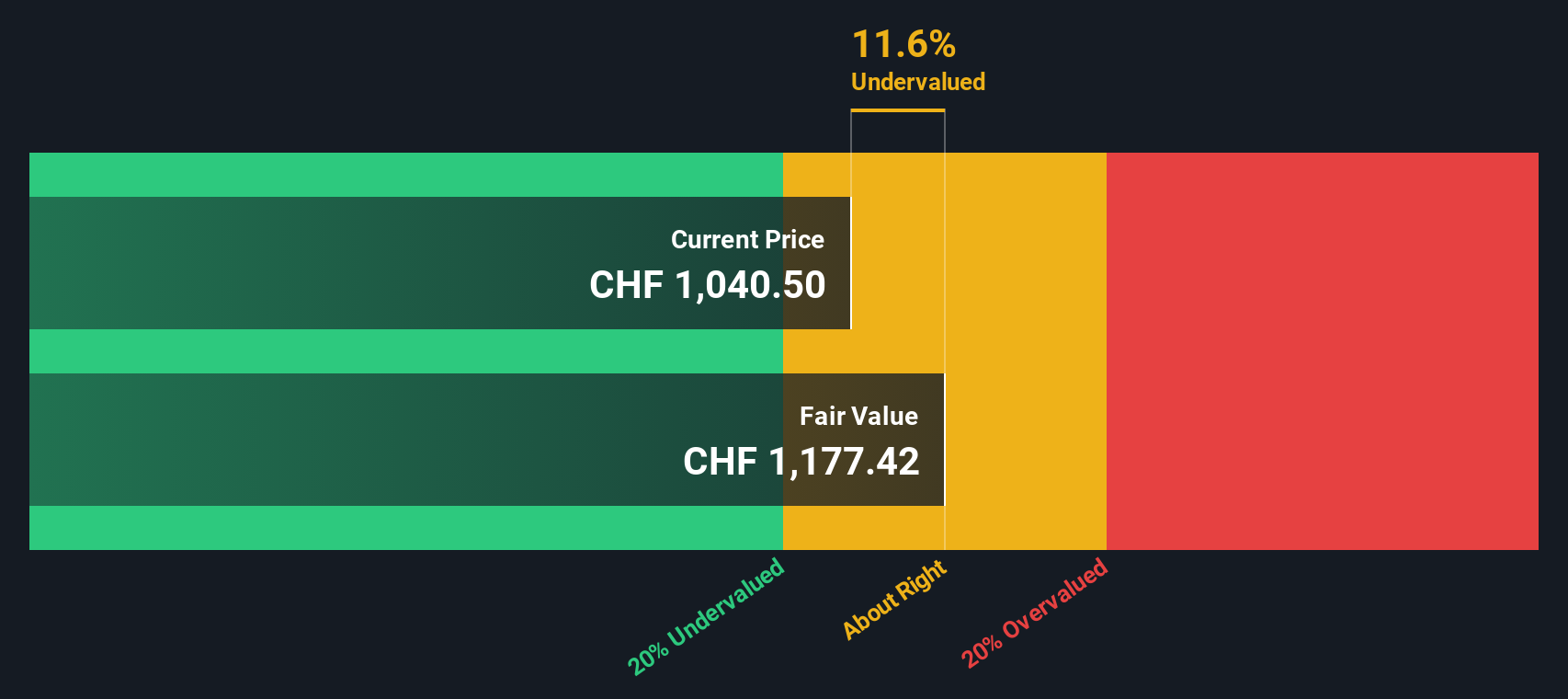

According to this method, Partners Group is generating a notably high excess return compared to its equity cost. This suggests it is putting shareholder capital to work effectively over the long term. The estimated intrinsic value using this model is CHF1,178.20 per share, which is 10.2% above the latest share price. That implies the stock is currently undervalued by this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests Partners Group Holding is undervalued by 10.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Partners Group Holding Price vs Earnings

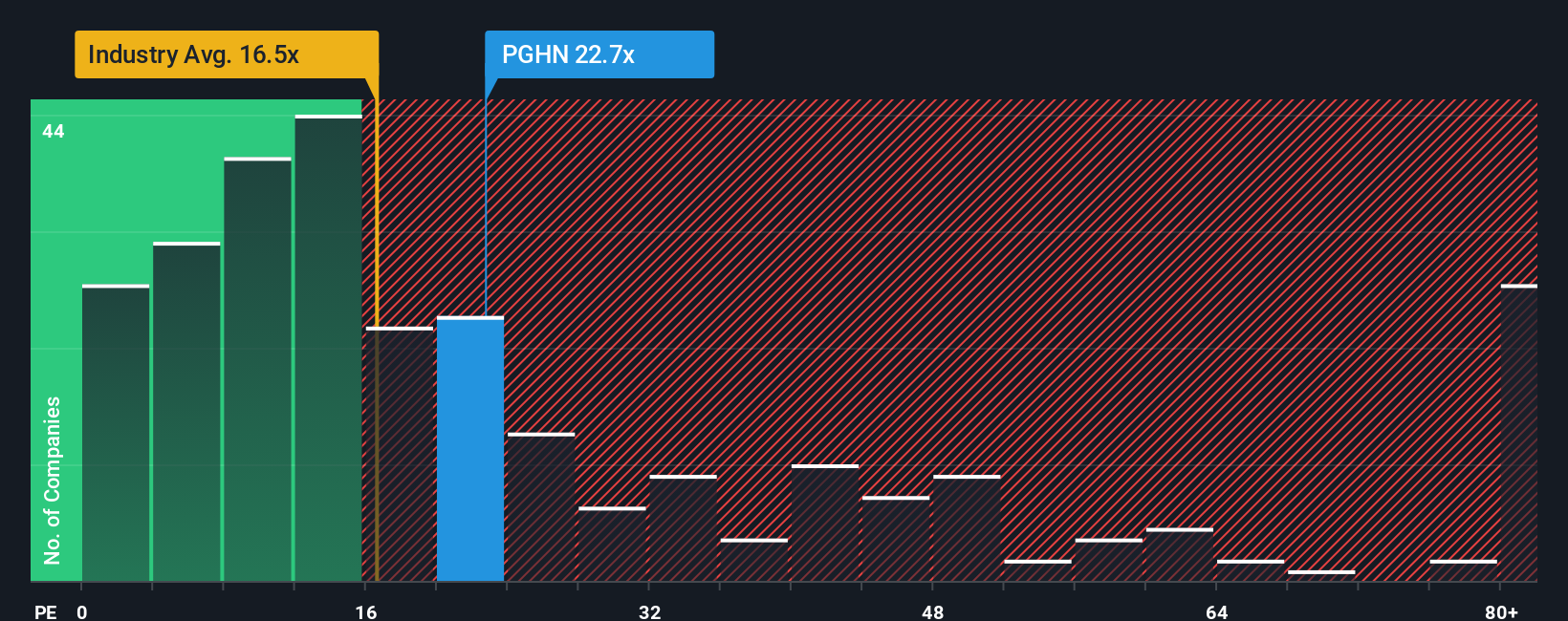

The Price-to-Earnings (PE) ratio is a useful tool for valuing profitable businesses because it allows investors to quickly compare a company’s stock price to its earnings power. For a company like Partners Group Holding, which consistently delivers profits, the PE ratio can provide a snapshot of how the market is valuing its current and future earnings potential.

However, it is important to remember that what counts as a “normal” or “fair” PE ratio varies from one company to another, shaped by factors such as future growth expectations and perceived risks. Higher growth businesses often command higher PE multiples, while riskier or slower-growth companies tend to trade at lower ratios.

At present, Partners Group is trading at a PE of 22.90x. This is notably above the Capital Markets industry average of 19.61x and also above the average for its peer group, which sits at 17.21x. To put these numbers in context, Simply Wall St’s proprietary “Fair Ratio” stands at 20.64x for Partners Group. The Fair Ratio is designed to go beyond the usual benchmarks by factoring in the company’s unique combination of earnings growth, risks, profit margin, industry dynamics and market capitalization.

This makes the Fair Ratio a more nuanced and tailored measure than simply comparing to industry averages or peers, which may not fully reflect Partners Group’s strengths or vulnerabilities. In this case, Partners Group’s current PE is not far above its Fair Ratio, signaling the price investors pay is broadly justified given its underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Partners Group Holding Narrative

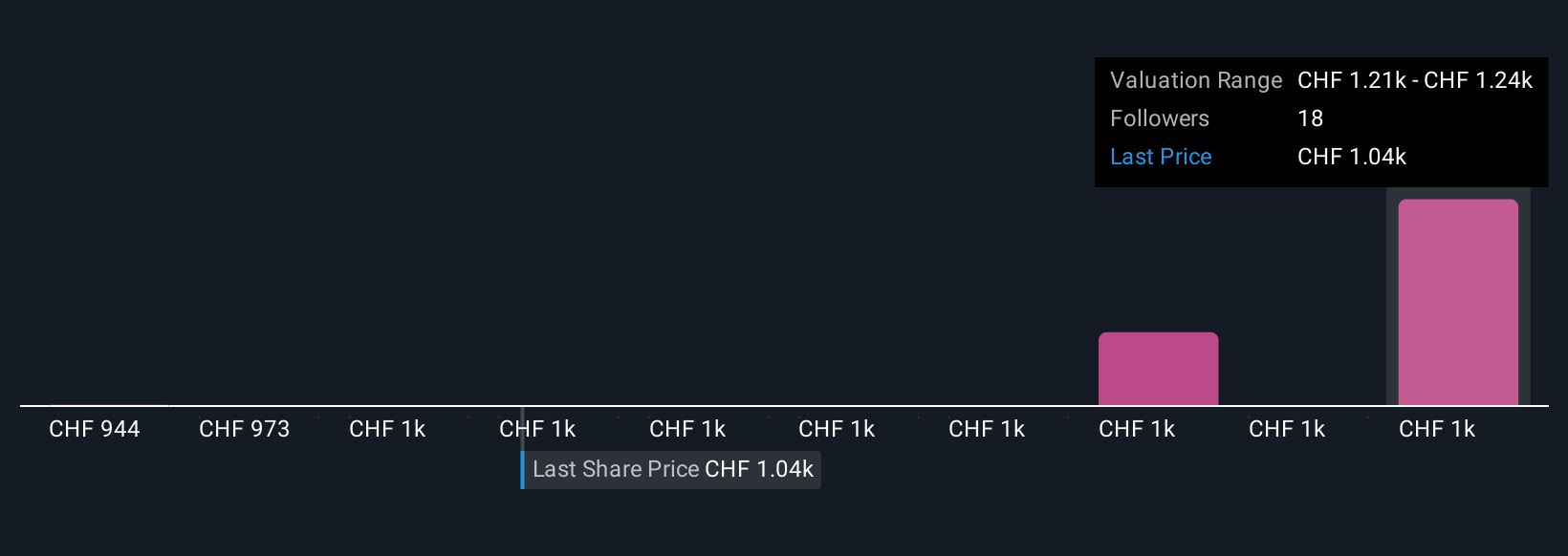

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply the story behind your view of a company, tying together your assumptions about its future revenue, profits, and fair value. Think of it as a bridge between what you believe, based on new information, trends, or personal conviction, and the financial forecasts that drive your buy or sell decision.

With Narratives, you can connect your view of Partners Group's market opportunities or risks with a dynamic fair value estimate that instantly updates as news or earnings emerge. This feature is available on Simply Wall St’s Community page and used by millions of investors, making it easy and accessible to build and compare investment stories. No complex spreadsheets are required.

Narratives empower you to see how your perspective compares with others and let you track how your fair value stacks up against the current share price and the views of the broader market. For example, one investor’s Narrative for Partners Group may highlight resilient fee growth and expanding digital solutions to justify a bullish CHF 1,475 price target. Another might focus on rising competition and margin pressures to argue for a more conservative CHF 1,120 target.

Do you think there's more to the story for Partners Group Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives