- Switzerland

- /

- Machinery

- /

- SWX:VACN

Three Growth Companies On SIX Swiss Exchange With High Insider Ownership And 50% ROE

Reviewed by Simply Wall St

The Swiss stock market concluded on a robust note this Wednesday, buoyed by positive international economic news that quelled concerns over rising interest rates. This upward trajectory in the SMI index reflects a broader optimism that could favor companies with strong fundamentals and high insider ownership, characteristics often linked to sustained growth and resilience in varying market conditions.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.9% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| LEM Holding (SWX:LEHN) | 34.5% | 9.9% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.2% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 84.7% |

| Arbonia (SWX:ARBN) | 28.8% | 80% |

Here's a peek at a few of the choices from the screener.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm that manages investments across multiple sectors including equity, real estate, infrastructure, and debt, with a market capitalization of approximately CHF 33.23 billion.

Operations: The firm's revenue is derived from various segments: Private Equity at CHF 1.17 billion, Infrastructure at CHF 379.20 million, Private Credit at CHF 211.30 million, and Real Estate at CHF 186.90 million.

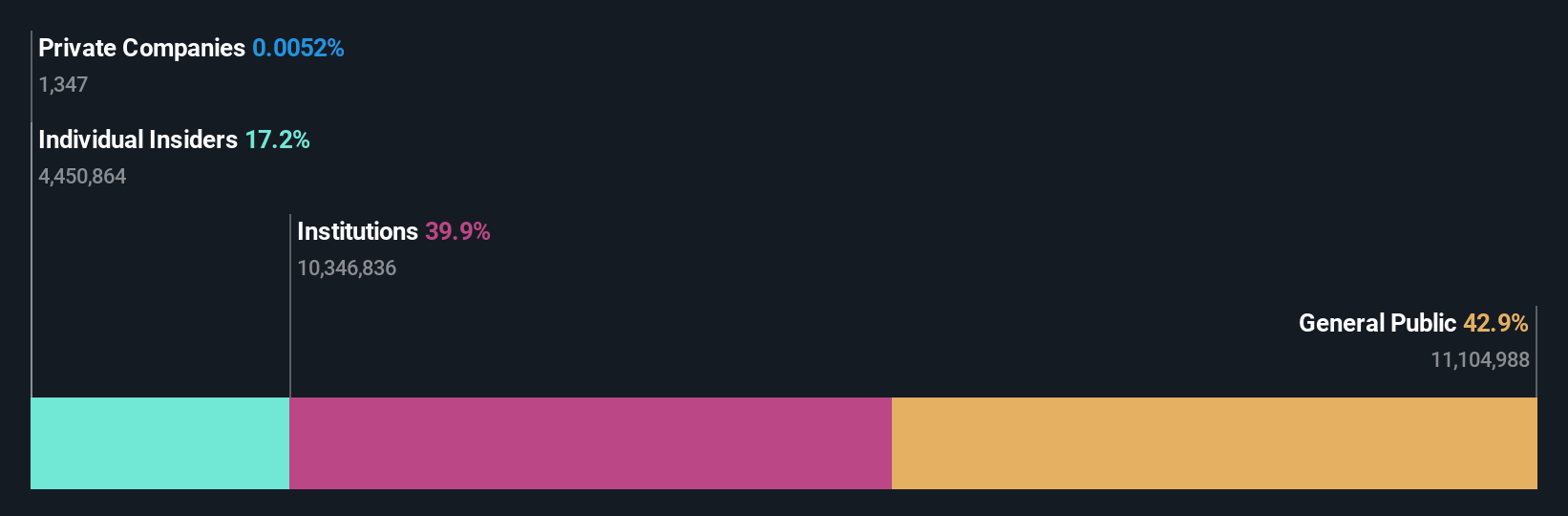

Insider Ownership: 17.1%

Return On Equity Forecast: 50% (2026 estimate)

Partners Group Holding, a Swiss private equity firm, demonstrates robust insider ownership with active strategic maneuvers including potential sales of substantial assets like Formosa Solar and VSB Holding GmbH, indicating agility in its portfolio management. Despite a slight dip in earnings per share in 2023, the company is poised for above-market revenue and profit growth. However, it grapples with high debt levels which could overshadow its strong projected return on equity.

- Dive into the specifics of Partners Group Holding here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Partners Group Holding is trading beyond its estimated value.

Sonova Holding (SWX:SOON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG is a company that specializes in manufacturing and selling hearing care solutions for adults and children across regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of CHF 17.73 billion.

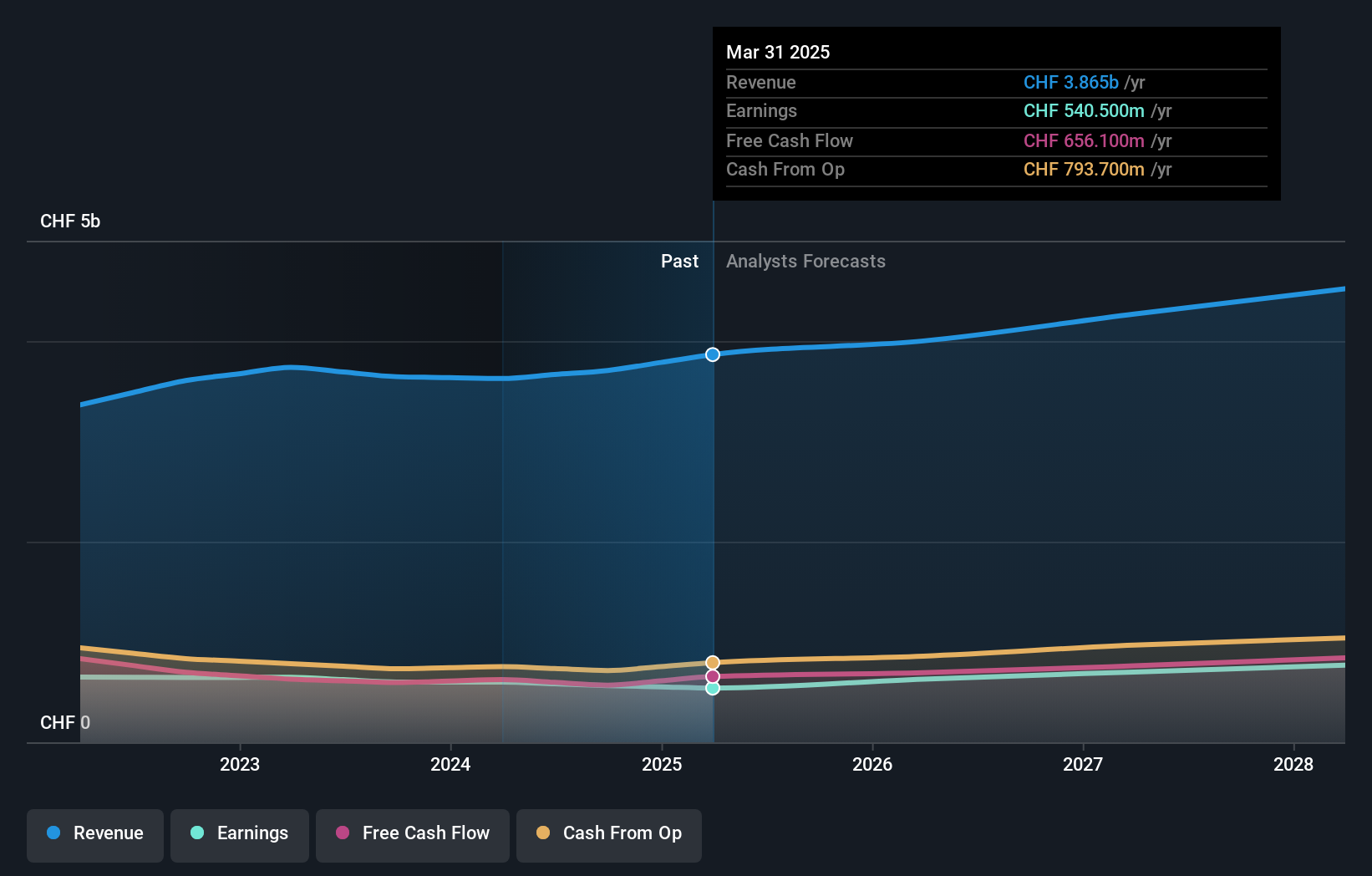

Operations: The company's revenue is primarily derived from two segments: Cochlear Implants generating CHF 280.30 million and Hearing Instruments contributing CHF 3.38 billion.

Insider Ownership: 17.7%

Return On Equity Forecast: 28% (2026 estimate)

Sonova Holding AG, a Swiss growth company with significant insider ownership, trades at 33.8% below its estimated fair value and is poised for robust financial performance. Expected to outpace the Swiss market, its revenue and earnings are forecasted to grow by 6.8% and 10.2% per year respectively, compared to market averages of 4.3% and 8%. While its high level of debt poses a challenge, a forecasted return on equity of 27.9% in three years underscores strong potential profitability.

- Delve into the full analysis future growth report here for a deeper understanding of Sonova Holding.

- Upon reviewing our latest valuation report, Sonova Holding's share price might be too pessimistic.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG specializes in developing, manufacturing, and supplying vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across various global markets, with a market capitalization of approximately CHF 14.42 billion.

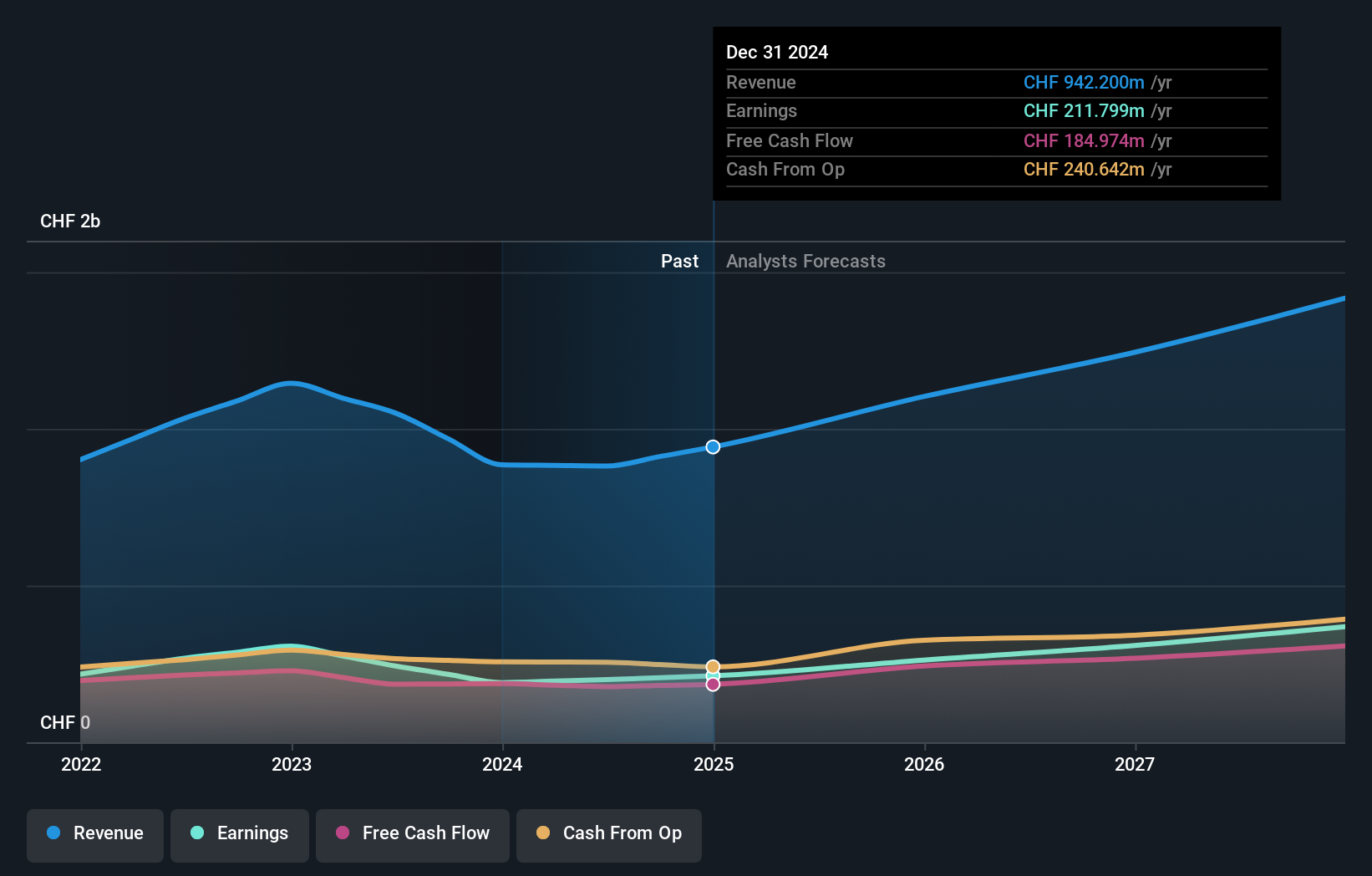

Operations: The company generates CHF 782.74 million from its Valves segment and CHF 172.87 million from Global Service operations.

Insider Ownership: 10.2%

Return On Equity Forecast: 39% (2026 estimate)

VAT Group AG, a Swiss company with high insider ownership, is navigating a challenging period with a significant drop in sales and net income as reported for the full year ended December 31, 2023. Despite this downturn, the company's revenue and earnings are forecasted to grow at 15.5% and 21.2% per year respectively, outpacing the Swiss market averages significantly. The firm maintains a high forecasted return on equity of 39.1%, indicating strong potential profitability despite its recent volatility in share price.

- Click to explore a detailed breakdown of our findings in VAT Group's earnings growth report.

- The valuation report we've compiled suggests that VAT Group's current price could be inflated.

Summing It All Up

- Reveal the 17 hidden gems among our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows in Switzerland, rest of Europe, the United States, Japan, Korea, Singapore, China, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.