- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Could Nicholas Smith Wang's Appointment Signal a Shift in Partners Group (SWX:PGHN) Technology Ambitions?

Reviewed by Sasha Jovanovic

- Partners Group has appointed Nicholas Smith Wang as Partner and Co-Head of its Private Equity Technology Vertical, bringing his experience in technology investments from Warburg Pincus to its Baar-Zug, Switzerland headquarters.

- This leadership addition reflects the firm's continuing focus on growing its technology private equity platform by leveraging deep sector expertise and global reach.

- We’ll now consider how Nicholas Smith Wang’s expertise in global technology investments may influence Partners Group's business outlook and investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Partners Group Holding Investment Narrative Recap

To be a shareholder in Partners Group, you have to believe in the firm's ability to capture rising allocations to private markets, particularly as institutional and high-net-worth clients seek diversification and yield. The recent appointment of Nicholas Smith Wang as Co-Head of Private Equity Technology enhances sector expertise within an important growth segment, but is unlikely to dramatically shift the immediate catalyst, which remains centered on asset and fee growth amid fierce industry competition. The most pressing risk continues to be margin pressure from industry pricing dynamics and a challenging fundraising backdrop.

Of the company’s recent announcements, the partnership with PGIM to develop multi-asset portfolio solutions for a broader investor base stands out in relation to asset gathering and recurring fee revenue. This aligns with the sector’s long-term catalyst: regulatory changes and increased demand making private markets more accessible, but the lure of higher flows is offset by the need to maintain healthy margins as client acquisition costs rise and product complexity increases.

At the same time, investors should not overlook how intensifying private equity competition and shifting fee models could ...

Read the full narrative on Partners Group Holding (it's free!)

Partners Group Holding's narrative projects CHF3.2 billion in revenue and CHF1.6 billion in earnings by 2028. This requires 11.7% yearly revenue growth and a CHF0.4 billion increase in earnings from the current CHF1.2 billion.

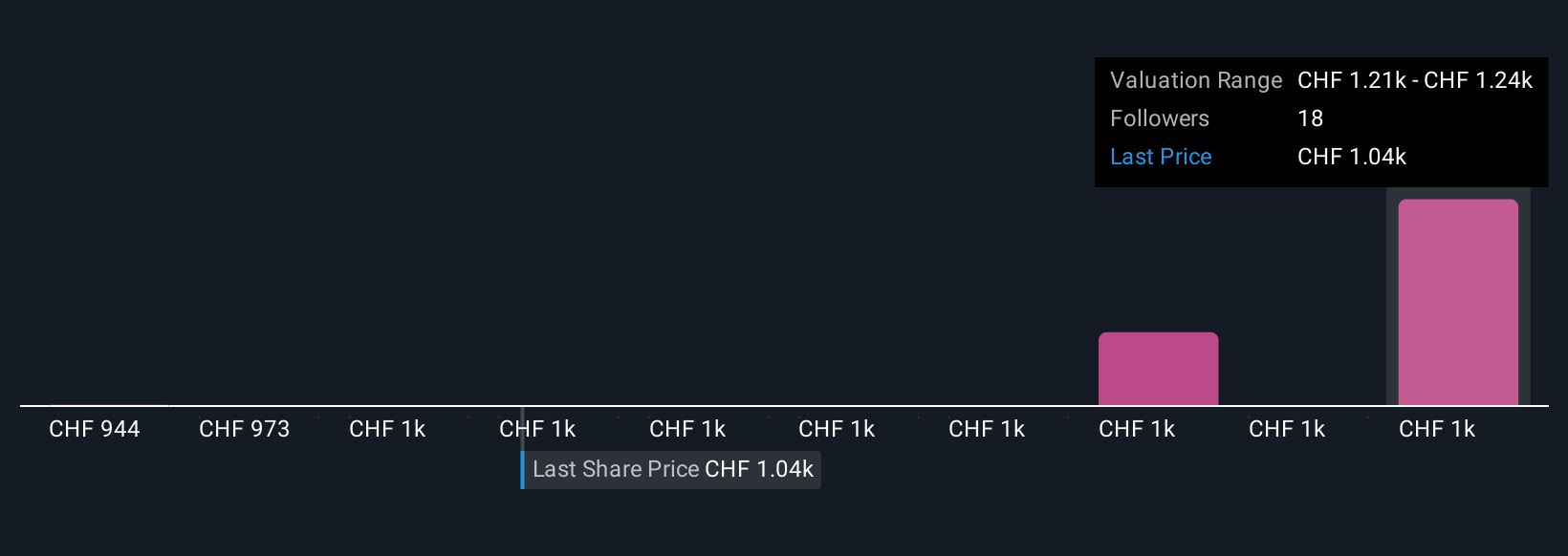

Uncover how Partners Group Holding's forecasts yield a CHF1252 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Private fair value estimates from the Simply Wall St Community range tightly from CHF1,219.62 to CHF1,251.71, drawing on 3 individual forecasts. Many believe increased access to private markets will support future revenue growth, though growing competition for institutional capital could test Partners Group’s share of wallet over time.

Explore 3 other fair value estimates on Partners Group Holding - why the stock might be worth as much as 37% more than the current price!

Build Your Own Partners Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Partners Group Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Partners Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Partners Group Holding's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives