- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Assessing Partners Group (SWX:PGHN) Valuation After Naming Nicholas Smith Wang to Lead Tech Investments

Reviewed by Simply Wall St

Partners Group Holding (SWX:PGHN) has named Nicholas Smith Wang as Partner and Co-Head of its Private Equity Technology Vertical. This move underscores the firm's focus on expanding its technology investment capabilities with experienced senior leadership.

See our latest analysis for Partners Group Holding.

Partners Group's appointment of Nicholas Smith Wang comes at a time when momentum around the stock has been mixed. The company’s 1-year total shareholder return stands at -24.6%, signaling some challenges for long-term holders. The recent 90-day share price return of -19% suggests near-term sentiment has weakened. However, with a 5-year total return still positive and new leadership aiming to expand their technology presence, there is potential for shifts in investor perception if these strategic moves begin to pay off.

If you’re curious about other trends shaping the market, now’s the perfect moment to discover fast growing stocks with high insider ownership for new investment opportunities beyond the usual names.

With shares now trading at a notable discount to analyst price targets, the key question is whether Partners Group is a value play with untapped upside or if the market is simply reflecting realistic expectations for future growth.

Most Popular Narrative: 27% Undervalued

Partners Group Holding’s most widely followed narrative pegs its fair value at CHF 1,251.71, a significant premium to the last close of CHF 917.80. The market’s current stance is cautious, but the narrative suggests there could be substantially more upside if the core assumptions play out.

The trend toward broader access to private markets, accelerated by regulatory moves enabling inclusion of private assets in retirement plans and more democratized products, positions Partners Group to benefit from rising asset flows from both high-net-worth and retail clients. This is likely to lead to higher long-term AUM and increased recurring management fee revenues.

Want to know what underpins Partners Group’s optimistic valuation? This narrative hints at a bold acceleration in recurring revenues, driven by seismic shifts in client demand and asset flows. The true growth levers are hidden in future earnings projections and a profit multiple rarely seen in its sector. Discover exactly how these ambitions fuel that hefty price target.

Result: Fair Value of $1,251.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and unpredictable fundraising trends could put pressure on Partners Group’s margins and challenge its ability to sustain strong long-term revenue growth.

Find out about the key risks to this Partners Group Holding narrative.

Another View: Are Multiples Sending a Different Signal?

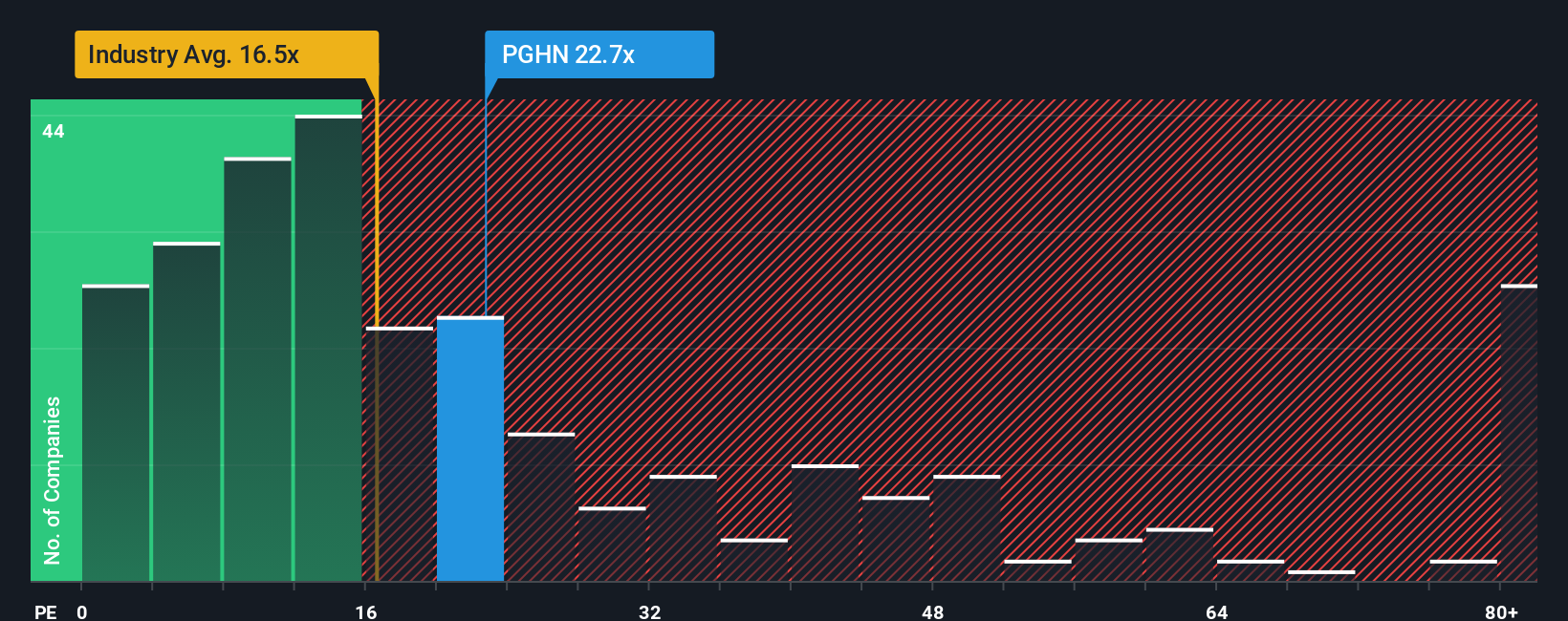

While our first look at value relied on future earnings and discounting, another angle is to compare the company’s price-to-earnings ratio with the market. Partners Group trades at 19.9x earnings, which is higher than the industry’s 15.6x and peer average of 16.8x. The fair ratio is estimated at 20.1x. This narrow gap means the stock is not a screaming bargain or an obvious risk by this method, but which valuation story will the market believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Partners Group Holding Narrative

If you want to challenge this perspective or would rather form your own take from the data, you can build a personalized view in just a few minutes with Do it your way.

A great starting point for your Partners Group Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let today’s opportunities pass you by. Broaden your investing toolkit and seize the chance to uncover unique stocks transforming tomorrow’s markets before everyone else.

- Tap into the power of digital finance by tracking these 81 cryptocurrency and blockchain stocks companies that are setting the pace in blockchain innovation and secure payment solutions.

- Grow your passive income stream with these 17 dividend stocks with yields > 3% offering solid yields and the stability of proven cash flows.

- Embrace cutting-edge breakthroughs in medicine and artificial intelligence by reviewing these 30 healthcare AI stocks at the forefront of healthcare transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives