- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Discovering Switzerland's Hidden Stock Gems This October 2024

Reviewed by Simply Wall St

In recent weeks, the Swiss market has experienced fluctuations, with the SMI index closing slightly lower amid concerns over rising U.S. consumer price inflation and increased jobless claims. Despite these broader economic challenges, there remain opportunities to uncover promising stocks that show resilience and potential in such a dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Burkhalter Holding AG, with a market cap of CHF962.77 million, operates through its subsidiaries to deliver electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding AG generates revenue primarily from electrical engineering services, amounting to CHF1.18 billion. The company's financial performance is reflected in its net profit margin, which provides insight into its profitability relative to total revenue.

Burkhalter Holding, a Swiss construction player, has shown robust performance with earnings up 10% over the past year, outpacing the industry’s 8.7%. Recent half-year results revealed revenue of CHF 570.3 million and net income of CHF 23.3 million. Despite a high debt-to-equity ratio climbing to 89% over five years, interest payments are well-covered by EBIT at 46 times. Trading slightly below fair value, its financial health is underlined by positive free cash flow and quality earnings.

- Unlock comprehensive insights into our analysis of Burkhalter Holding stock in this health report.

Gain insights into Burkhalter Holding's past trends and performance with our Past report.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

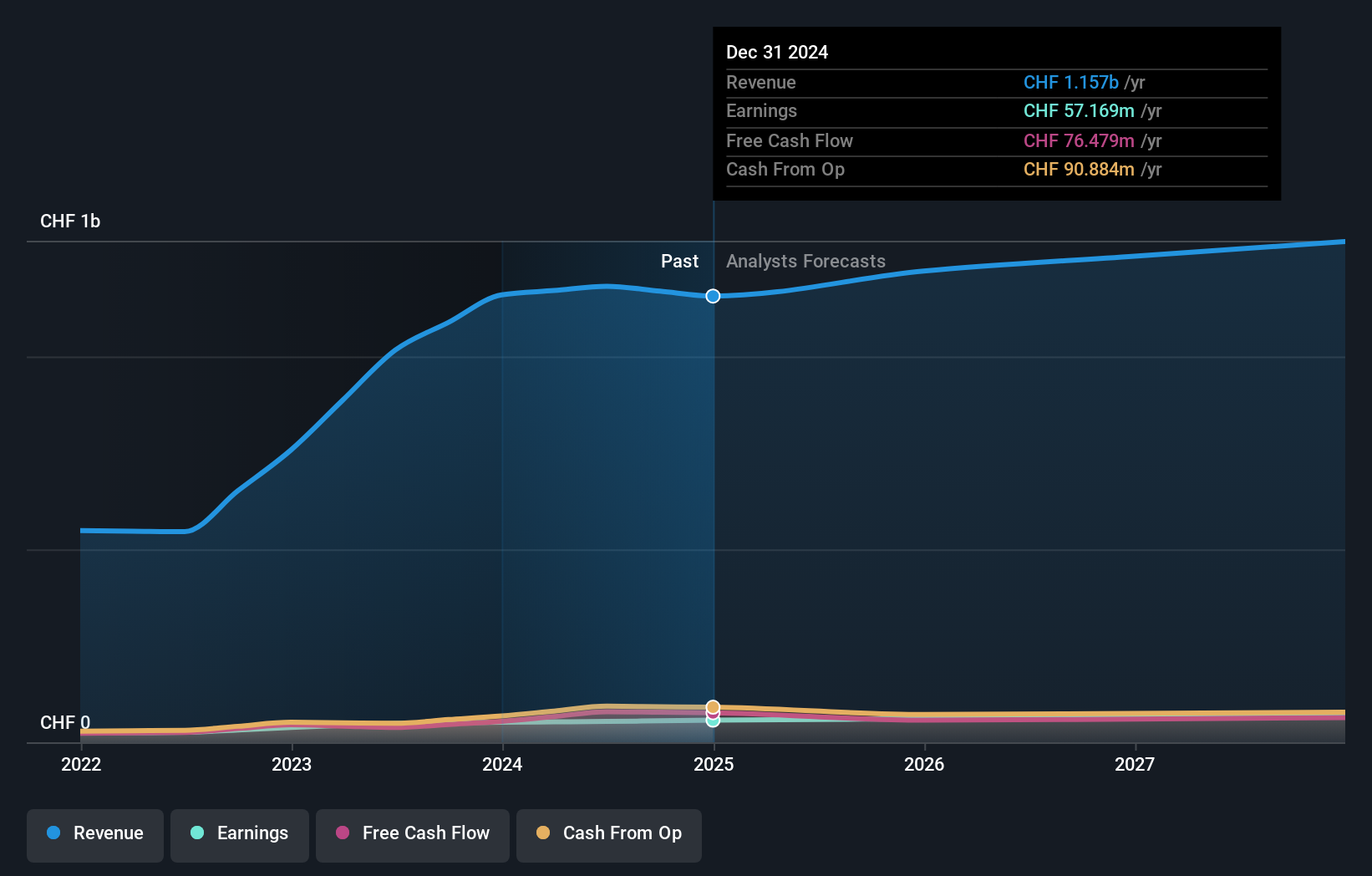

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market capitalization of CHF1.25 billion.

Operations: The company generates revenue primarily from three regions: Europe, Middle East and Africa (CHF452.85 million), Americas (CHF352.67 million), and Asia-Pacific (CHF273.16 million).

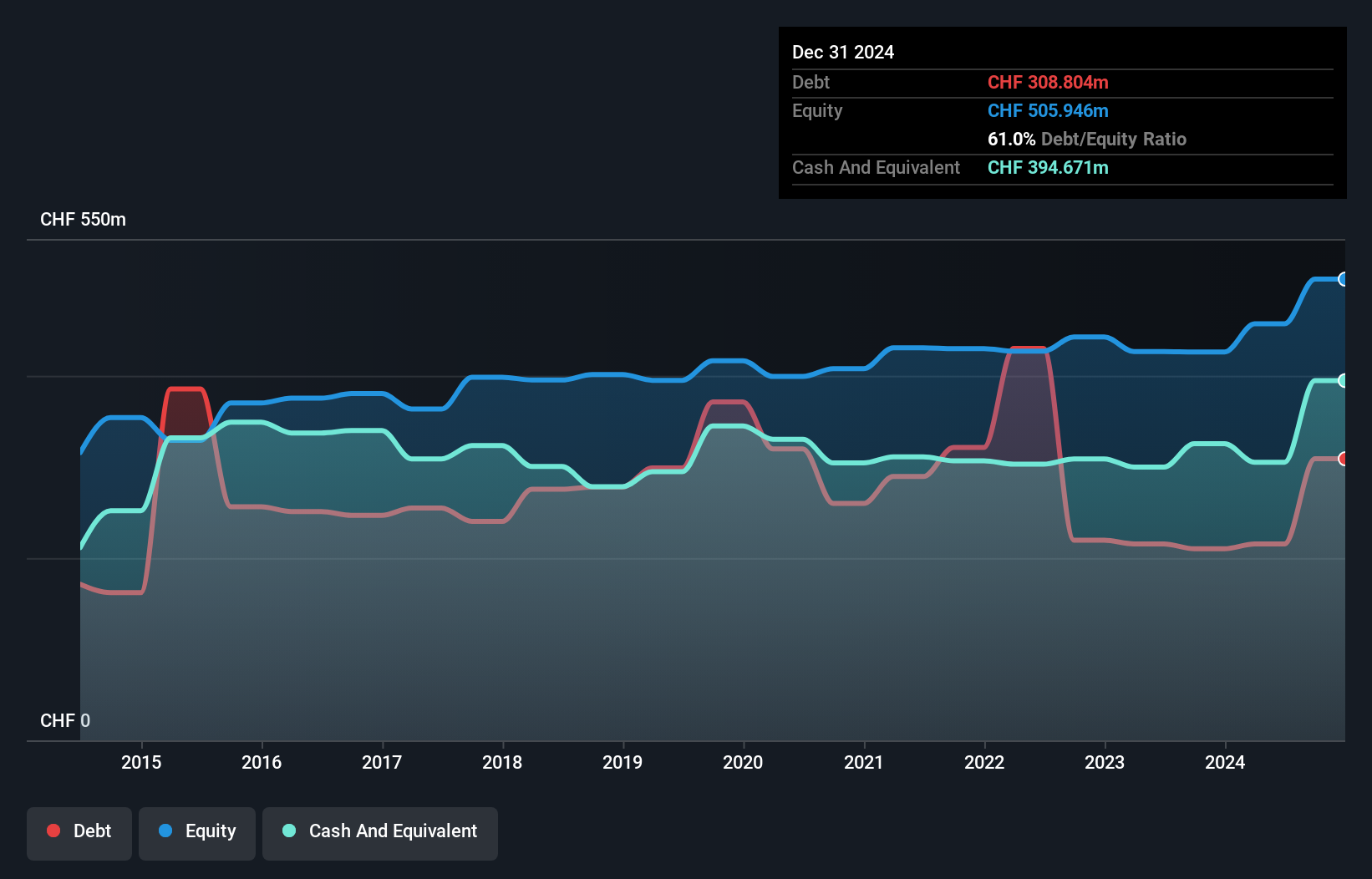

With high-quality earnings and a debt-to-equity ratio reduced to 47.1% over five years, Compagnie Financière Tradition seems well-positioned in the capital markets sector. It outpaced industry growth with a 16.1% increase in earnings, while net income rose to CHF 59.99 million for the half year ended June 2024 from CHF 51.02 million previously. Despite recent shareholder dilution, the company trades at an attractive valuation of nearly 29% below estimated fair value, hinting at potential upside for investors familiar with this niche player in Switzerland's financial landscape.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG specializes in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both in Switzerland and internationally, with a market capitalization of CHF366.43 million.

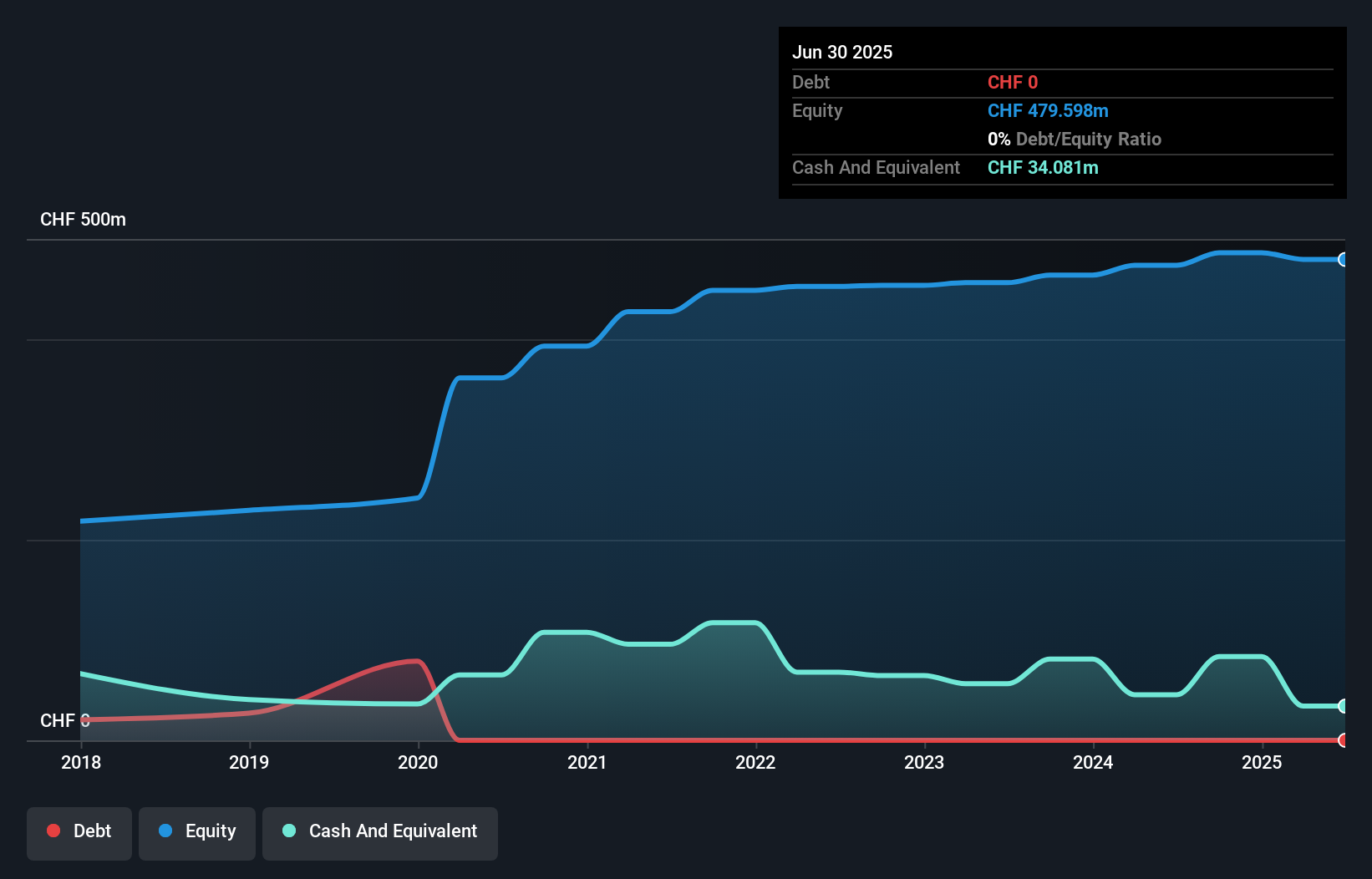

Operations: V-ZUG generates revenue primarily from its Household Appliances segment, which reported CHF571.35 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

V-ZUG, a notable player in Switzerland's appliance sector, showcases impressive growth with earnings surging 89% last year, outpacing the industry. Despite a drop in sales to CHF 284 million for the half-year ending June 2024, net income doubled to CHF 8.73 million. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 22%. Trading at a substantial discount of over 80% below estimated fair value suggests potential upside if forecasts hold true.

- Click here and access our complete health analysis report to understand the dynamics of V-ZUG Holding.

Gain insights into V-ZUG Holding's historical performance by reviewing our past performance report.

Next Steps

- Click here to access our complete index of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.