- Switzerland

- /

- Capital Markets

- /

- SWX:BAER

Is Now the Right Time to Consider Julius Bär After Recent 8.7% Monthly Slide?

Reviewed by Simply Wall St

If you are standing at the crossroads of whether to buy, sell, or hold Julius Bär Gruppe, you are not alone. Investors have watched the stock make some strong moves in recent years, and there is a real question about whether the current price offers genuine value or a reason for caution. The stock’s journey has been anything but dull: while the past week and month have brought noticeable dips (down 5.7% and 8.7%, respectively), anyone who zooms out will see that the last twelve months delivered a healthy jump of 19.2%. Stretch that window back five years and you are looking at a remarkable 78.8% gain. Short-term slides can sometimes leave investors unnerved, but they can also set up new opportunities, especially if market risk perception changes or sector sentiment shifts.

What really matters is how these price movements stack up against the company’s fundamentals. Interestingly, Julius Bär Gruppe currently claims a value score of 5 out of 6, meaning it is considered undervalued in nearly every major valuation check. That is not something you see every day, and it begs a closer look. What’s behind this score, and how should it shape your next move? Let’s walk through the key valuation methods that underpin these numbers, and stick around for a perspective on valuation that goes a step further than the standard checks.

Why Julius Bär Gruppe is lagging behind its peersApproach 1: Julius Bär Gruppe Excess Returns Analysis

The Excess Returns valuation model aims to measure how much value a company creates for its shareholders above its cost of equity capital. It does this by comparing the company's return on invested capital with its cost of equity, then projecting long-term performance using estimates for key financial metrics.

For Julius Bär Gruppe, this approach highlights several important figures. The company's Book Value stands at CHF32.79 per share, while the Stable Earnings Per Share (EPS) are projected to be CHF5.20, based on a weighted average of return on equity forecasts from eight analysts. The Cost of Equity is CHF2.43 per share, which implies an annual Excess Return of CHF2.77. Notably, the average Return on Equity (ROE) is strong at 14.09%, and the Stable Book Value is projected to rise to CHF36.92 per share, according to nine analysts' estimates.

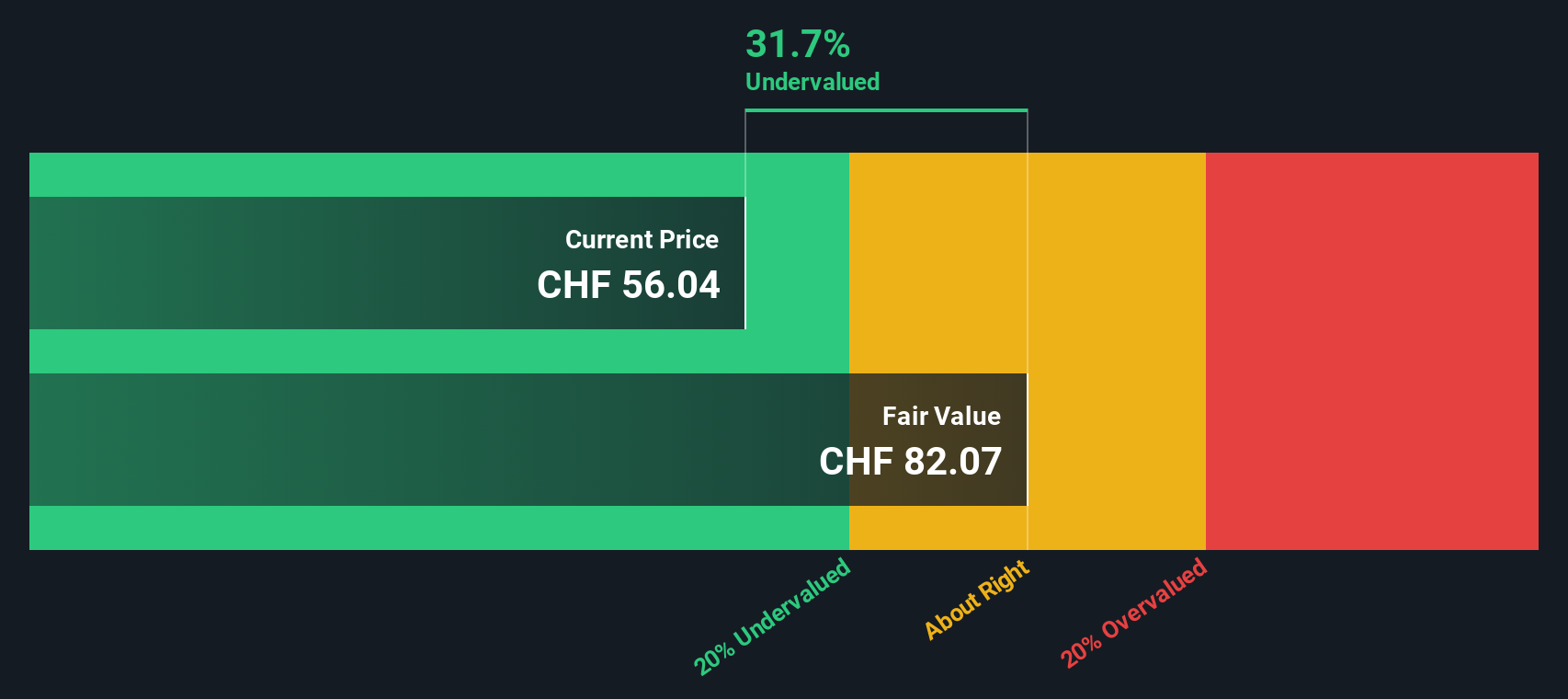

Based on these metrics, the Excess Returns model estimates that Julius Bär Gruppe is trading at a 33.7% discount to its intrinsic value. This sizable undervaluation suggests the stock may offer substantial upside potential from current levels, assuming the company continues to deliver returns above its cost of equity.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Julius Bär Gruppe.

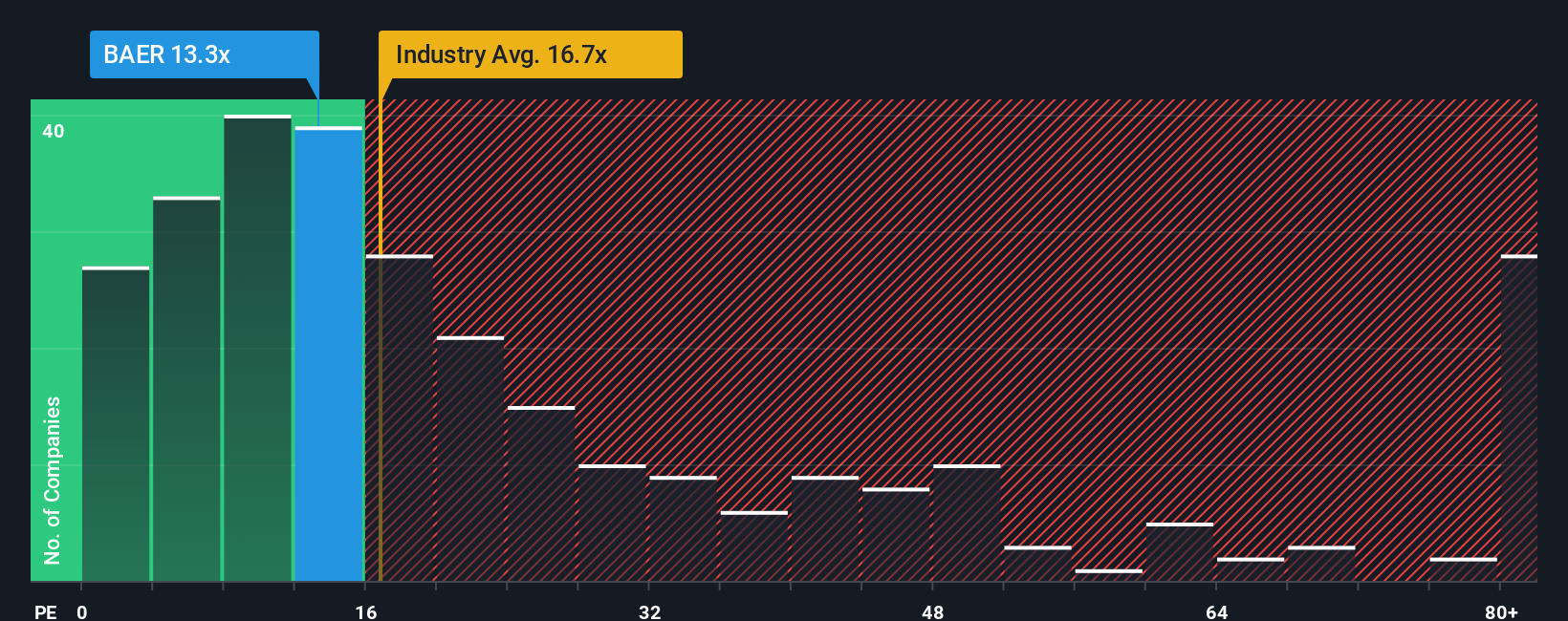

Approach 2: Julius Bär Gruppe Price vs Earnings

For profitable companies like Julius Bär Gruppe, the price-to-earnings (PE) ratio is a widely used and meaningful measure of valuation. The PE ratio tells investors how much they are paying for each franc of current earnings, making it a direct and relatable way to gauge whether a stock is expensive or represents good value.

The "normal" or "fair" PE ratio for any company should reflect not only its industry environment but also its growth prospects and risk profile. Companies growing fast or operating in safer, more stable industries typically deserve higher PE multiples, while slower-growing or riskier businesses tend to trade at lower ratios.

Currently, Julius Bär Gruppe trades at a PE ratio of 12.89x. That is well below the Capital Markets industry average of 19.50x and also lower than its peer average of 19.74x. While these benchmarks provide a useful sense check, they can miss important company-specific factors like earnings growth, profit margins, and unique risks.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio takes into account not just the company’s sector, but also its specific growth outlook, profitability, risks, and size. This results in a more accurate picture of what Julius Bär Gruppe’s PE ratio should be, which is calculated as 19.79x. Because the Fair Ratio considers the most relevant drivers of value, it provides a more nuanced benchmark than basic peer or industry comparisons.

With Julius Bär Gruppe’s current PE ratio of 12.89x compared to a Fair Ratio of 19.79x, the company appears to be meaningfully undervalued at present.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Julius Bär Gruppe Narrative

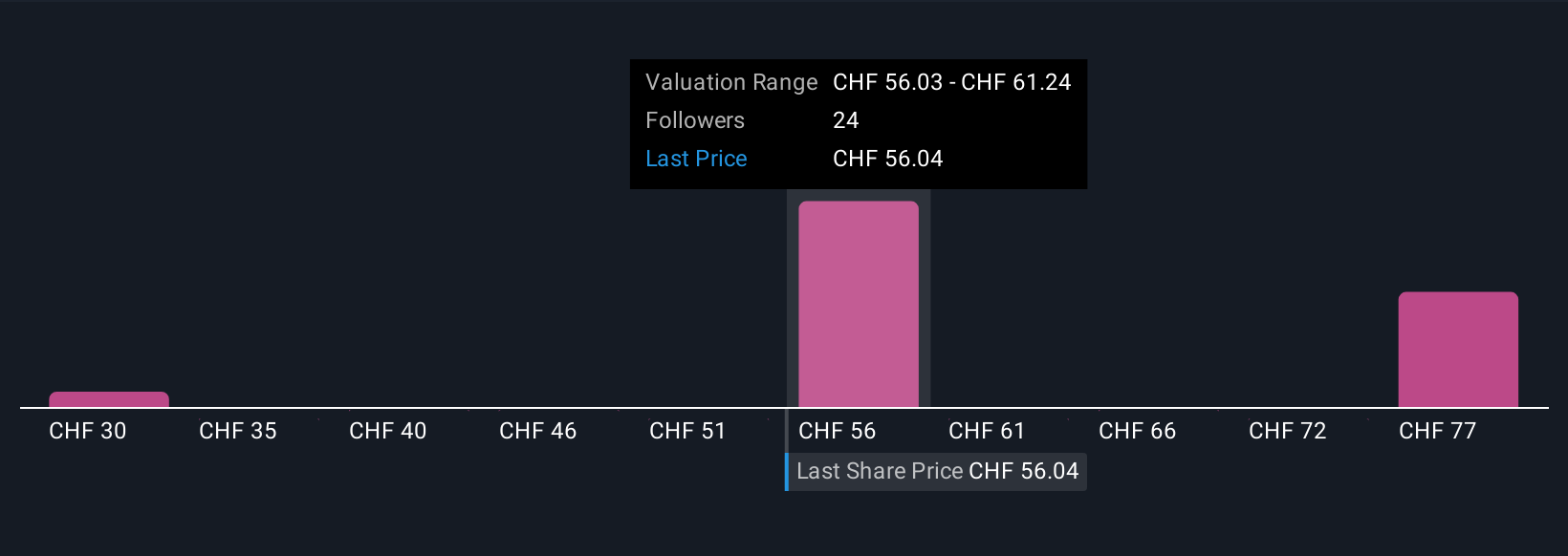

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective behind a company—the “why” supporting your assumptions about future revenue, earnings, and profit margins that make up your own view of fair value.

Instead of relying solely on historical ratios, Narratives connect the dots between a company’s fundamentals, the expected outlook, and the resulting valuation. This approach lets you link a company’s story to a realistic long-term forecast. On Simply Wall St’s Community page, millions of investors use Narratives as a dynamic and easy tool to articulate their view, test different scenarios, or sense-check analyst assumptions.

Narratives empower you to act when it matters most by showing whether your fair value estimate suggests you should buy, hold, or sell, directly next to the latest market price. Best of all, these Narratives update automatically whenever new earnings reports or major news is released, ensuring your view is always current.

For example, some Julius Bär Gruppe Narratives expect the stock could be worth CHF70 based on optimistic growth in global wealth and digital innovation. Others see more risk from market competition and expect as little as CHF52.40.

Do you think there's more to the story for Julius Bär Gruppe? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BAER

Julius Bär Gruppe

Provides wealth management solutions in Switzerland, Europe, the Americas, Asia, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives