- Switzerland

- /

- Consumer Durables

- /

- SWX:VZUG

Does V-ZUG Holding AG (VTX:VZUG) Create Value For Shareholders?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). We'll use ROE to examine V-ZUG Holding AG (VTX:VZUG), by way of a worked example.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for V-ZUG Holding

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for V-ZUG Holding is:

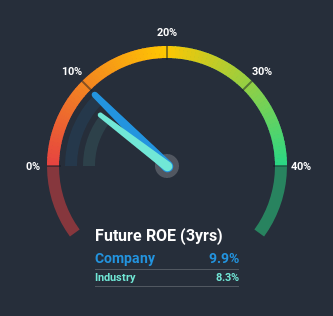

9.9% = CHF36m ÷ CHF362m (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every CHF1 worth of equity, the company was able to earn CHF0.10 in profit.

Does V-ZUG Holding Have A Good Return On Equity?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. You can see in the graphic below that V-ZUG Holding has an ROE that is fairly close to the average for the Consumer Durables industry (8.3%).

So while the ROE is not exceptional, at least its acceptable. Although the ROE is similar to the industry, we should still perform further checks to see if the company's ROE is being boosted by high debt levels. If a company takes on too much debt, it is at higher risk of defaulting on interest payments.

How Does Debt Impact ROE?

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

V-ZUG Holding's Debt And Its 9.9% ROE

One positive for shareholders is that V-ZUG Holding does not have any net debt! Its respectable ROE suggests it is a business worth watching, but it's even better the company achieved this without leverage. After all, when a company has a strong balance sheet, it can often find ways to invest in growth, even if it takes some time.

Summary

Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. So you might want to check this FREE visualization of analyst forecasts for the company.

But note: V-ZUG Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

If you decide to trade V-ZUG Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:VZUG

V-ZUG Holding

Engages in the development, manufacture, sale, and services of kitchen and laundry appliances for private households in Switzerland, rest of Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives