- Switzerland

- /

- Luxury

- /

- SWX:UHR

The Swatch Group AG (VTX:UHR) Investors Are Less Pessimistic Than Expected

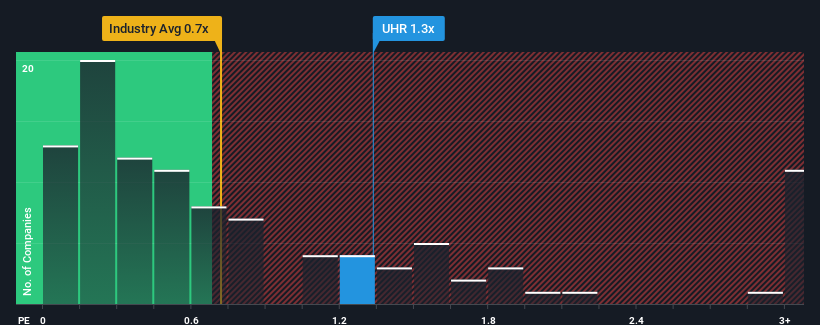

The Swatch Group AG's (VTX:UHR) price-to-sales (or "P/S") ratio of 1.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Luxury industry in Switzerland have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Swatch Group

How Has Swatch Group Performed Recently?

Swatch Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Swatch Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Swatch Group?

The only time you'd be truly comfortable seeing a P/S as high as Swatch Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.9% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.2% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.5% each year, which is noticeably more attractive.

In light of this, it's alarming that Swatch Group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Swatch Group's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Swatch Group, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Swatch Group (at least 1 which is concerning), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:UHR

Swatch Group

Designs, manufactures, and sells finished watches, jewelry, and watch movements and components in Switzerland, rest of Europe, Greater China, rest of Asia, America, Oceania, and Africa.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives