Stock Analysis

- Switzerland

- /

- Machinery

- /

- SWX:SUN

July 2024 Insight Into Three Stocks Possibly Below Value Estimates on SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market recently exhibited moderate declines, reflecting broader concerns about global economic growth. The benchmark SMI fluctuated narrowly before closing with a notable drop. In such a climate, identifying stocks that may be undervalued could offer investors opportunities for potential value in an otherwise uncertain market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF132.40 | CHF219.81 | 39.8% |

| COLTENE Holding (SWX:CLTN) | CHF45.60 | CHF73.96 | 38.3% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF610.00 | CHF852.83 | 28.5% |

| Georg Fischer (SWX:GF) | CHF65.00 | CHF99.70 | 34.8% |

| Julius Bär Gruppe (SWX:BAER) | CHF51.96 | CHF93.68 | 44.5% |

| Sonova Holding (SWX:SOON) | CHF264.80 | CHF467.86 | 43.4% |

| Temenos (SWX:TEMN) | CHF61.00 | CHF95.60 | 36.2% |

| SGS (SWX:SGSN) | CHF92.10 | CHF125.60 | 26.7% |

| Comet Holding (SWX:COTN) | CHF349.00 | CHF588.03 | 40.6% |

| Medartis Holding (SWX:MED) | CHF73.80 | CHF131.55 | 43.9% |

Let's review some notable picks from our screened stocks.

SGS (SWX:SGSN)

Overview: SGS SA is a company that offers inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 17.43 billion.

Operations: The revenue segments for the company are distributed as follows: Industries & Environment at CHF 2.19 billion, Natural Resources at CHF 1.58 billion, Connectivity & Products at CHF 1.25 billion, Health & Nutrition at CHF 0.86 billion, and Business Assurance at CHF 0.75 billion.

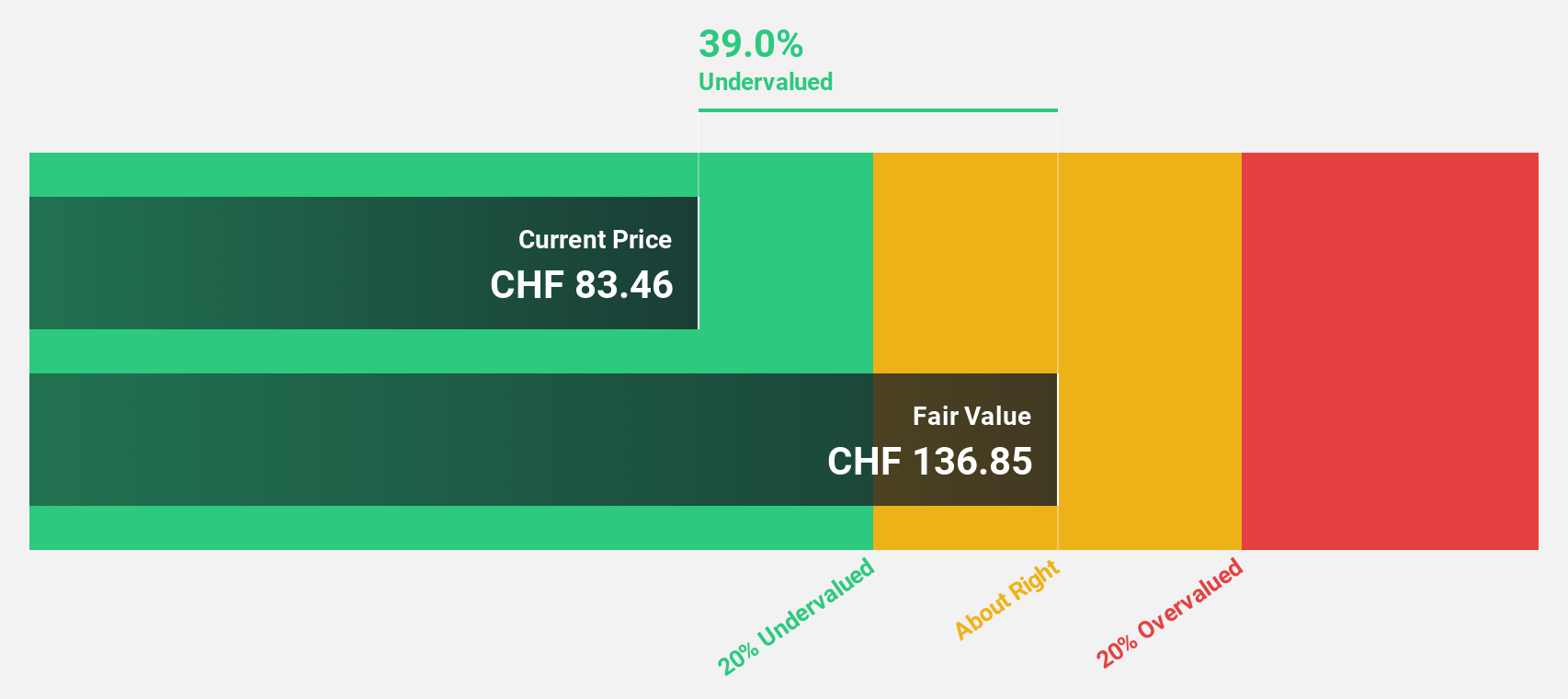

Estimated Discount To Fair Value: 26.7%

SGS SA, with its recent half-year earnings showing a slight dip in net income and EPS, still presents as undervalued based on cash flows. Trading at CHF 92.1 against a fair value estimate of CHF 125.6, the company is positioned below its intrinsic value by more than 20%. Despite high debt levels and under-covered dividends, SGS's revenue and earnings growth forecasts are promising at 4.8% and 9.6% per year respectively, outpacing the Swiss market averages.

- Our growth report here indicates SGS may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of SGS.

Sulzer (SWX:SUN)

Overview: Sulzer Ltd is a global company specializing in the development and sale of products and services for fluid engineering and chemical processing, with a market capitalization of CHF 4.48 billion.

Operations: The company's revenue is divided into three main segments: Chemtech, which generated CHF 772.50 million; Services, with CHF 1.15 billion; and Flow Equipment, contributing CHF 1.35 billion.

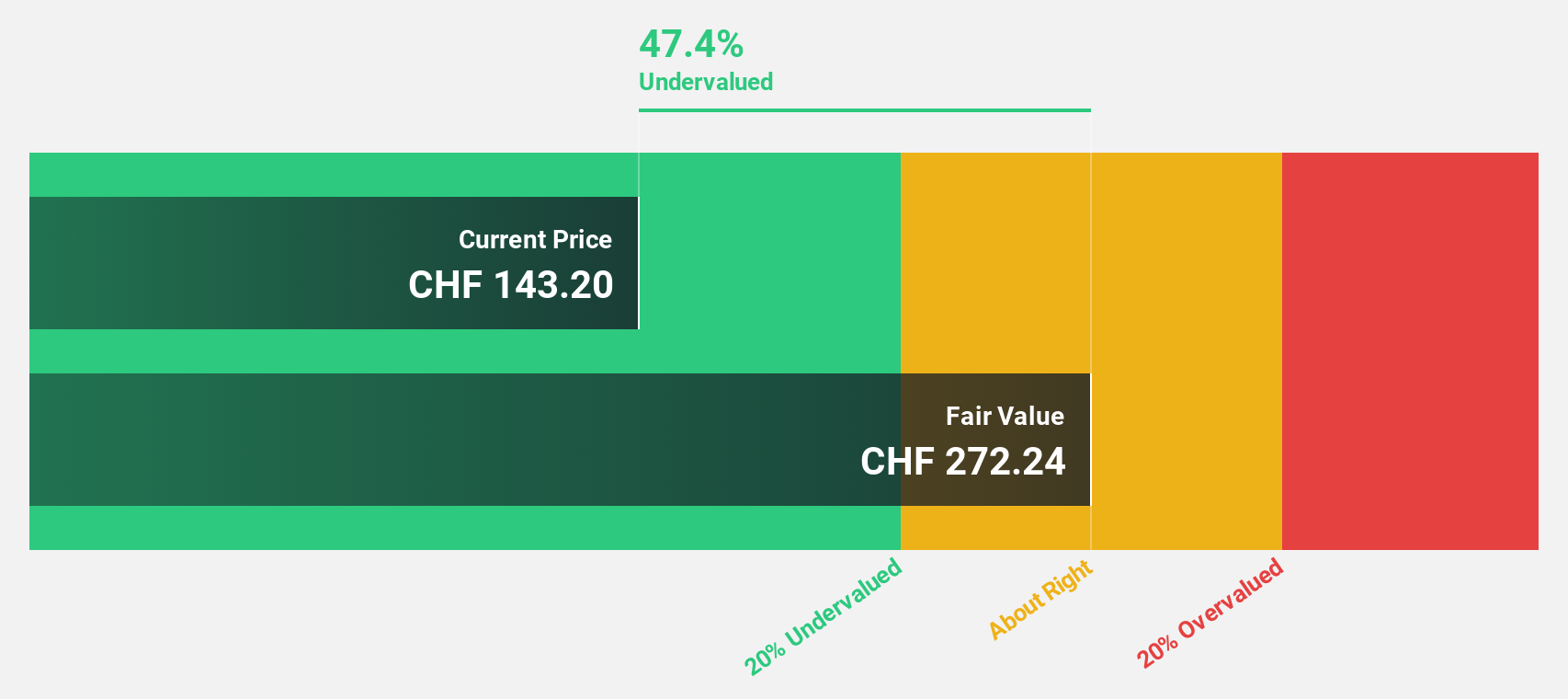

Estimated Discount To Fair Value: 39.8%

Sulzer Ltd, priced at CHF 132.4, is significantly undervalued compared to its estimated fair value of CHF 219.81, reflecting a substantial discount of over 20%. The company's earnings are poised for robust growth, projected at 10.27% annually, outstripping the Swiss market forecast of 8.3%. Despite an unstable dividend history, Sulzer's return on equity is expected to be strong at 21.6% in three years, signaling potential for increased financial efficiency and shareholder value.

- The analysis detailed in our Sulzer growth report hints at robust future financial performance.

- Dive into the specifics of Sulzer here with our thorough financial health report.

VAT Group (SWX:VACN)

Overview: VAT Group AG specializes in developing, manufacturing, and supplying vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across various global markets, with a market capitalization of approximately CHF 13.02 billion.

Operations: VAT Group's revenue is primarily derived from its Valves segment, which generated CHF 783.51 million, and its Global Service segment, contributing CHF 163.83 million.

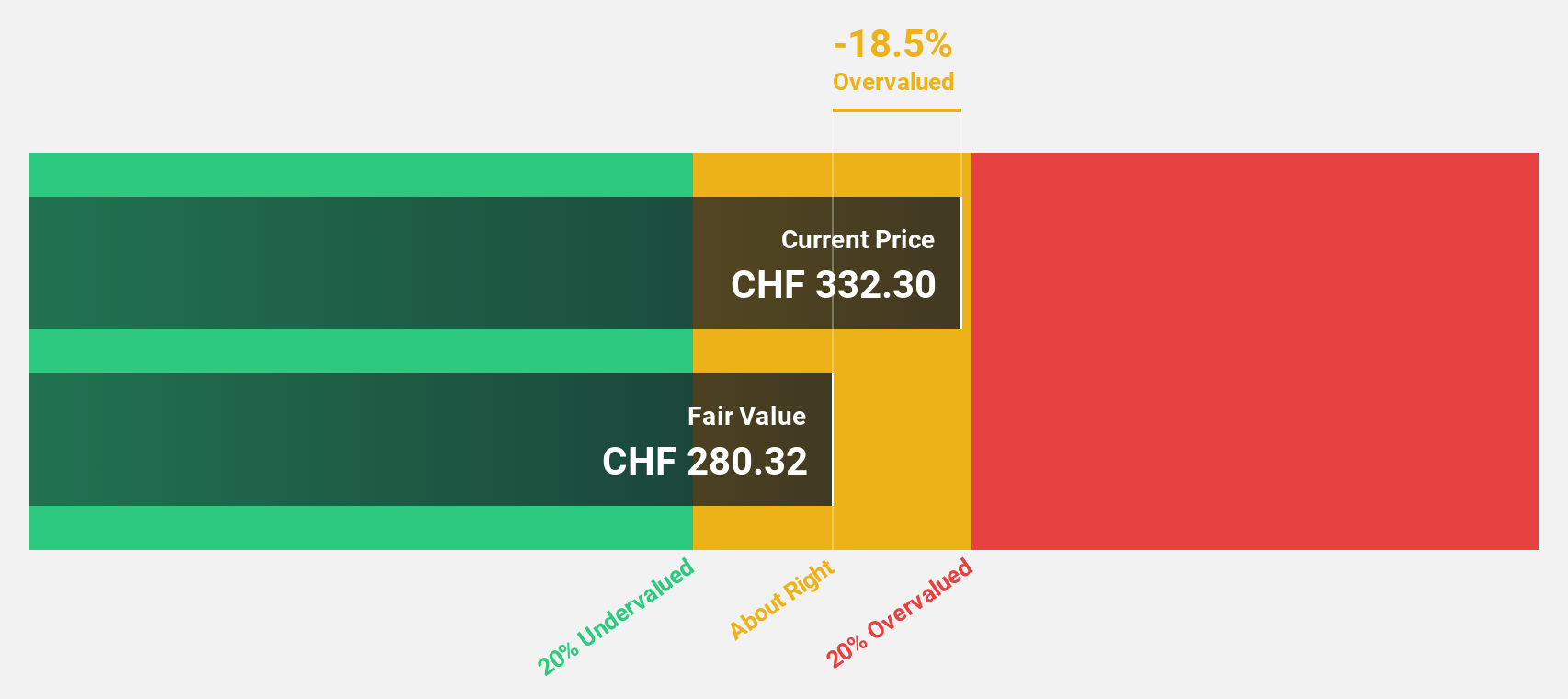

Estimated Discount To Fair Value: 11.4%

VAT Group, with a recent stock price of CHF 434.3, trades below its estimated fair value of CHF 489.99, suggesting undervaluation. The company's half-year earnings rose to CHF 94 million from CHF 84.2 million year-over-year, with sales slightly down at CHF 449.61 million. Forecasts indicate robust annual earnings growth at 23.07% and revenue growth at 19.1%, both surpassing the Swiss market averages significantly, highlighting strong future financial performance despite a highly volatile share price recently.

- Our comprehensive growth report raises the possibility that VAT Group is poised for substantial financial growth.

- Take a closer look at VAT Group's balance sheet health here in our report.

Summing It All Up

- Embark on your investment journey to our 17 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SUN

Sulzer

Develops and sells products and services for fluid engineering and chemical processing applications worldwide.

Outstanding track record with excellent balance sheet.