- Switzerland

- /

- Trade Distributors

- /

- SWX:DKSH

Here's Why Shareholders May Consider Paying DKSH Holding AG's (VTX:DKSH) CEO A Little More

Key Insights

- DKSH Holding to hold its Annual General Meeting on 16th of March

- CEO Stefan Butz's total compensation includes salary of CHF1.00m

- The total compensation is 50% less than the average for the industry

- Over the past three years, DKSH Holding's EPS grew by 5.3% and over the past three years, the total shareholder return was 80%

Shareholders will probably not be disappointed by the robust results at DKSH Holding AG (VTX:DKSH) recently and they will be keeping this in mind as they go into the AGM on 16th of March. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for DKSH Holding

How Does Total Compensation For Stefan Butz Compare With Other Companies In The Industry?

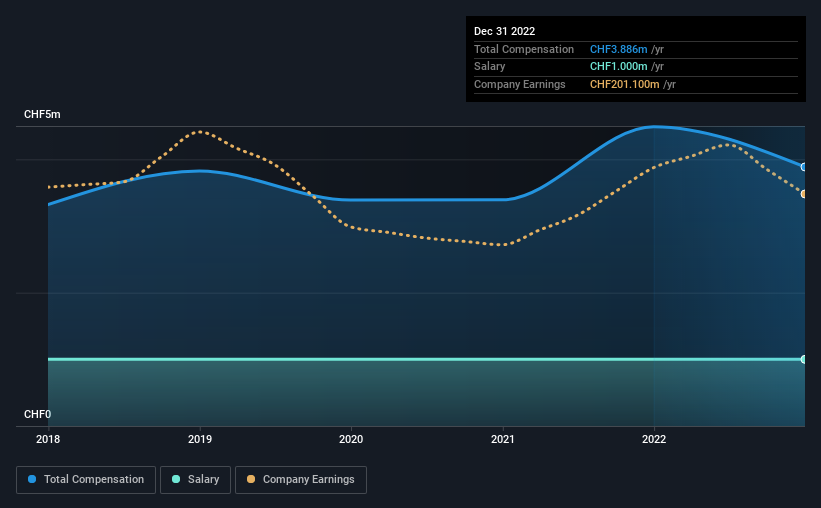

According to our data, DKSH Holding AG has a market capitalization of CHF5.0b, and paid its CEO total annual compensation worth CHF3.9m over the year to December 2022. Notably, that's a decrease of 13% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF1.0m.

On examining similar-sized companies in the Switzerland Professional Services industry with market capitalizations between CHF3.7b and CHF11b, we discovered that the median CEO total compensation of that group was CHF7.8m. In other words, DKSH Holding pays its CEO lower than the industry median. What's more, Stefan Butz holds CHF5.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CHF1.0m | CHF1.0m | 26% |

| Other | CHF2.9m | CHF3.5m | 74% |

| Total Compensation | CHF3.9m | CHF4.5m | 100% |

On an industry level, roughly 55% of total compensation represents salary and 45% is other remuneration. DKSH Holding pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at DKSH Holding AG's Growth Numbers

Over the past three years, DKSH Holding AG has seen its earnings per share (EPS) grow by 5.3% per year. It achieved revenue growth of 1.9% over the last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has DKSH Holding AG Been A Good Investment?

Most shareholders would probably be pleased with DKSH Holding AG for providing a total return of 80% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's overall performance, while not bad, could be better. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

Whatever your view on compensation, you might want to check if insiders are buying or selling DKSH Holding shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:DKSH

DKSH Holding

Provides various market expansion services in Thailand, Greater China, Malaysia, Singapore, rest of the Asia Pacific, and internationally.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success