- Switzerland

- /

- Professional Services

- /

- SWX:ADEN

Will Adecco Group's (SWX:ADEN) CFO Transition Reshape Its Financial Strategy Amid Profit Pressures?

Reviewed by Sasha Jovanovic

- Adecco Group AG recently released its third-quarter 2025 results, reporting sales of €5.78 billion and net income of €89 million, while also announcing that Coram Williams will step down as CFO to be succeeded by Valentina Ficaio in January 2026.

- The leadership change comes as Adecco faces flat sales growth but lower profits, positioning the company for a new phase in financial management amid evolving market conditions.

- We'll consider how the appointment of a new CFO, alongside recent earnings results, could influence Adecco's medium-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Adecco Group Investment Narrative Recap

To hold Adecco Group stock, you need to believe in the company’s ability to profitably adapt as workforce solutions become more technology-driven and traditional staffing models face pressure. The recent CFO succession and Q3 results, showing flat sales but declining net income, do not materially alter the company’s core short-term catalyst: successful execution of digital transformation and improved operating efficiency. The biggest risk remains ongoing pressure on margins from competition and sector shifts, which could weigh on profitability if not addressed.

The announcement of Valentina Ficaio as incoming CFO is particularly relevant in this context, given her background in driving financial planning during periods of operational restructuring. Her appointment comes as Adecco aims to balance cost control with targeted investment in advanced digital platforms, a central catalyst for defending business mix and profitability in the near term.

Yet, in contrast to the leadership focus, investors should be alert to persistent margin compression and how it may signal deeper structural challenges for Adecco’s core business…

Read the full narrative on Adecco Group (it's free!)

Adecco Group's narrative projects €24.3 billion revenue and €458.6 million earnings by 2028. This requires 2.0% yearly revenue growth and a €168.6 million increase in earnings from €290.0 million today.

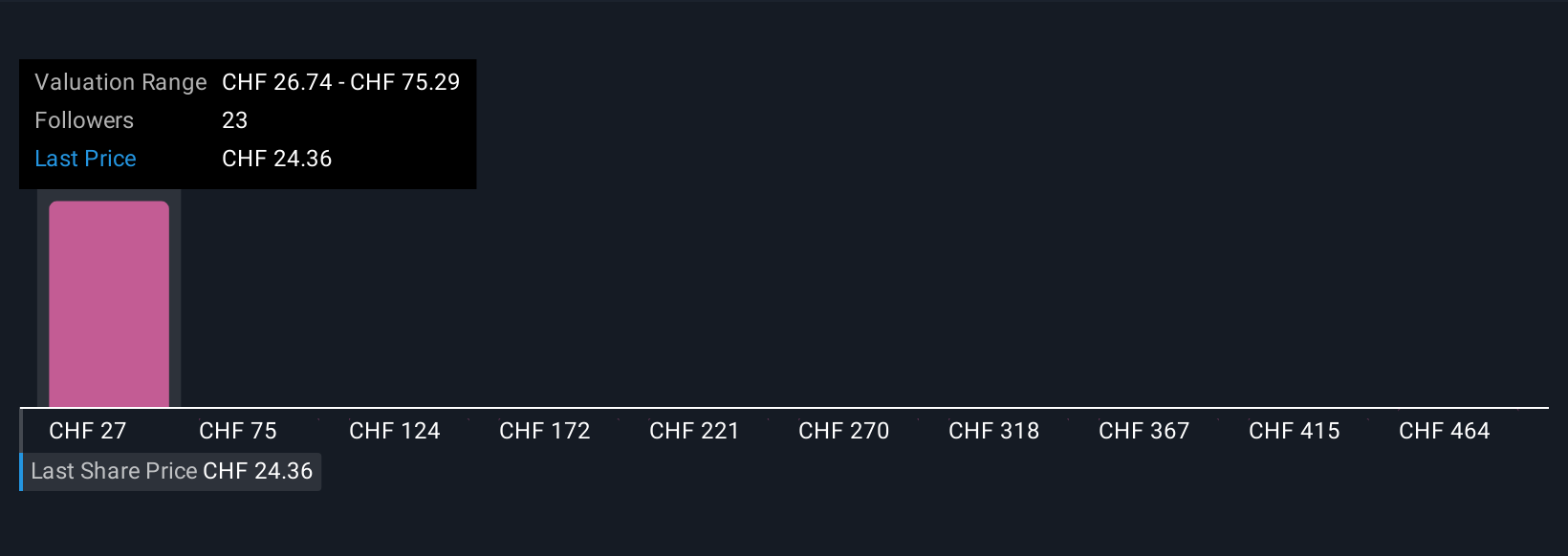

Uncover how Adecco Group's forecasts yield a CHF26.89 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four community fair value estimates for Adecco swing widely from CHF7.69 to CHF512.30 per share. With such varied Simply Wall St Community views and ongoing sector margin pressures, you may want to review several outlooks for Adecco’s prospects.

Explore 4 other fair value estimates on Adecco Group - why the stock might be a potential multi-bagger!

Build Your Own Adecco Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adecco Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Adecco Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adecco Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ADEN

Adecco Group

Provides human resource services to businesses and organizations in Europe, North America, the Asia Pacific, South America, and North Africa.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives