Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Zwahlen & Mayr SA (VTX:ZWM) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Our analysis indicates that ZWM is potentially undervalued!

How Much Debt Does Zwahlen & Mayr Carry?

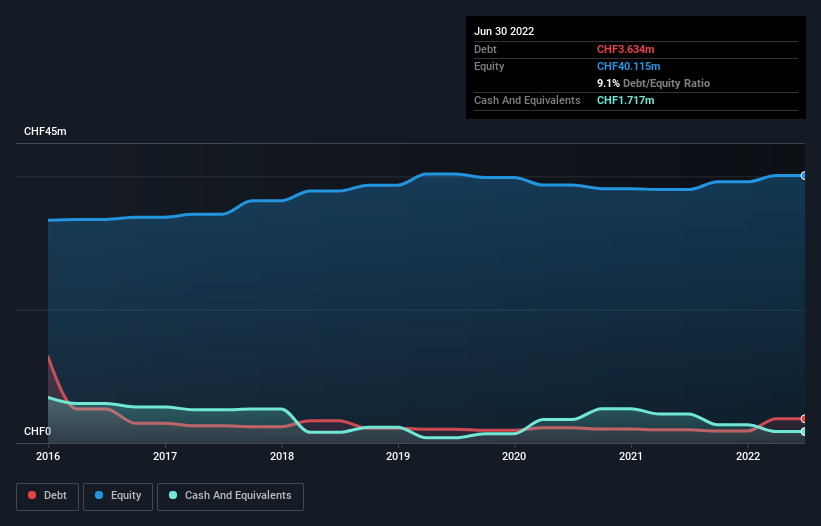

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Zwahlen & Mayr had CHF3.63m of debt, an increase on CHF1.98m, over one year. However, it does have CHF1.72m in cash offsetting this, leading to net debt of about CHF1.92m.

How Strong Is Zwahlen & Mayr's Balance Sheet?

The latest balance sheet data shows that Zwahlen & Mayr had liabilities of CHF16.5m due within a year, and liabilities of CHF5.02m falling due after that. On the other hand, it had cash of CHF1.72m and CHF17.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CHF2.32m.

Of course, Zwahlen & Mayr has a market capitalization of CHF11.9m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Zwahlen & Mayr's low debt to EBITDA ratio of 0.43 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.6 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Although Zwahlen & Mayr made a loss at the EBIT level, last year, it was also good to see that it generated CHF2.3m in EBIT over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Zwahlen & Mayr will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Zwahlen & Mayr saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Zwahlen & Mayr's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. In particular, its net debt to EBITDA was re-invigorating. We think that Zwahlen & Mayr's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Zwahlen & Mayr (1 is a bit unpleasant) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Zwahlen & Mayr might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:ZWM

Zwahlen & Mayr

Engages in welded stainless-steel tubes production and steel construction businesses in Switzerland.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives