Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Zwahlen & Mayr SA (VTX:ZWM) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Zwahlen & Mayr

How Much Debt Does Zwahlen & Mayr Carry?

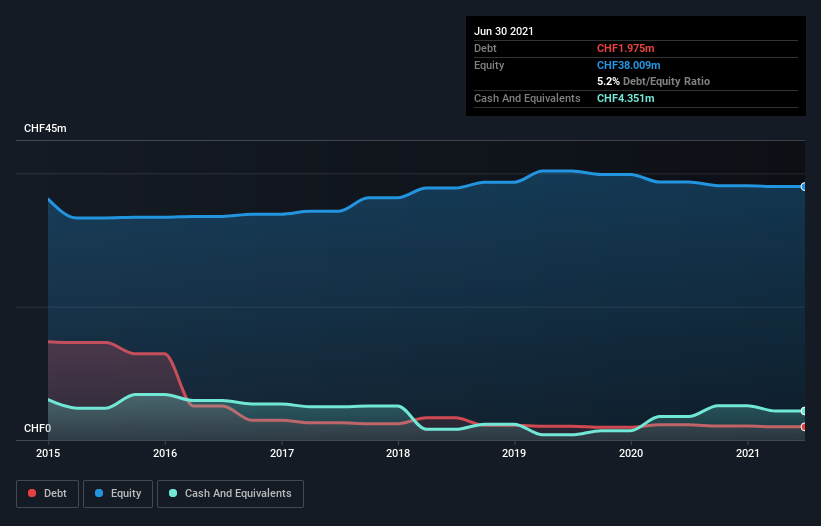

You can click the graphic below for the historical numbers, but it shows that Zwahlen & Mayr had CHF1.98m of debt in June 2021, down from CHF2.28m, one year before. But on the other hand it also has CHF4.35m in cash, leading to a CHF2.38m net cash position.

A Look At Zwahlen & Mayr's Liabilities

Zooming in on the latest balance sheet data, we can see that Zwahlen & Mayr had liabilities of CHF10.1m due within 12 months and liabilities of CHF4.73m due beyond that. Offsetting these obligations, it had cash of CHF4.35m as well as receivables valued at CHF16.5m due within 12 months. So it actually has CHF5.99m more liquid assets than total liabilities.

This luscious liquidity implies that Zwahlen & Mayr's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Zwahlen & Mayr has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Zwahlen & Mayr will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Zwahlen & Mayr had a loss before interest and tax, and actually shrunk its revenue by 3.4%, to CHF46m. That's not what we would hope to see.

So How Risky Is Zwahlen & Mayr?

While Zwahlen & Mayr lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow CHF2.2m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Zwahlen & Mayr (including 1 which is a bit concerning) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Zwahlen & Mayr might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:ZWM

Zwahlen & Mayr

Engages in welded stainless-steel tubes production and steel construction businesses in Switzerland.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives