- Switzerland

- /

- Machinery

- /

- SWX:VACN

Does UBS’s Upgrade on AI Data Center Growth Shift the Outlook for VAT Group (SWX:VACN)?

Reviewed by Sasha Jovanovic

- Earlier this week, UBS upgraded VAT Group AG from Neutral to Buy, highlighting anticipated positive order momentum in early 2026 driven by expected growth in AI data centers and rising semiconductor memory chip prices.

- A key insight from UBS’s outlook is that VAT Group’s leading role in vacuum valve technology, with an estimated 70% global market share, positions it to benefit as semiconductor industry capital spending ramps up in 2026–2027.

- We'll examine how expectations of increased semiconductor capital expenditure following UBS's upgrade could influence VAT Group's investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

VAT Group Investment Narrative Recap

To be a shareholder in VAT Group today, you need conviction in a global rebound in semiconductor capital spending, especially as AI and memory markets recover. The UBS upgrade underscores positive expected order momentum into 2026, but for now, the most important short-term catalyst remains clear evidence of a sustained pick-up in semiconductor equipment investment, while the largest risk continues to be sector cyclicality, as delays or disappointments in capex timing can weigh sharply on revenue growth. This news reinforces optimism about a coming upturn but does not fundamentally change these near-term drivers or risk factors.

In light of heightened interest tied to the semiconductor cycle, VAT Group’s recent Q3 2025 guidance, which projected sales between CHF 255 million and CHF 285 million, remains particularly relevant, as it provides a near-term benchmark against which any recovery in customer orders can be measured. While longer-term industry tailwinds are gaining attention, quarterly results like this are a litmus test for underlying demand and management’s ability to navigate cyclicality.

Yet, despite the positive signals for future growth, investors should stay alert to the risk that...

Read the full narrative on VAT Group (it's free!)

VAT Group's outlook anticipates CHF1.5 billion in revenue and CHF359.6 million in earnings by 2028. This scenario relies on a projected 12.3% annual revenue growth rate and a CHF136.2 million increase in earnings from the current CHF223.4 million.

Uncover how VAT Group's forecasts yield a CHF351.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

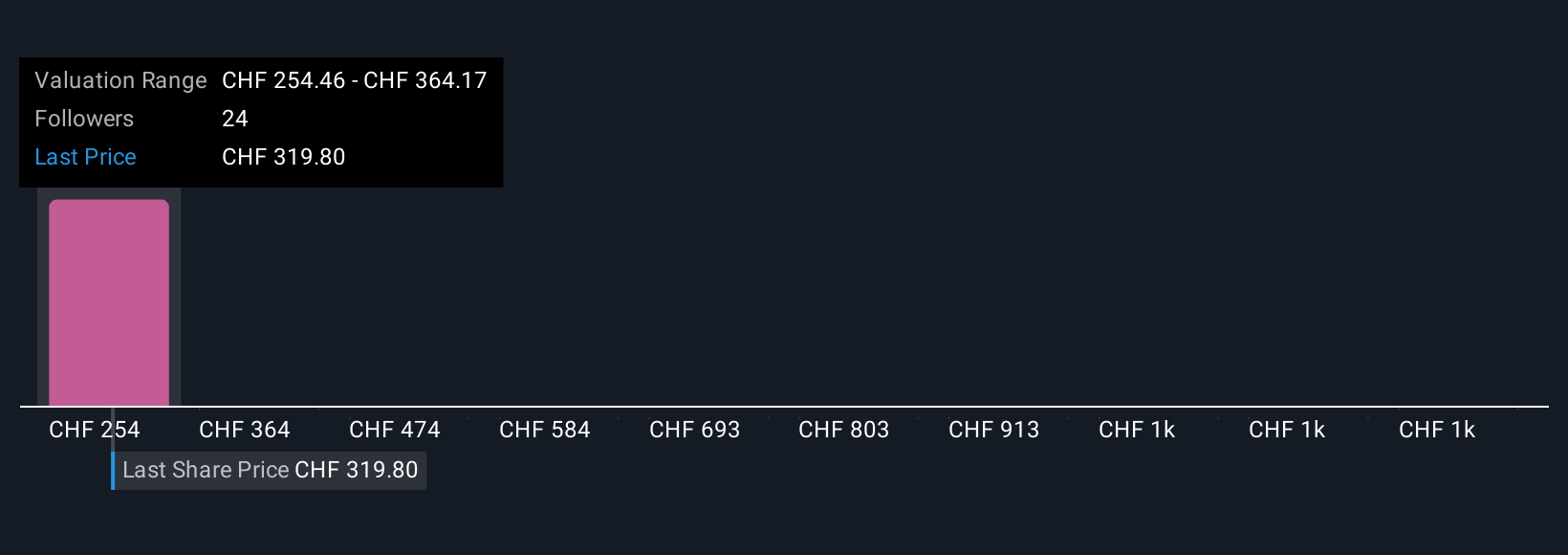

Simply Wall St Community members offered four fair value estimates for VAT Group, stretching from CHF 254.46 to CHF 1,351.52. While opinions range widely, capex timing risk remains central to any view on the company’s future results, so consider how differing forecasts may factor this in as you explore alternative viewpoints.

Explore 4 other fair value estimates on VAT Group - why the stock might be worth over 4x more than the current price!

Build Your Own VAT Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VAT Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VAT Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VAT Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and sells vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives