- Switzerland

- /

- Machinery

- /

- SWX:STGN

StarragTornos Group's (VTX:STGN) Dividend Will Be Increased To CHF2.50

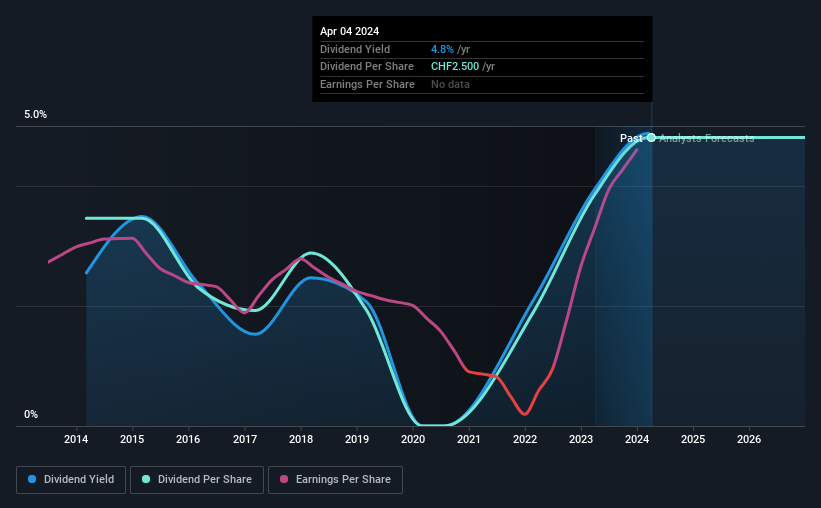

The board of StarragTornos Group AG (VTX:STGN) has announced that it will be paying its dividend of CHF2.50 on the 26th of April, an increased payment from last year's comparable dividend. This makes the dividend yield 4.8%, which is above the industry average.

See our latest analysis for StarragTornos Group

StarragTornos Group's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, StarragTornos Group was paying a whopping 111% as a dividend, but this only made up 35% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Over the next year, EPS is forecast to fall by 11.1%. If the dividend continues along recent trends, we estimate the payout ratio could be 61%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of CHF1.80 in 2014 to the most recent total annual payment of CHF2.50. This works out to be a compound annual growth rate (CAGR) of approximately 3.3% a year over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that StarragTornos Group has grown earnings per share at 13% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

An additional note is that the company has been raising capital by issuing stock equal to 63% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

In Summary

Overall, we always like to see the dividend being raised, but we don't think StarragTornos Group will make a great income stock. While StarragTornos Group is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, StarragTornos Group has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:STGN

StarragTornos Group

Develops, manufactures, and distributes precision machine tools for milling, turning, boring, grinding, and machining of work pieces of metal, composite materials, and ceramics.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success