Stock Analysis

- Switzerland

- /

- Electrical

- /

- SWX:GAV

Exploring Bucher Industries And Two More Leading Dividend Stocks

Reviewed by Simply Wall St

The Switzerland market recently experienced a downturn, ending a prolonged period of gains as investors displayed caution in anticipation of upcoming economic data from Europe and the U.S. The SMI index reflected this cautious sentiment, closing lower by 0.3% at 12,001.50 amidst broad-based losses across key sectors. In such times of market volatility, dividend stocks like Bucher Industries can offer investors potential stability and regular income streams, making them an attractive option for those looking to mitigate risk while maintaining investment growth opportunities.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Roche Holding (SWX:ROG) | 4.10% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.55% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.24% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.48% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.68% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.59% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.90% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

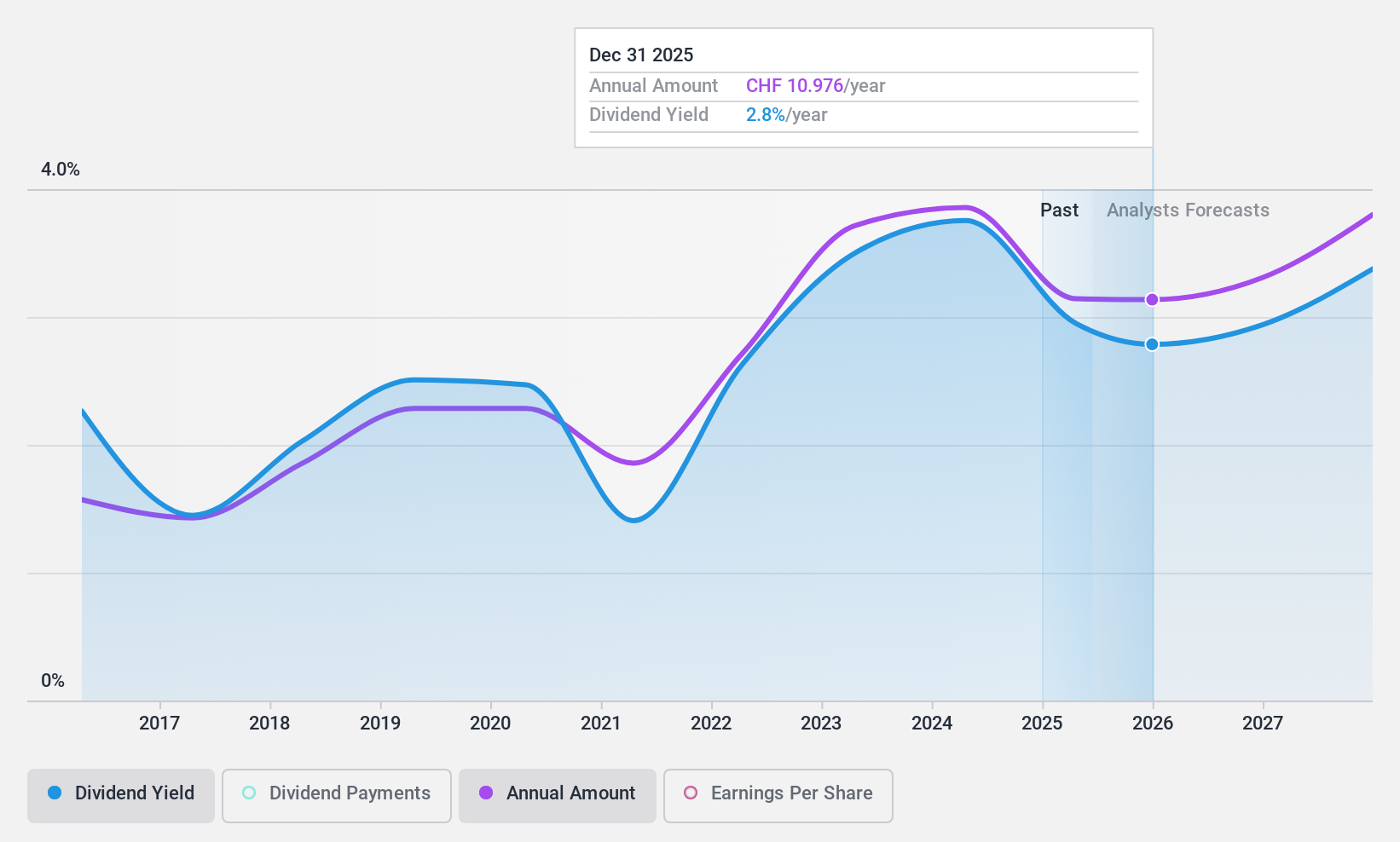

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG is a global manufacturer and seller of machinery, systems, and hydraulic components for food production, packaging, and public space maintenance, with a market capitalization of CHF 3.91 billion.

Operations: Bucher Industries AG's revenue is generated through several segments: Kuhn Group contributes CHF 1.42 billion, Bucher Specials CHF 398 million, Bucher Municipal CHF 572.5 million, Bucher Hydraulics CHF 743.6 million, and Bucher Emhart Glass CHF 523.6 million.

Dividend Yield: 3.5%

Bucher Industries, a Swiss firm, declared a CHF 13.5 cash dividend with an ex-dividend date set for April 22, 2024. Despite its modest yield of 3.53%, the company has demonstrated consistent dividend growth and stability over the past decade. However, its dividends are not well supported by cash flows, with a high cash payout ratio of 127.1%. Financially, Bucher reported a slight decrease in annual sales to CHF 3.57 billion in 2023 but saw an increase in net income to CHF 352.1 million and stable earnings per share at CHF 34.38.

- Dive into the specifics of Bucher Industries here with our thorough dividend report.

- Our valuation report unveils the possibility Bucher Industries' shares may be trading at a discount.

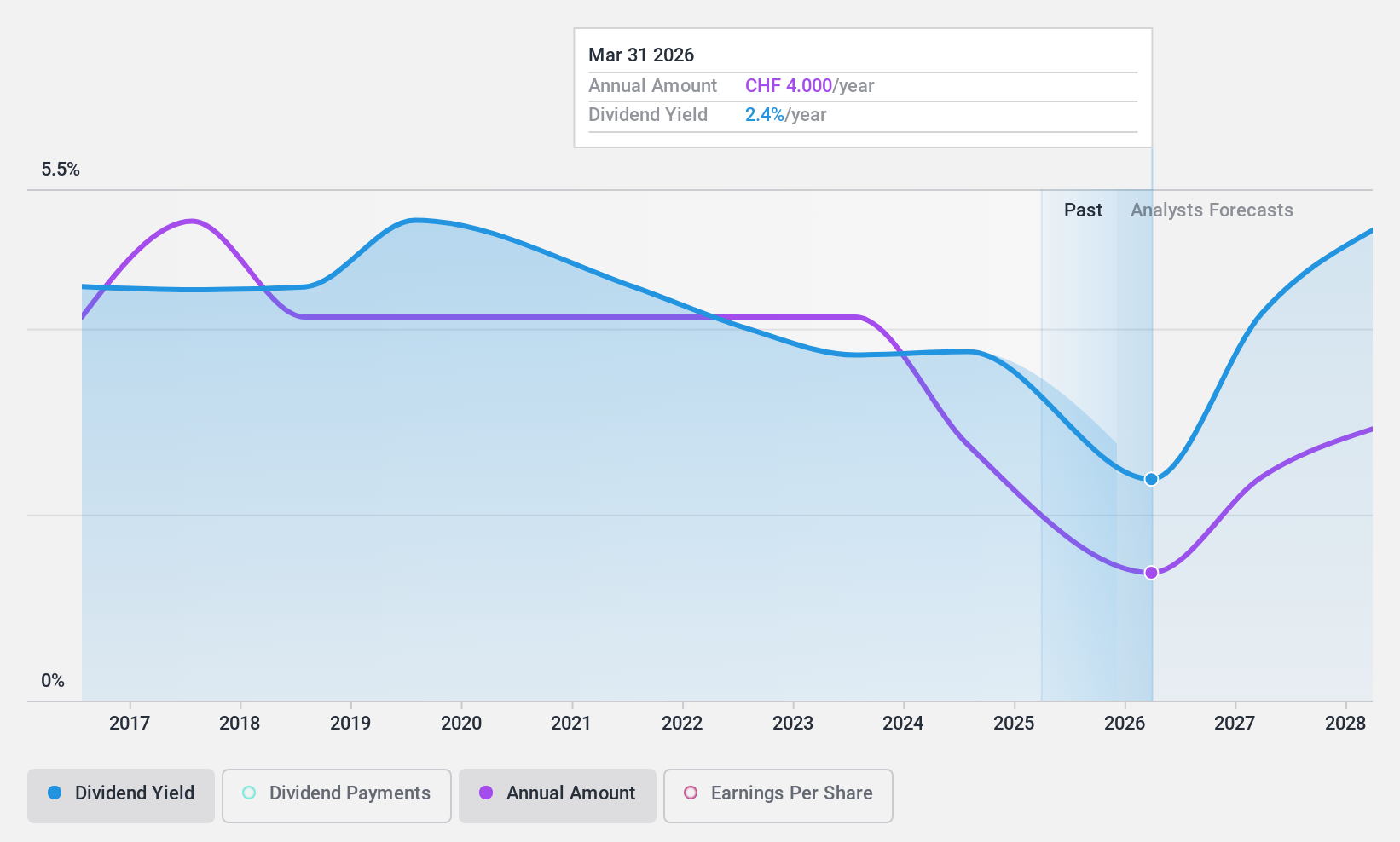

Carlo Gavazzi Holding (SWX:GAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carlo Gavazzi Holding AG specializes in designing, manufacturing, and selling electronic control components for the building and industrial automation markets, with a market capitalization of CHF 223.87 million.

Operations: Carlo Gavazzi Holding AG generates its revenue from the design, manufacture, and sale of electronic control components specifically tailored for the building and industrial automation sectors.

Dividend Yield: 3.8%

Carlo Gavazzi Holding has shown a 9% increase in earnings over the past year, supporting a sustainable dividend with a payout ratio of 31.8% and cash payout ratio of 47.6%. However, its dividend yield of 3.81% trails behind the top Swiss dividend payers and its history reveals an unstable track record with volatile payments over the last decade, despite recent growth in dividends. The stock is currently valued at 55.2% below estimated fair value, indicating potential undervaluation.

- Get an in-depth perspective on Carlo Gavazzi Holding's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Carlo Gavazzi Holding's current price could be quite moderate.

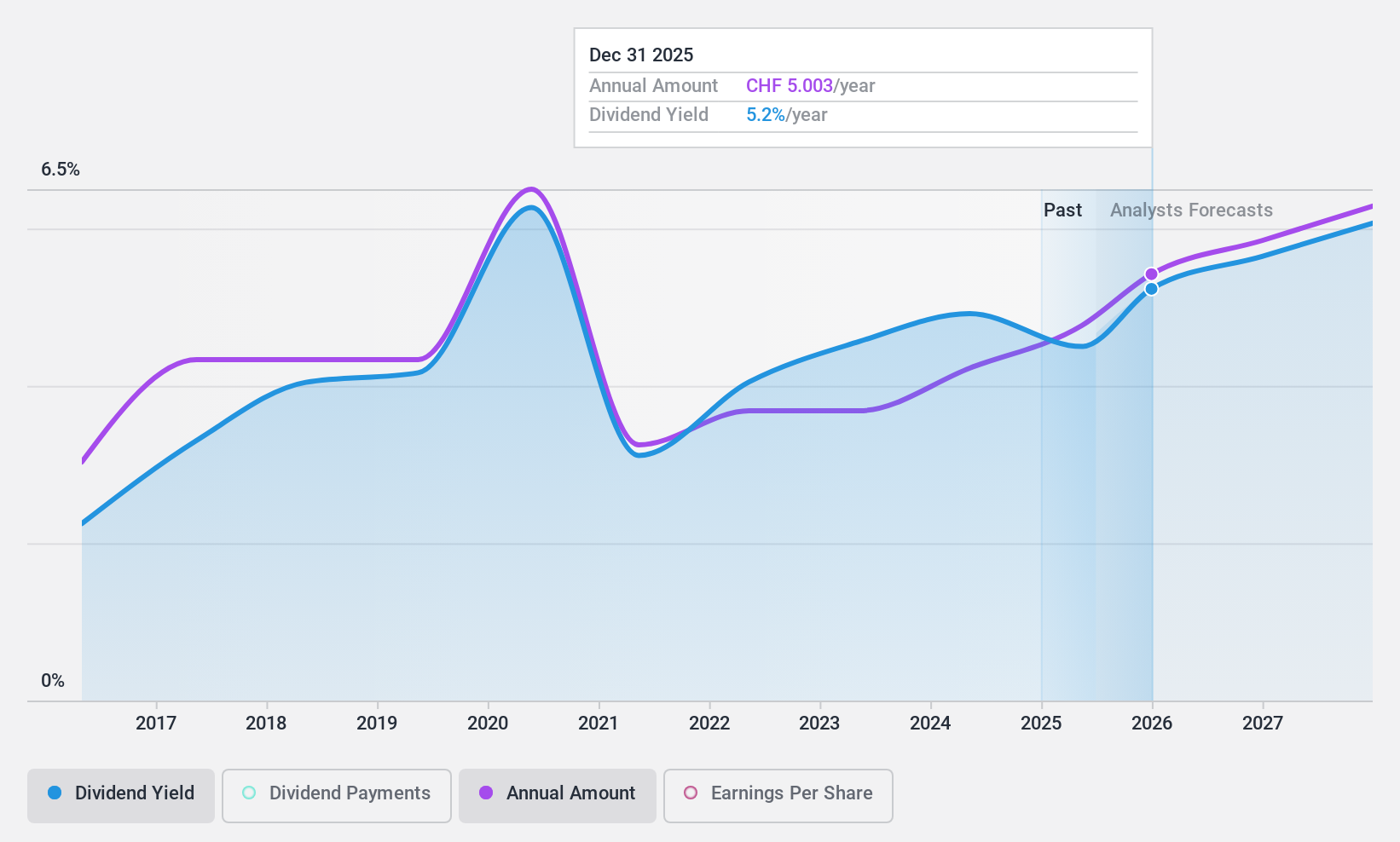

Orell Füssli (SWX:OFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security solutions and book retailing, serving both Swiss and international markets, with a market capitalization of CHF 153.66 million.

Operations: Orell Füssli AG generates its revenue primarily from three segments: CHF 117.48 million from the Book Trade, CHF 77.15 million from Security Printing, and CHF 21.59 million from Industrial Systems.

Dividend Yield: 5%

Orell Füssli AG reported a robust financial performance for 2023, with net income rising to CHF 12.04 million from CHF 8.49 million the previous year and revenues increasing to CHF 242.26 million. The company offers a dividend yield of 4.97%, ranking in the top quartile of Swiss dividend stocks, although it has only maintained dividends for eight years with some volatility in payments. Despite this, both earnings and cash flow adequately cover the dividend, with payout ratios at 63.5% and 61.6% respectively, suggesting sustainability from current operations.

- Unlock comprehensive insights into our analysis of Orell Füssli stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Orell Füssli is priced lower than what may be justified by its financials.

Taking Advantage

- Navigate through the entire inventory of 27 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Carlo Gavazzi Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GAV

Carlo Gavazzi Holding

Designs, manufactures, and sells electronic control components for building and industrial automation markets.

Flawless balance sheet, good value and pays a dividend.