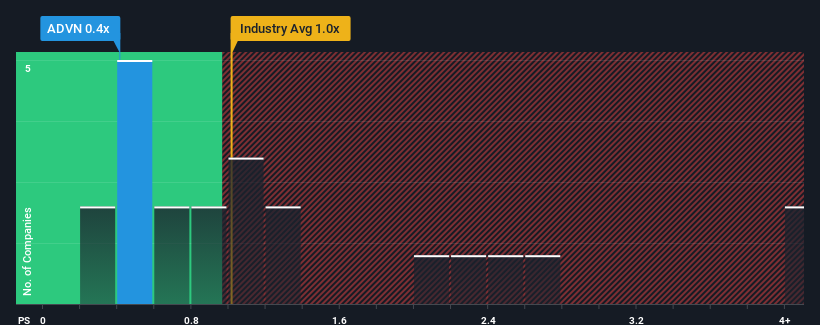

Adval Tech Holding AG's (VTX:ADVN) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Machinery industry in Switzerland have P/S ratios greater than 1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Adval Tech Holding

How Has Adval Tech Holding Performed Recently?

Adval Tech Holding's negative revenue growth of late has neither been better nor worse than most other companies. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Keen to find out how analysts think Adval Tech Holding's future stacks up against the industry? In that case, our free report is a great place to start.How Is Adval Tech Holding's Revenue Growth Trending?

In order to justify its P/S ratio, Adval Tech Holding would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.8%. Still, the latest three year period has seen an excellent 30% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.4% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 7.4% each year, which is noticeably more attractive.

In light of this, it's understandable that Adval Tech Holding's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Adval Tech Holding's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Adval Tech Holding's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Adval Tech Holding is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:ADVN

Adval Tech Holding

Manufactures and sells metal and plastic components and subassemblies in Switzerland and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives