Stock Analysis

- Switzerland

- /

- Banks

- /

- SWX:SGKN

Top Dividend Stocks On SIX Swiss Exchange In July 2024

Reviewed by Simply Wall St

Amidst a fluctuating Swiss market, with the benchmark SMI experiencing both highs and lows, investors are keenly observing trends as they unfold. In this environment, understanding the characteristics of resilient dividend stocks becomes crucial, especially when economic indicators like producer and import prices show continued variability.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Compagnie Financière Tradition (SWX:CFT) | 4.18% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.39% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.17% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.34% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.24% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.71% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.98% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.10% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.69% | ★★★★★☆ |

Let's take a closer look at a couple of our picks from the screened companies.

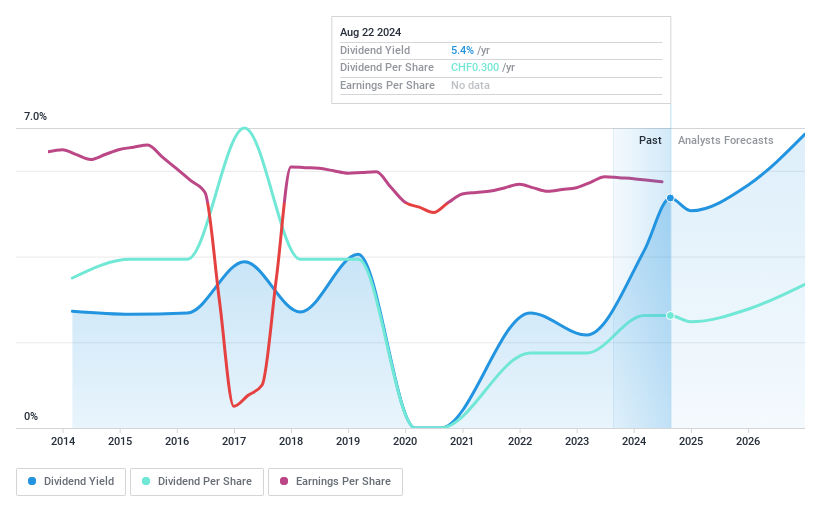

Ascom Holding (SWX:ASCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ascom Holding AG operates globally, offering healthcare ICT and mobile workflow solutions, with a market capitalization of approximately CHF 257.16 million.

Operations: Ascom Holding AG generates CHF 297.30 million in revenue primarily through its Wireless Solutions segment.

Dividend Yield: 4.2%

Ascom Holding AG recently increased its dividend to CHF 0.30 per share, reflecting a commitment to shareholder returns despite a history of unstable dividend payments over the past decade. The company trades at good value relative to peers, with earnings forecasted to grow by 11.53% annually. Dividends are reasonably covered by both earnings and cash flows, with payout ratios of 61.9% and 66.1%, respectively, suggesting sustainability amid financial growth and recent strategic expansions like the launch of Activity Monitoring software for long-term care homes on May 15, 2024.

- Navigate through the intricacies of Ascom Holding with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ascom Holding's shares may be trading at a discount.

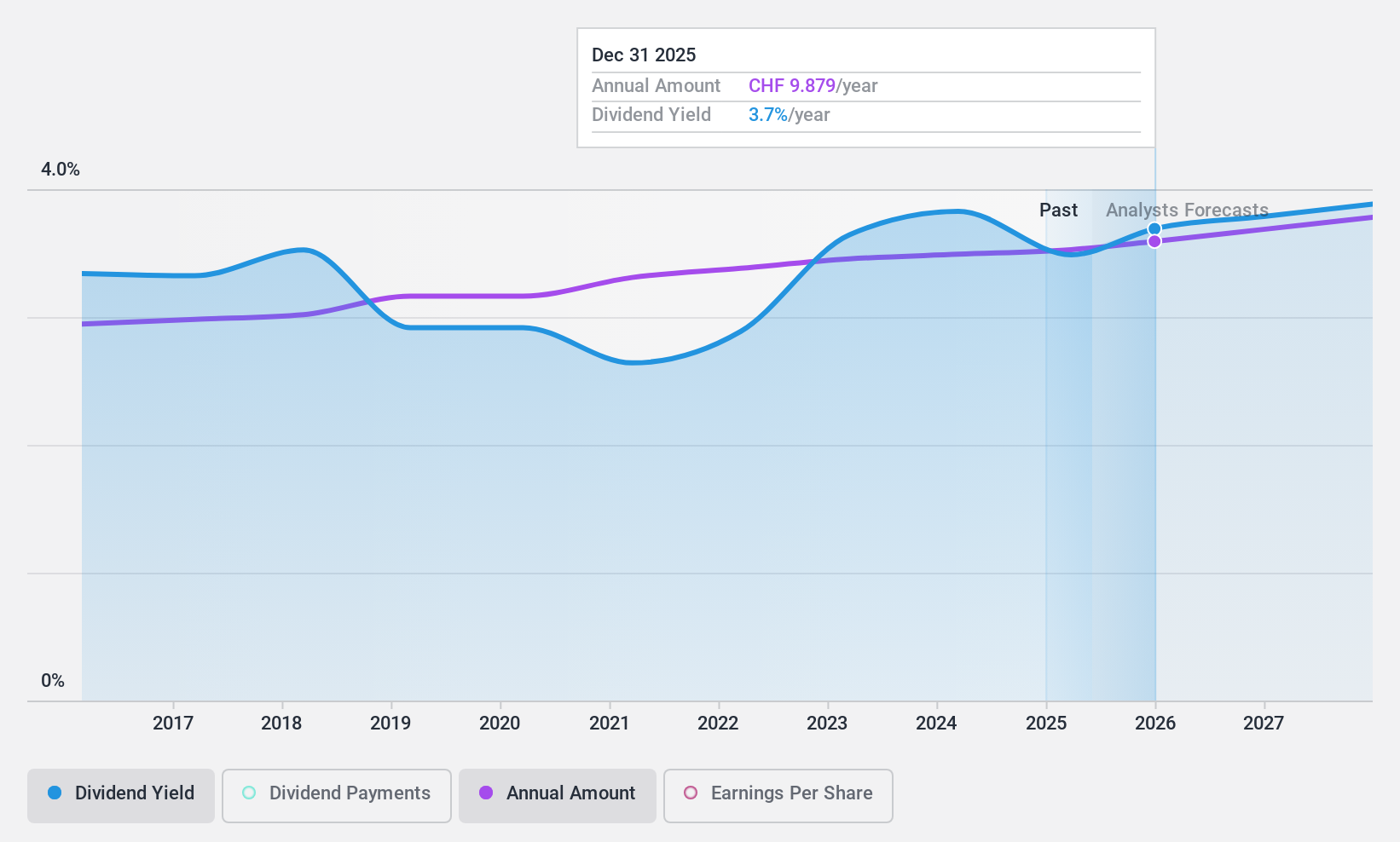

Roche Holding (SWX:ROG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Roche Holding AG operates in the pharmaceuticals and diagnostics sectors across multiple global regions, with a market capitalization of approximately CHF 209.07 billion.

Operations: Roche Holding AG generates revenue primarily through its Pharmaceuticals - Roche Pharmaceuticals segment, which contributed CHF 44.43 billion, followed by the Diagnostics division with CHF 14.16 billion, and Pharmaceuticals - Chugai at CHF 7.20 billion.

Dividend Yield: 3.7%

Roche Holding AG offers a modest dividend yield of 3.71%, slightly below the Swiss market's top quartile. Despite this, Roche has demonstrated a consistent dividend track record over the past decade, with growing payments supported by stable free cash flows and earnings, evidenced by payout ratios of 66.7% and 66.9% respectively. However, it carries a high level of debt which could impact future financial flexibility. Trading at a significant discount to its estimated fair value suggests potential undervaluation relative to its fundamentals. Recent product approvals and launches indicate ongoing operational progress despite some clinical setbacks in its pipeline updates as of mid-July 2024.

- Unlock comprehensive insights into our analysis of Roche Holding stock in this dividend report.

- In light of our recent valuation report, it seems possible that Roche Holding is trading behind its estimated value.

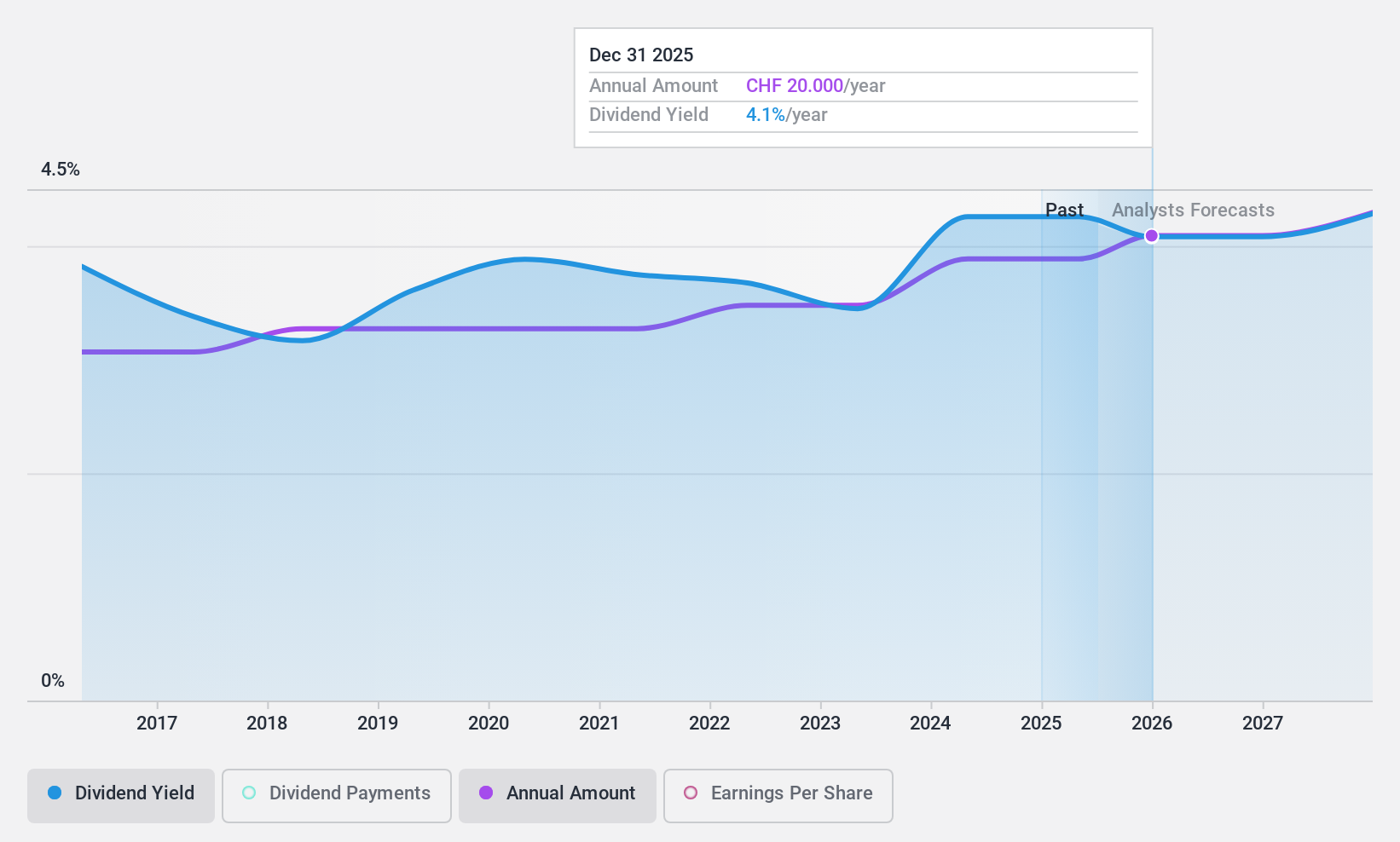

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG is a cantonal bank that offers banking products and services to individuals and small to mid-sized businesses in the Cantons of St. Gallen, with a market capitalization of CHF 2.62 billion.

Operations: St. Galler Kantonalbank AG generates its revenue by serving individuals and small to mid-sized businesses in the Cantons of St. Gallen.

Dividend Yield: 4.3%

St. Galler Kantonalbank, trading 24.4% below its estimated fair value, offers a robust dividend yield of 4.34%, ranking in the top quartile of Swiss dividend stocks. Its dividends have shown consistent growth over the past decade with stable payments supported by a payout ratio of 54.9%, indicating coverage by earnings. This trend is expected to continue with a forecasted payout ratio of 49.2% in three years, underpinned by an earnings growth rate of 5.2% annually over the past five years and a low allowance for bad loans at 55%.

- Delve into the full analysis dividend report here for a deeper understanding of St. Galler Kantonalbank.

- Our valuation report here indicates St. Galler Kantonalbank may be undervalued.

Make It Happen

- Click this link to deep-dive into the 27 companies within our Top SIX Swiss Exchange Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether St. Galler Kantonalbank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGKN

St. Galler Kantonalbank

A cantonal bank, provides banking products and services to the local population, and small and middle-sized companies in the Cantons of St.

6 star dividend payer with excellent balance sheet.