- Switzerland

- /

- Banks

- /

- SWX:BEKN

3 Swiss Dividend Stocks Offering Up To 5.9% Yield

Reviewed by Simply Wall St

Despite recent fluctuations in the Swiss market, with a cautious downturn noted on Friday influenced by international political events and local economic data, investors continue to seek stable returns amidst uncertainty. In this context, dividend stocks remain appealing for their potential to offer consistent income, particularly when consumer confidence shows signs of resilience and modest improvements are observed in economic indicators.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Vontobel Holding (SWX:VONN) | 5.47% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.47% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.40% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.33% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.95% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.99% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.11% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.49% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Berner Kantonalbank (SWX:BEKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Berner Kantonalbank AG is a Swiss bank that provides a range of banking products and services to private individuals and corporate customers, with a market capitalization of approximately CHF 2.15 billion.

Operations: Berner Kantonalbank AG generates CHF 532.28 million in revenue from its banking operations.

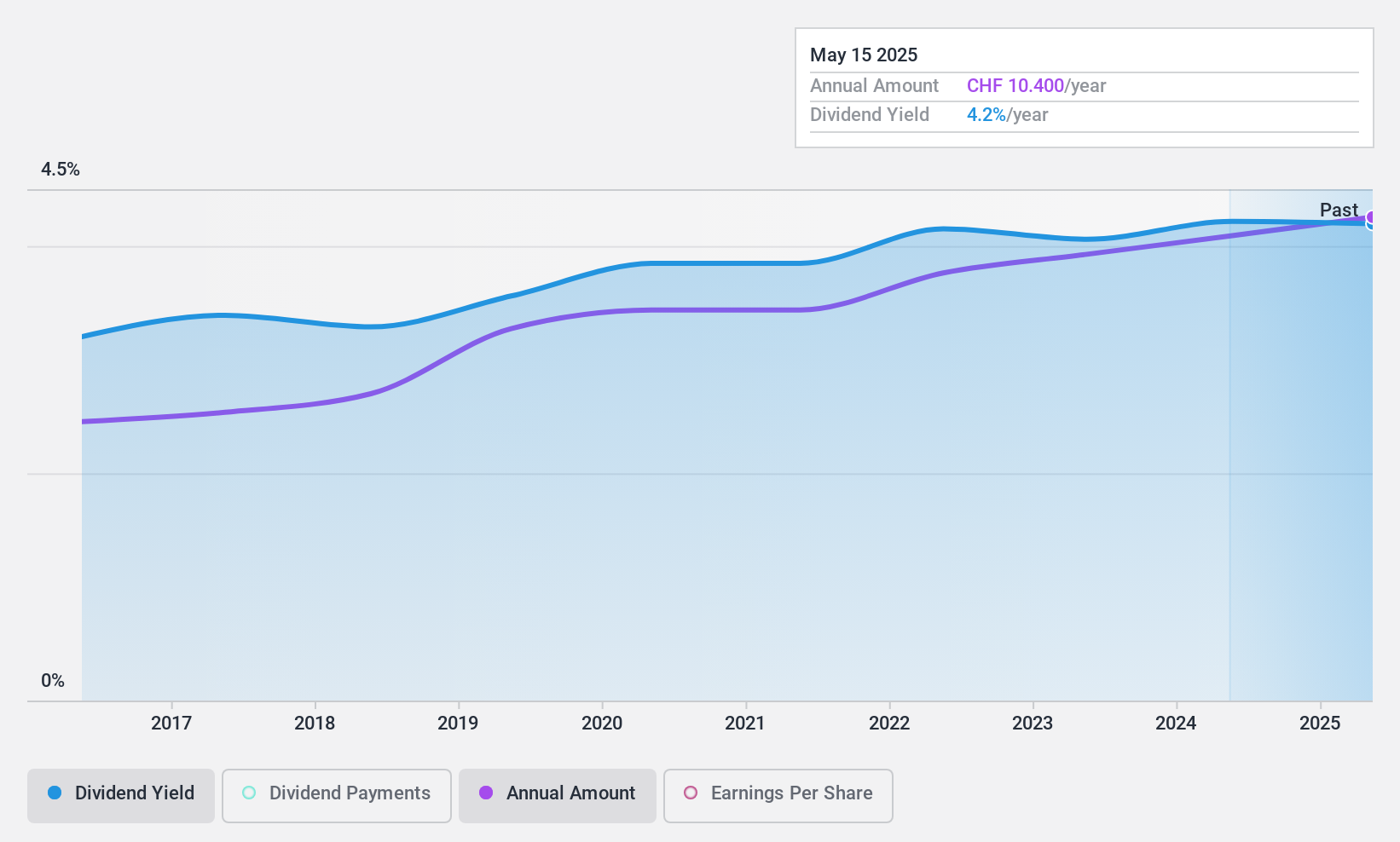

Dividend Yield: 4.3%

Berner Kantonalbank maintains a stable dividend history, with payments growing consistently over the past decade. Its current yield of 4.29% ranks in the top 25% of Swiss dividend payers, supported by a reasonable payout ratio of 52.8%, indicating earnings sufficiently cover dividends. Trading at 29.4% below estimated fair value, it presents potential value; however, long-term sustainability is unclear due to insufficient data on future coverage and growth prospects in earnings or dividends.

- Click to explore a detailed breakdown of our findings in Berner Kantonalbank's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Berner Kantonalbank shares in the market.

Luzerner Kantonalbank (SWX:LUKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luzerner Kantonalbank AG is a Swiss bank that offers a range of banking products and services, with a market capitalization of approximately CHF 3.27 billion.

Operations: Luzerner Kantonalbank AG operates primarily in the banking sector within Switzerland.

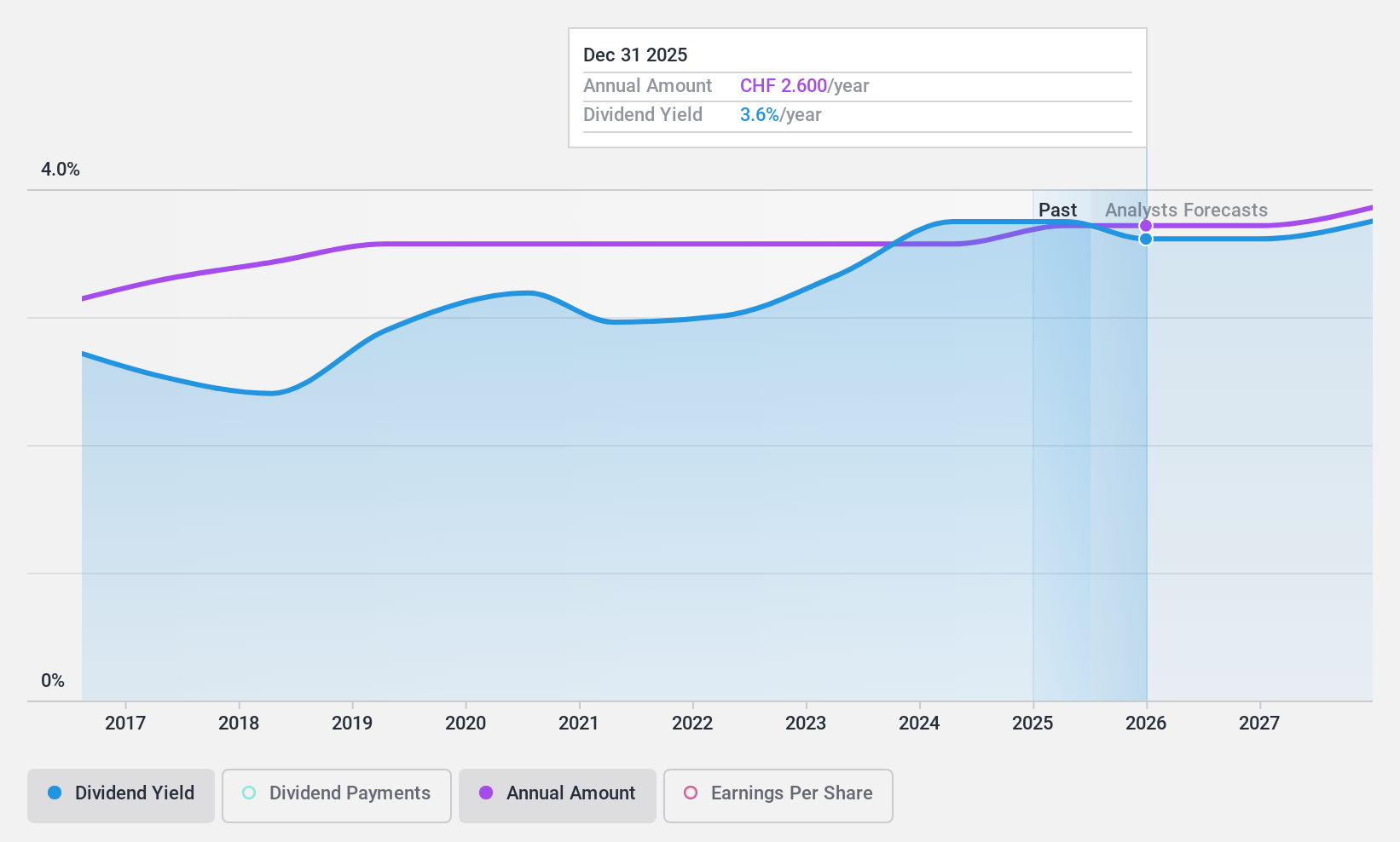

Dividend Yield: 3.8%

Luzerner Kantonalbank offers a consistent dividend yield of 3.77%, though it's below the top quartile of Swiss dividend stocks at 4.15%. Its dividends are well-supported by earnings with a payout ratio of 46.5%. The bank's net interest income and net income have shown growth, reporting CHF 106.56 million and CHF 74.81 million respectively in Q1 2024, up from the previous year. Despite trading at a substantial discount to its fair value, long-term dividend sustainability remains uncertain without clearer future earnings projections.

- Navigate through the intricacies of Luzerner Kantonalbank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Luzerner Kantonalbank's current price could be quite moderate.

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Phoenix Mecano AG operates globally, manufacturing and selling components for industrial customers, with a market capitalization of approximately CHF 471.79 million.

Operations: Phoenix Mecano's revenue is generated through three primary segments: Enclosure Systems (€231.16 million), Industrial Components (€223.58 million), and Dewertokin Technology Group (€335.80 million).

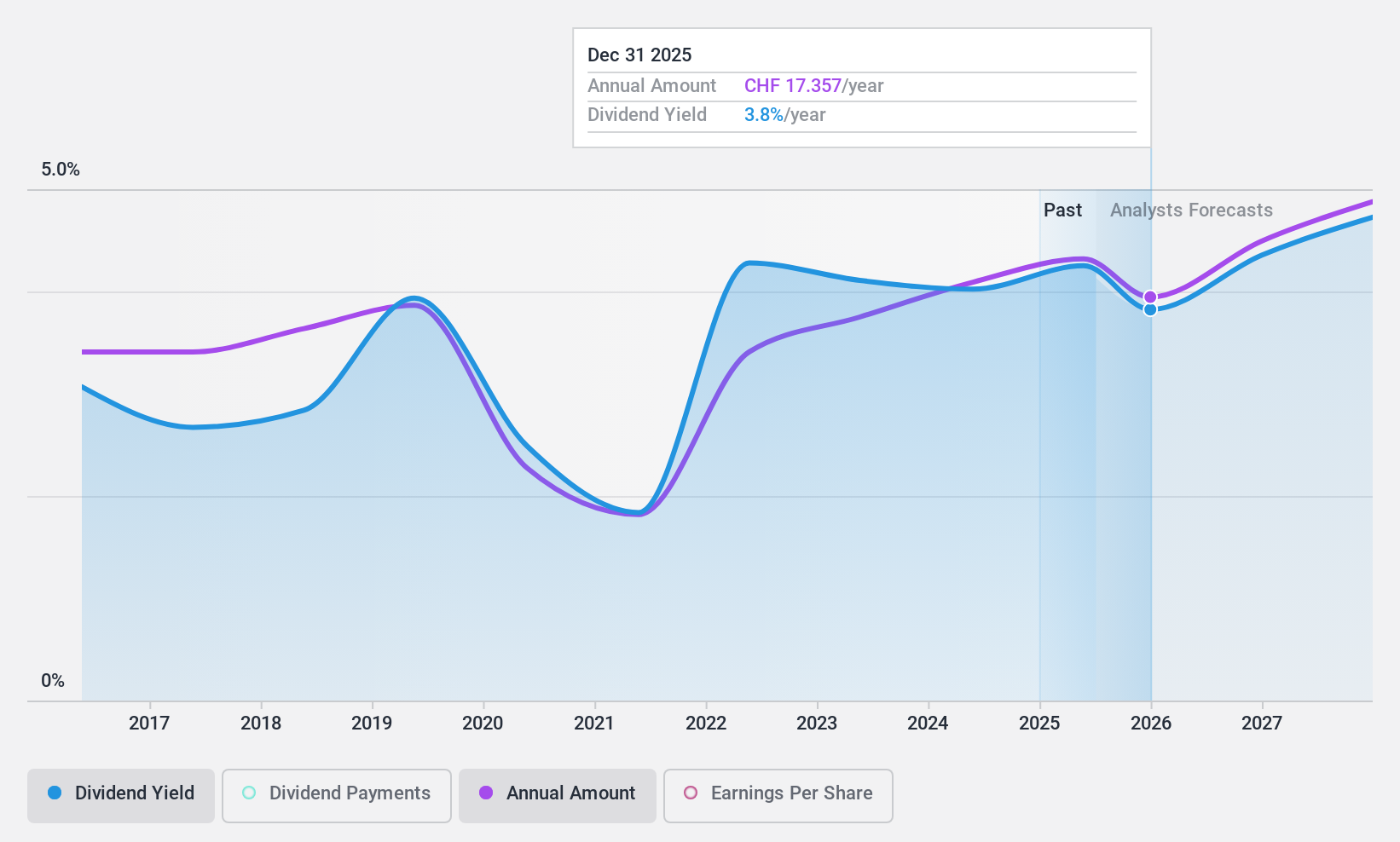

Dividend Yield: 5.9%

Phoenix Mecano's dividend yield of 5.94% places it among the top 25% in the Swiss market, supported by a reasonable payout ratio of 68.4% and cash payout ratio of 58.1%, indicating dividends are well-covered by both earnings and cash flow. Despite this, its dividend history has shown volatility over the past decade, with significant annual fluctuations. Recently, Phoenix Mecano announced a special dividend along with an increase in its regular dividend at its AGM on May 24, 2024, reflecting a positive short-term outlook for shareholder returns.

- Click here to discover the nuances of Phoenix Mecano with our detailed analytical dividend report.

- Our expertly prepared valuation report Phoenix Mecano implies its share price may be lower than expected.

Key Takeaways

- Reveal the 26 hidden gems among our Top Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berner Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BEKN

Berner Kantonalbank

Offers banking products and services to private individuals and corporate customers in Switzerland.

Established dividend payer with adequate balance sheet.