- Switzerland

- /

- Banks

- /

- SWX:BCVN

Top Dividend Stocks On SIX Swiss Exchange September 2024

Reviewed by Simply Wall St

The Swiss market ended higher on Friday, extending gains to a third straight session, as encouraging European and U.S. economic data and optimism about interest rate cuts helped underpin sentiment. With the KOF Economic Barometer rising to 101.6 in August 2024, investors are increasingly looking for stable income sources like dividend stocks to navigate the current economic landscape effectively.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.10% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.76% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.73% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.56% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.25% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.69% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.81% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.69% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.31% | ★★★★★☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise provides a range of financial services in Vaud Canton, Switzerland, the European Union, North America, and internationally with a market cap of CHF7.81 billion.

Operations: Banque Cantonale Vaudoise generates revenue through a variety of financial services offered in Switzerland, the European Union, North America, and globally.

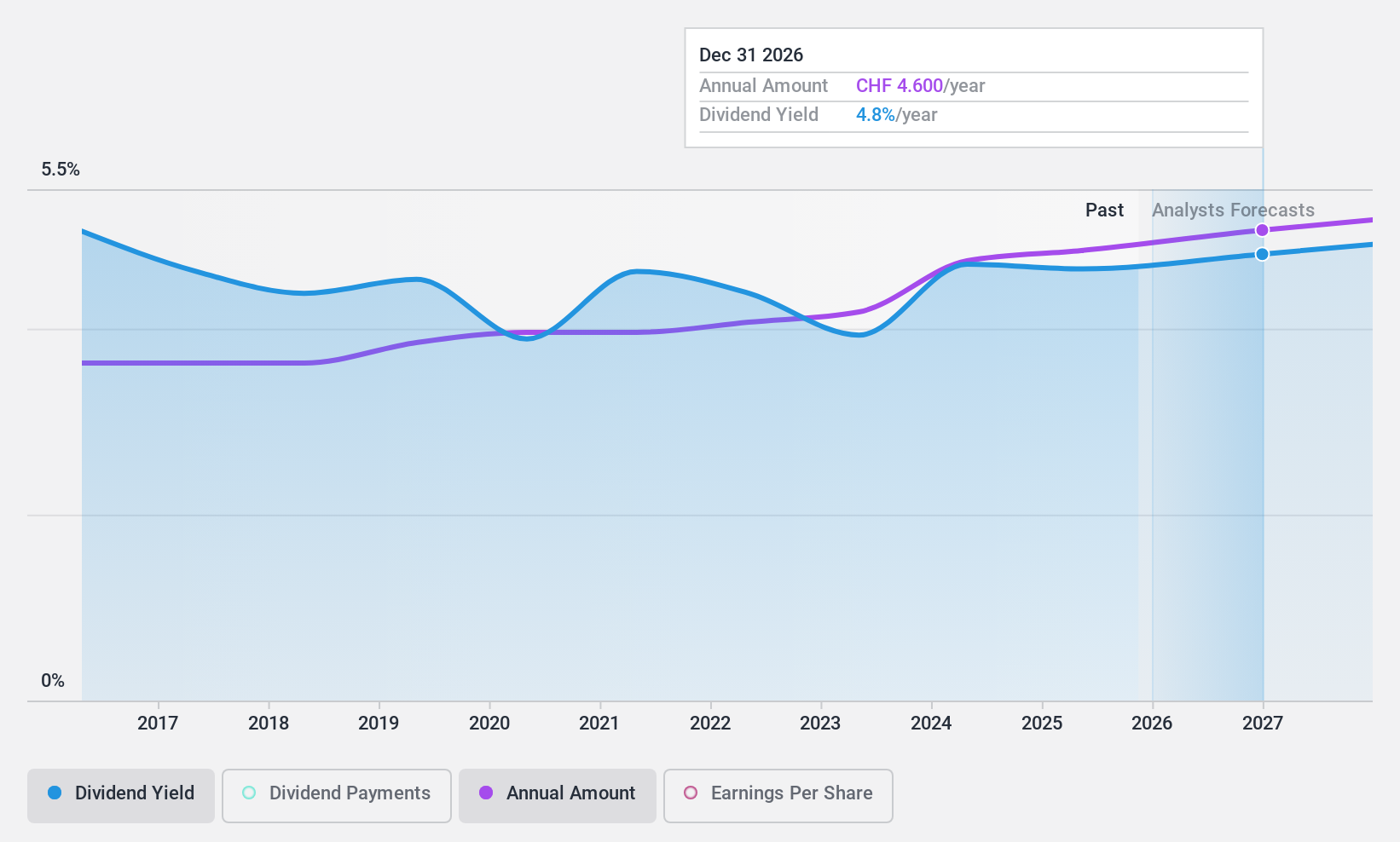

Dividend Yield: 4.7%

Banque Cantonale Vaudoise offers a stable and growing dividend, with payments increasing over the past decade. The current yield of 4.73% places it in the top 25% of Swiss dividend payers. Despite a slight dip in net income to CHF 221.1 million for H1 2024, dividends remain covered by earnings (78.7% payout ratio). The bank's allowance for bad loans is low at 71%, and its P/E ratio of 17.3x suggests good value compared to the Swiss market average of 21.8x.

- Delve into the full analysis dividend report here for a deeper understanding of Banque Cantonale Vaudoise.

- Upon reviewing our latest valuation report, Banque Cantonale Vaudoise's share price might be too optimistic.

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services across Liechtenstein, Switzerland, Germany, Austria, and internationally, with a market cap of CHF 2.23 billion.

Operations: Liechtensteinische Landesbank Aktiengesellschaft's revenue segments include Retail & Corporate Banking at CHF 313.30 million and International Wealth Management at CHF 241.83 million, with the Corporate Center contributing CHF 2.40 million.

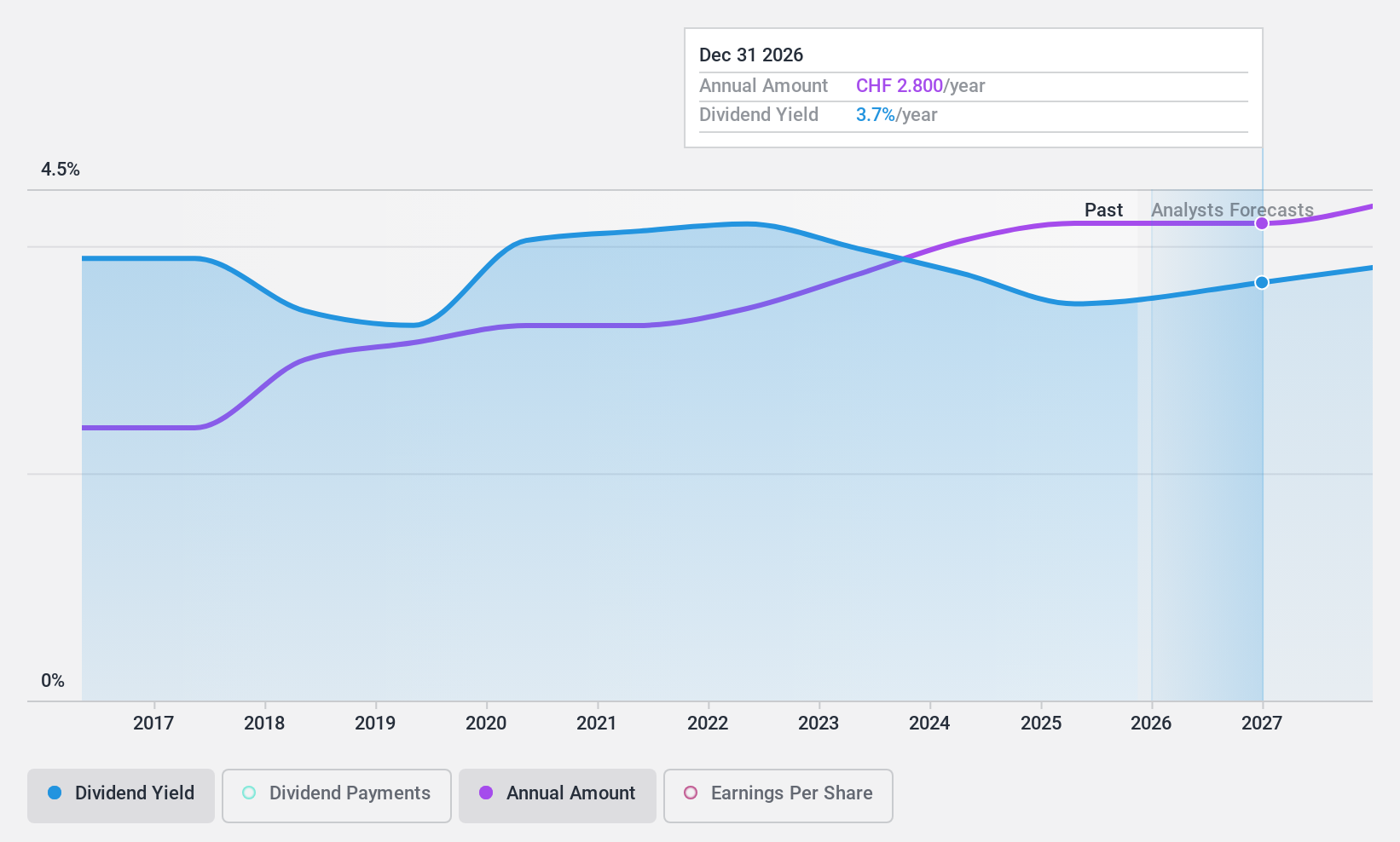

Dividend Yield: 3.7%

Liechtensteinische Landesbank's dividends are well covered by earnings, with a current payout ratio of 49.7% and forecasted to be 47.7% in three years. Despite an unstable dividend track record and a yield of 3.69%, lower than the top 25% in Switzerland, the bank's earnings have grown at 11.3% annually over the past five years. Recent half-year results show net income rose to CHF 90.16 million from CHF 88.59 million year-over-year, indicating financial stability amidst fluctuating interest income.

- Navigate through the intricacies of Liechtensteinische Landesbank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Liechtensteinische Landesbank's current price could be quite moderate.

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG develops, manufactures, and distributes precision machine tools for milling, turning, boring, grinding, and machining of metal, composite materials, and ceramics; the company has a market cap of CHF253.32 million.

Operations: StarragTornos Group AG generates revenue through the development, manufacturing, and distribution of precision machine tools used for various machining processes on metal, composite materials, and ceramics.

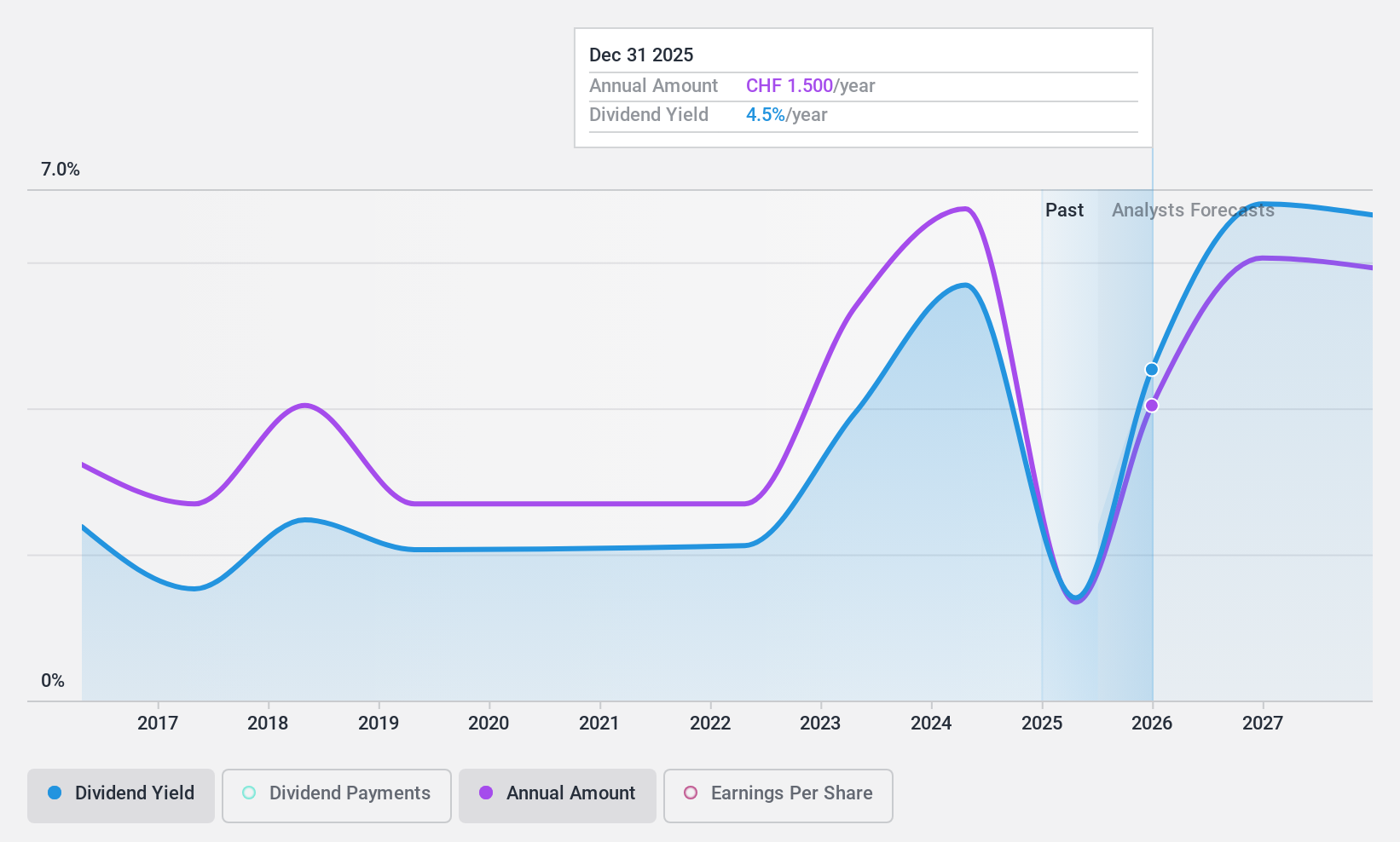

Dividend Yield: 5.4%

StarragTornos Group's dividend yield of 5.36% places it in the top 25% of Swiss dividend payers, but its dividends are not covered by free cash flows despite a reasonable payout ratio of 62.7%. Recent earnings show sales increased to CHF 254.95 million for H1 2024 from CHF 199.88 million a year ago, while net income fell to CHF 6.57 million from CHF 13.62 million, highlighting potential volatility and sustainability concerns in dividend payments.

- Dive into the specifics of StarragTornos Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of StarragTornos Group shares in the market.

Seize The Opportunity

- Explore the 26 names from our Top SIX Swiss Exchange Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banque Cantonale Vaudoise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BCVN

Banque Cantonale Vaudoise

Engages in the provision of various financial services in Vaud Canton and rest of Switzerland, the European Union, North America, and internationally.

6 star dividend payer with excellent balance sheet.