- Canada

- /

- Metals and Mining

- /

- TSXV:MAI

Maxim Power And Two Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

The Canadian stock market is experiencing a robust year, with the TSX up more than 17%, reflecting broader trends of economic growth and favorable central bank policies. In such an environment, investors might find opportunities in lesser-known areas like penny stocks, which despite their outdated name, remain relevant for those seeking hidden value. These smaller or newer companies can offer unique growth potential and financial strength that larger firms may overlook, making them intriguing options for investors looking to explore beyond the mainstream.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.26 | CA$138.39M | ★★★★☆☆ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Maxim Power (TSX:MXG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Maxim Power Corp. is an independent power producer that acquires, develops, owns, and operates power and related projects in Alberta, Canada with a market cap of CA$206.77 million.

Operations: There are no reported revenue segments for this independent power producer operating in Alberta, Canada.

Market Cap: CA$206.77M

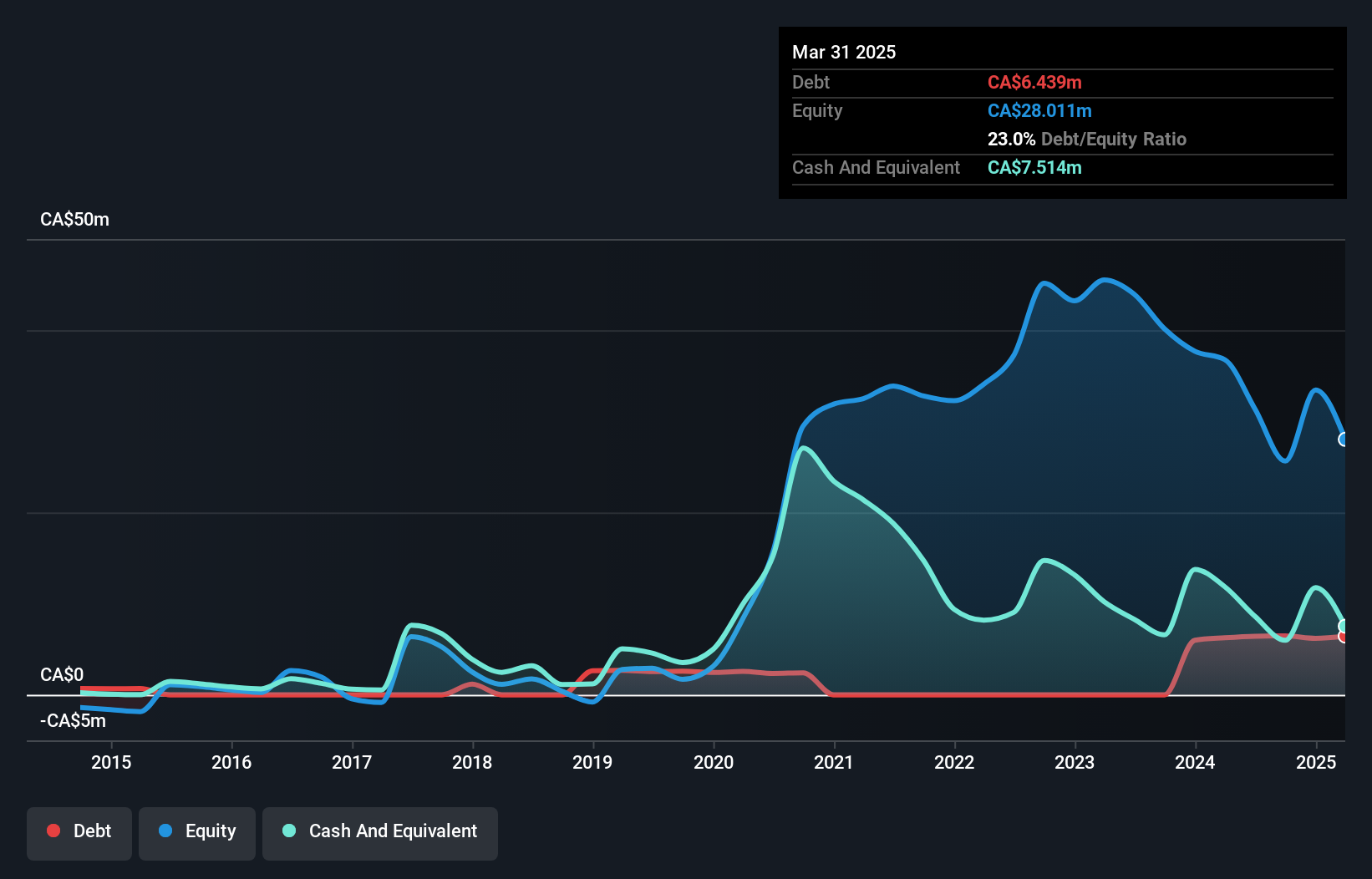

Maxim Power Corp. has demonstrated prudent financial management, recently repaying CA$49.9 million in debt, leaving unrestricted cash of CA$50.8 million and reducing its fixed-rate facilities to nil. Despite a decline in net income compared to last year, the company remains profitable with revenues of CA$57.8 million for the first half of 2024 and maintains a healthy interest coverage ratio of 3.2x EBIT over interest payments. The board's share buyback plan indicates confidence in long-term value creation, although recent earnings growth has been negative against industry trends, reflecting challenges within its operating environment.

- Click here to discover the nuances of Maxim Power with our detailed analytical financial health report.

- Gain insights into Maxim Power's past trends and performance with our report on the company's historical track record.

Minera Alamos (TSXV:MAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Minera Alamos Inc. is involved in the acquisition, exploration, development, and operation of mineral properties in Mexico with a market cap of CA$184.55 million.

Operations: The company generates revenue from its Metals & Mining - Miscellaneous segment, totaling CA$7.52 million.

Market Cap: CA$184.55M

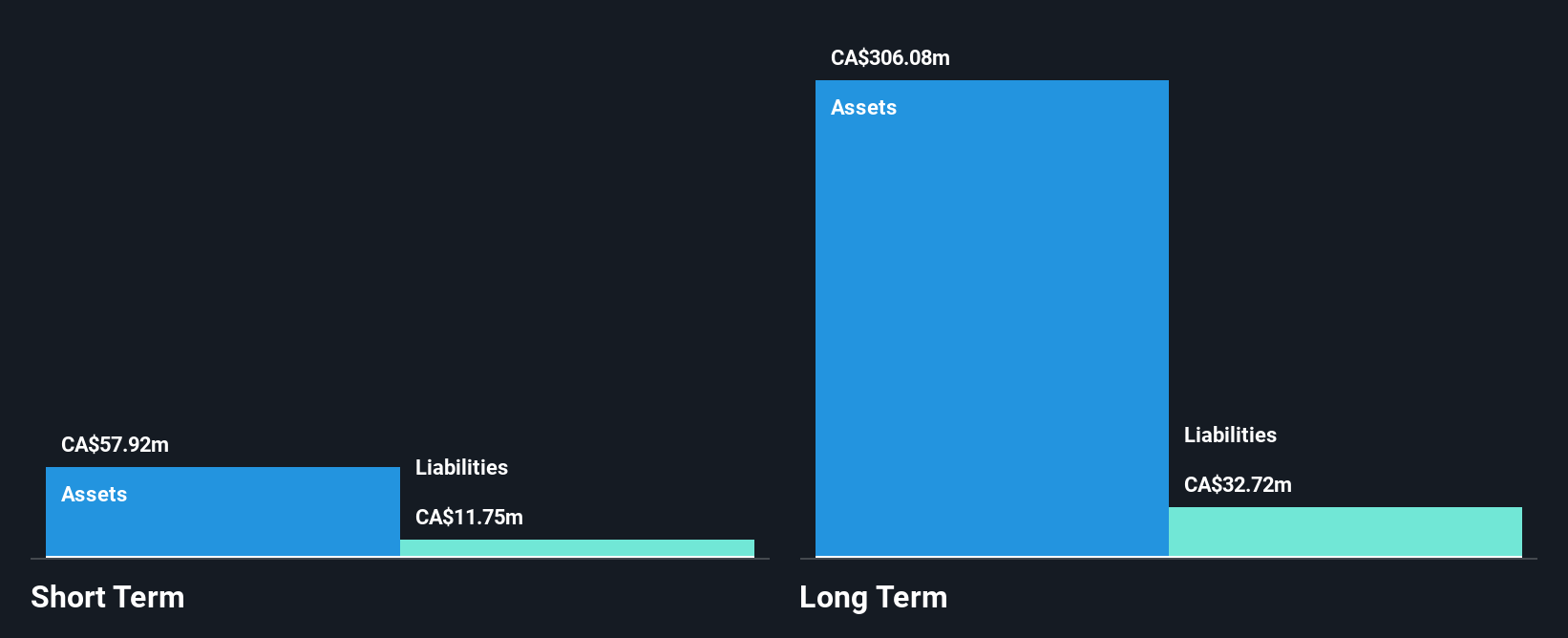

Minera Alamos Inc., with a market cap of CA$184.55 million, faces challenges as it reported a net loss of CA$7.04 million for Q2 2024, contrasting with net income from the previous year. Despite this, the company maintains strong short-term financial health, with assets (CA$18.9M) surpassing both short and long-term liabilities. The management team is experienced, and there has been no significant shareholder dilution recently. Although unprofitable currently and experiencing declining earnings over five years at 1.7% annually, revenue is forecast to grow by nearly 50% per year according to consensus estimates.

- Dive into the specifics of Minera Alamos here with our thorough balance sheet health report.

- Evaluate Minera Alamos' prospects by accessing our earnings growth report.

Wilton Resources (TSXV:WIL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wilton Resources Inc. is a Canadian oil and gas exploration and development company with a market cap of CA$47.65 million.

Operations: The company's revenue is derived entirely from its oil and gas exploration and development segment, totaling CA$0.01 million.

Market Cap: CA$47.65M

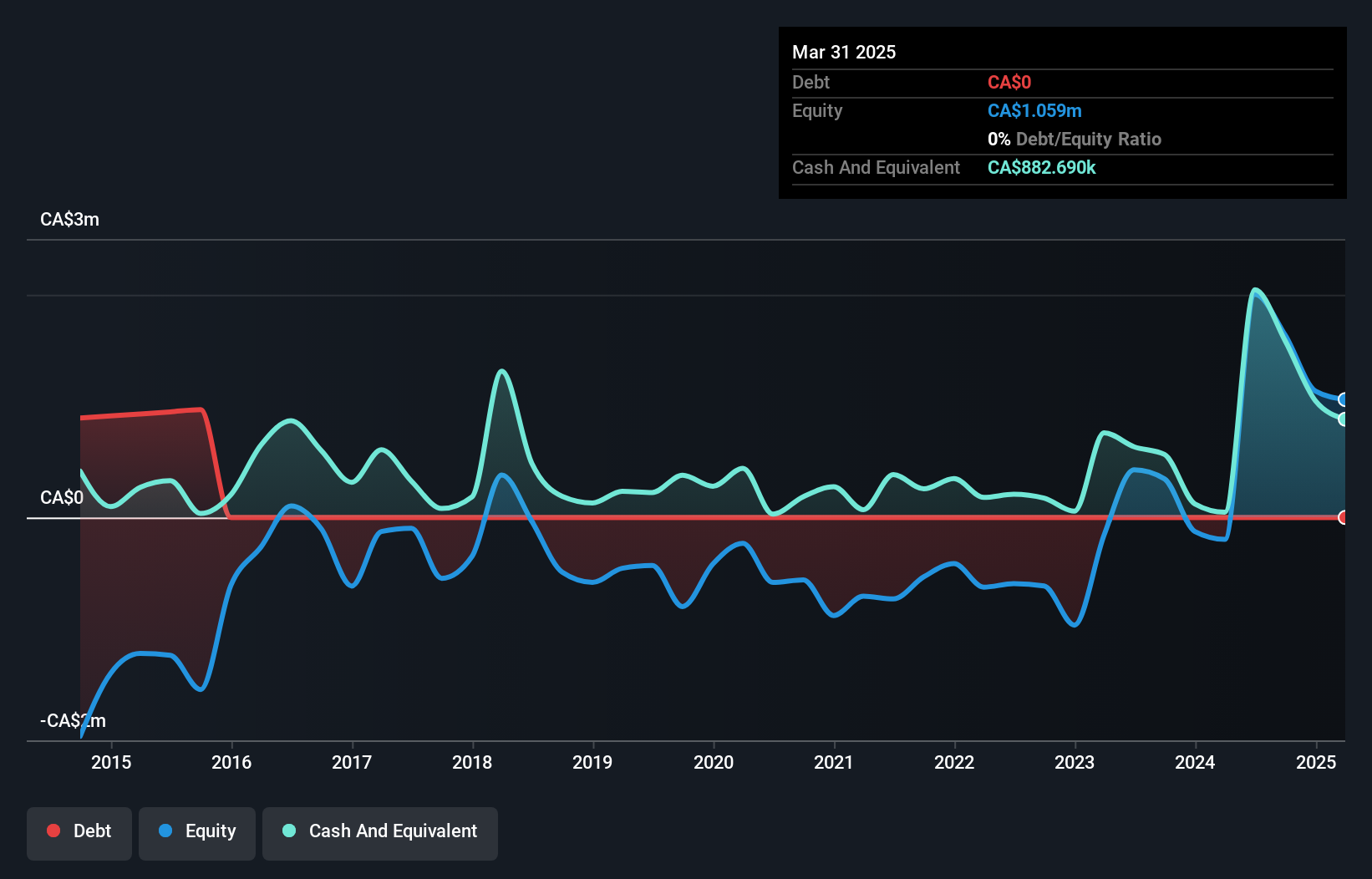

Wilton Resources Inc., with a market cap of CA$47.65 million, remains pre-revenue, generating minimal income from its oil and gas exploration activities. Despite being debt-free and having short-term assets (CA$2.1M) that exceed liabilities, the company faces challenges with shareholder dilution and significant net losses reported in recent earnings. The management team is seasoned, boasting an average tenure of 13.2 years. While Wilton has reduced its losses over five years by 4.9% annually, it still struggles with high share price volatility and negative return on equity due to ongoing unprofitability.

- Unlock comprehensive insights into our analysis of Wilton Resources stock in this financial health report.

- Assess Wilton Resources' previous results with our detailed historical performance reports.

Seize The Opportunity

- Click this link to deep-dive into the 947 companies within our TSX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MAI

Minera Alamos

Engages in the acquisition, exploration, development, and operation of mineral properties in Mexico.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives