- Canada

- /

- Electric Utilities

- /

- TSX:H

Hydro One (TSX:H): A Fresh Look at Valuation After $1.6 Billion Sustainable Financing Announcement

Reviewed by Simply Wall St

Hydro One (TSX:H) just announced the pricing of a $1.6 billion medium-term note under its Sustainable Financing Framework. The initiative aims to fund new or existing green projects. This move showcases Hydro One’s increasing commitment to sustainability-focused investments.

See our latest analysis for Hydro One.

Hydro One's recent surge in sustainability financing hasn’t gone unnoticed by investors. The stock is up over 23% year-to-date and has delivered a remarkable 23% total shareholder return over the past year. This reflects momentum driven by strong earnings, robust dividend growth, and a flurry of company updates, including new labor negotiations and expanded green bond offerings. Both short- and long-term performance signals that market confidence is building as Hydro One leans further into the green transition.

If you’re curious what other companies are attracting attention for growth and ownership trends, now is an ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares rallying and a series of upbeat announcements fueling optimism, the key question now is whether Hydro One’s future growth is already fully reflected in its price or if investors still have a window to buy in.

Most Popular Narrative: 8.9% Overvalued

With Hydro One trading at CA$54.70 and the most popular narrative’s fair value estimate at CA$50.21, the valuation signals caution as the market price sits above what analysts have determined based on key business fundamentals.

“Surging electricity demand in Ontario, projected to grow 70% by 2050, along with government policy accelerating transmission and distribution infrastructure expansion, position Hydro One for sustained, rate base-driven revenue and earnings growth as electrification of transportation and industry advances.”

Think the story ends with defensive stability? The real surprise is the ambitious growth path this narrative uses to justify that premium. Wonder what bold projections analysts are making to back such a confident price tag? Dive in to see which financial assumptions could reshape expectations for Hydro One and its fair value calculation.

Result: Fair Value of $50.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital expenditures and regulatory uncertainty could create challenges for Hydro One’s growth path. This may potentially limit future earnings and put pressure on shareholder returns.

Find out about the key risks to this Hydro One narrative.

Another View: What Does Our DCF Model Say?

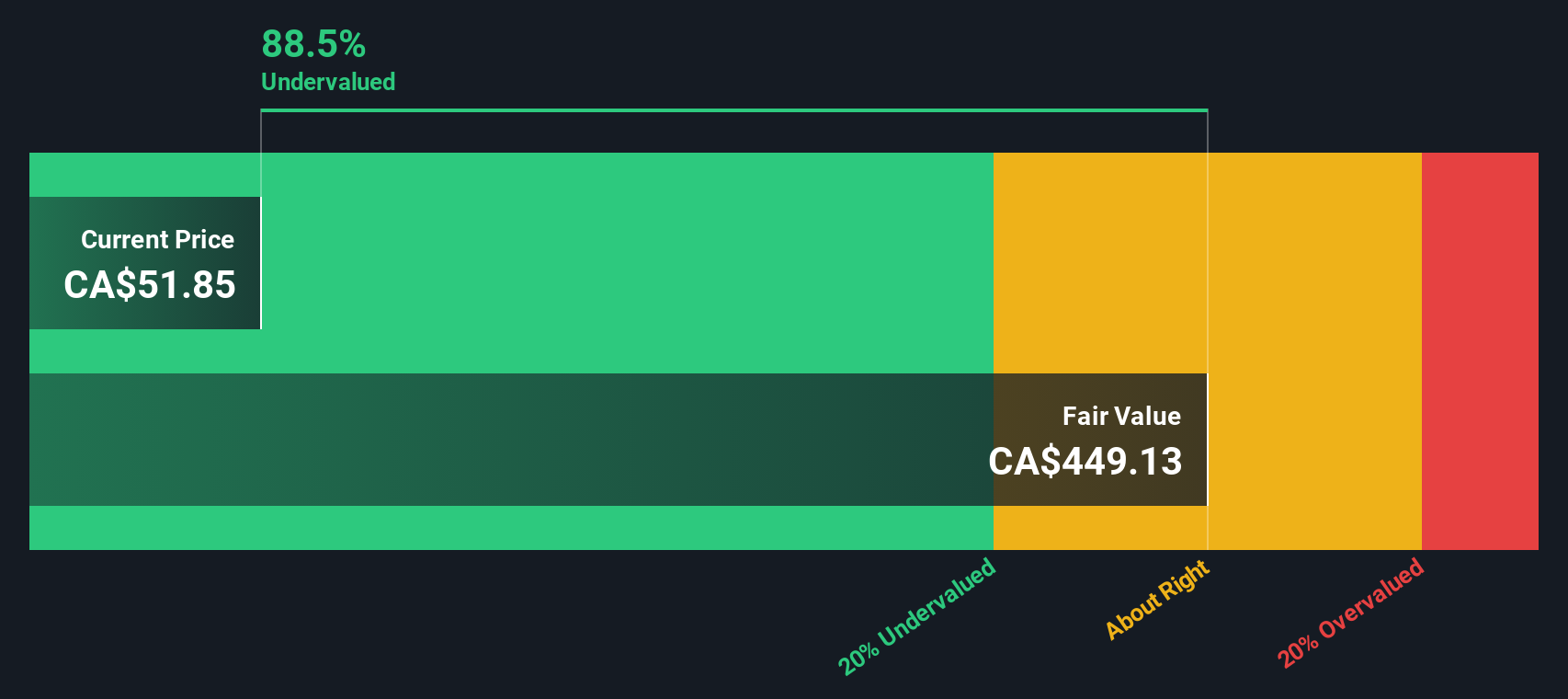

Taking a step back from analyst consensus, our SWS DCF model looks at Hydro One’s cash flows. This method produces an estimated fair value of CA$539.06, which is far above the current price. Such a wide gap challenges traditional valuation perspectives. Is the market ignoring long-term potential, or is something being missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hydro One for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hydro One Narrative

If you want to challenge these conclusions or prefer hands-on analysis, you can craft your own data-driven view in just a few minutes, and Do it your way.

A great starting point for your Hydro One research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always a step ahead. Maximize your edge by checking these handpicked opportunities before the next wave of growth leaves you behind.

- Supercharge your passive income with these 16 dividend stocks with yields > 3%, featuring companies offering robust yields above 3%, perfect for building a resilient portfolio.

- Experience the AI revolution firsthand by jumping into these 26 AI penny stocks, where the latest advancements drive powerful returns in cutting-edge industries.

- Get ahead of the market and uncover hidden value with these 926 undervalued stocks based on cash flows, based on cash flows that highlight tomorrow’s potential winners today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydro One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:H

Hydro One

Through its subsidiaries, operates as an electricity transmission and distribution company in Ontario.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives