Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hydro One (TSE:H). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Hydro One

How Quickly Is Hydro One Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Hydro One managed to grow EPS by 7.6% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

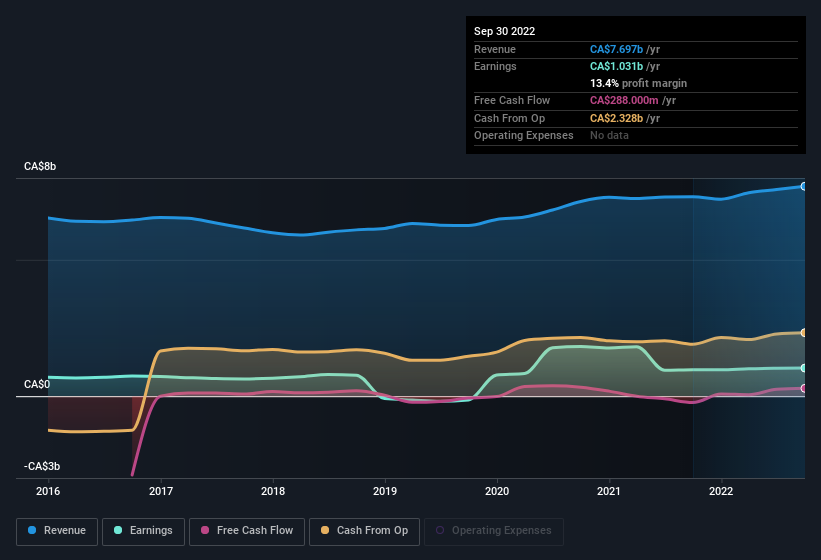

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Hydro One remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 5.3% to CA$7.7b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Hydro One?

Are Hydro One Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Hydro One shares, in the last year. With that in mind, it's heartening that Paul Harricks, the Executive VP & Chief Legal Officer of the company, paid CA$17k for shares at around CA$34.15 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, it's good to see that Hydro One insiders have a valuable investment in the business. To be specific, they have CA$17m worth of shares. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.08%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Bill Sheffield, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Hydro One, with market caps over CA$11b, is around CA$10.0m.

The CEO of Hydro One only received CA$82k in total compensation for the year ending December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Hydro One To Your Watchlist?

One important encouraging feature of Hydro One is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. It is worth noting though that we have found 2 warning signs for Hydro One (1 is potentially serious!) that you need to take into consideration.

The good news is that Hydro One is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hydro One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:H

Hydro One

Through its subsidiaries, operates as an electricity transmission and distribution company in Ontario.

Acceptable track record unattractive dividend payer.