- Canada

- /

- Electric Utilities

- /

- TSX:FTS

Fortis (TSX:FTS) Valuation: Assessing Fair Value After Q3 Sales Growth and Dividend Hike

Reviewed by Simply Wall St

Fortis (TSX:FTS) has investors talking after releasing third quarter earnings that highlighted higher sales compared to last year. The utility also announced regular and increased dividends for both preferred and common shareholders.

See our latest analysis for Fortis.

Fortis has been quietly gaining ground, with this week’s higher sales and dividend news adding to a steady run. The company’s year-to-date share price return is 20.7%. Over the longer term, Fortis has delivered a total shareholder return of 21.6% over the past year and an impressive 60.7% over five years. This suggests momentum has been building as income investors remain attracted to its consistent payouts.

If you’re looking to expand beyond the usual names in utilities, this could be the perfect moment to discover fast growing stocks with high insider ownership

But with Fortis shares already delivering strong multi-year returns and trading close to analyst price targets, investors may wonder if there is still hidden value for new entrants or if the market has already priced in future growth.

Most Popular Narrative: 3.6% Overvalued

Fortis’s current share price trades above the most popular narrative’s calculated fair value, reflecting optimism built into recent price action and analyst models. Investors are weighing whether future growth prospects can justify the premium, which sets the stage for deeper scrutiny of the valuation thesis below.

The rapid growth in electricity demand driven by large-scale data center projects in Arizona, along with continued load growth across North America, supports a multi-year expansion of Fortis's rate base. This indicates higher future revenues and earnings stability as these long-term contracts ramp up from 2027 onward.

Want to know what’s fueling this lofty estimate? The real story is layered forecasts about future earnings, revenue jumps, and sector-defying profit margins. Every number in the fair value rests on bold projections. The blueprint behind this price is not what most would expect from a utility stock. Curiosity piqued? Discover the pivotal growth expectations and number crunching that drive the narrative.

Result: Fair Value of $69.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty in key markets and rising capital costs may pose challenges to Fortis’s ability to deliver on its growth and margin projections.

Find out about the key risks to this Fortis narrative.

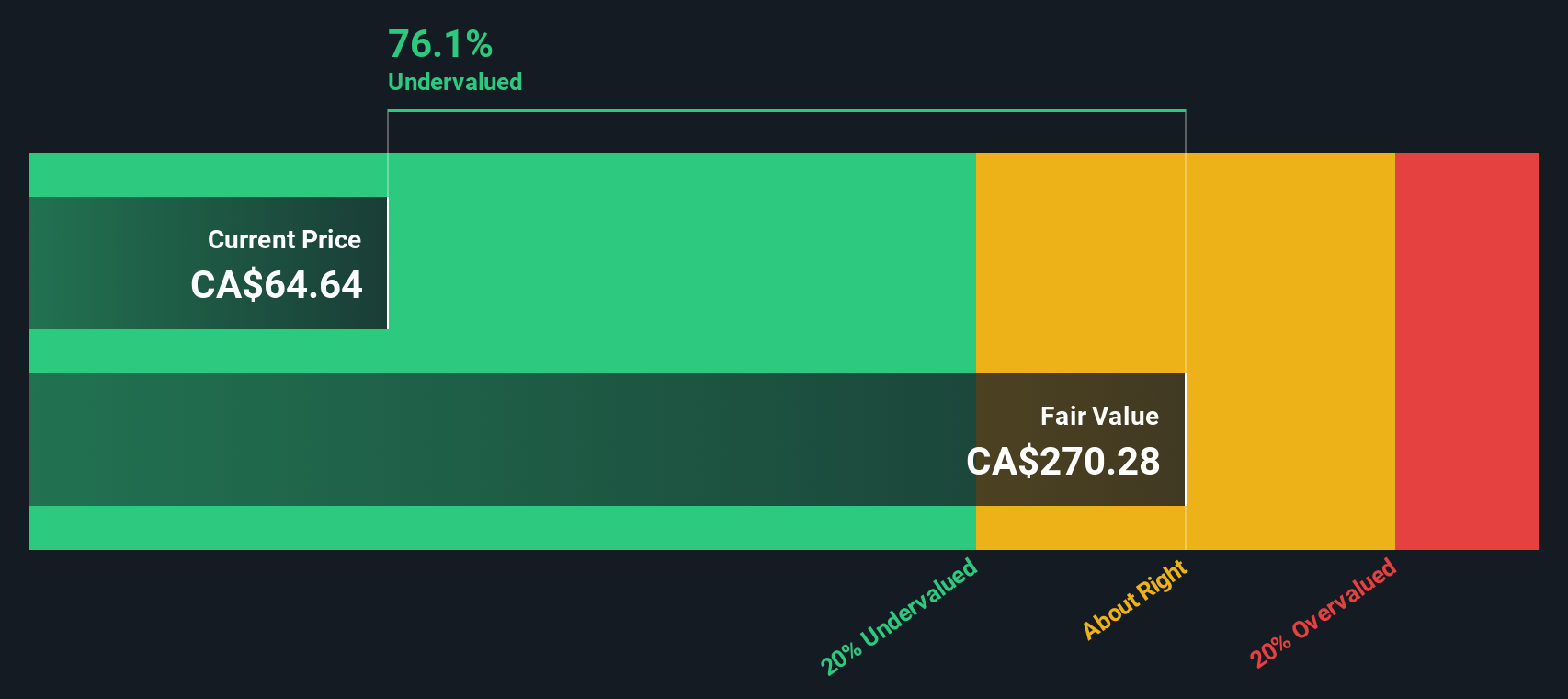

Another View: DCF Model Points to Undervaluation

Looking at Fortis through the lens of the SWS DCF model tells a different story. Despite current market concerns, our DCF suggests the stock trades below its fair value. This may indicate a potential undervaluation. Does this suggest the market has missed something, or are there risks hidden beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fortis for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fortis Narrative

If you want to dig into the numbers firsthand or have a different take on Fortis’s outlook, you can build your own forecast in just a couple of minutes. Do it your way

A great starting point for your Fortis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Smart investors always look ahead, and Simply Wall Street’s Screener brings an edge. Don’t let the next big winner pass you by.

- Capture income growth by hunting down high-yield stocks featured in these 16 dividend stocks with yields > 3%, perfect for boosting your cash flow.

- Tap into the momentum of cutting-edge artificial intelligence advancements with these 24 AI penny stocks and get ahead of tomorrow’s innovations.

- Supercharge your portfolio with value plays that stand out using these 875 undervalued stocks based on cash flows and seize missed opportunities before they attract the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FTS

Fortis

Operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives