- Canada

- /

- Other Utilities

- /

- TSX:CU

How Investors May Respond To Canadian Utilities (TSX:CU) Surging Q3 Profit Amid Slight Sales Dip

Reviewed by Sasha Jovanovic

- Canadian Utilities Limited reported third quarter 2025 earnings, showing net income of C$100 million and sales of C$792 million, compared to C$12 million and C$810 million, respectively, in the same period last year.

- The company achieved very large year-over-year net income growth and higher earnings per share, despite a slight decrease in sales during the quarter.

- We'll consider how Canadian Utilities' significant improvement in profitability may influence its investment outlook and prospects for margin expansion.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Canadian Utilities Investment Narrative Recap

To own shares in Canadian Utilities, you'd need to believe in the long-term resilience of Alberta’s regulated utility sector and the company’s ability to manage regulatory risk while investing in essential energy infrastructure. The sharp jump in Q3 2025 net income supports optimism for margin recovery, but since sales were slightly lower and regulatory disputes remain unresolved, the impact of these results on the main short-term catalysts and risks appears limited for now.

The recent approval from the Alberta Utilities Commission for the Yellowhead Pipeline Project is the most relevant recent announcement, as it strengthens Canadian Utilities’ position to capture future growth from expanding gas demand. This development ties directly to potential revenue drivers, but also underscores existing regulatory challenges that are still in play.

On the other hand, as sales soften and rate decisions stay uncertain, investors should be aware that...

Read the full narrative on Canadian Utilities (it's free!)

Canadian Utilities is projected to reach CA$4.6 billion in revenue and CA$808.3 million in earnings by 2028. This outlook assumes 7.4% annual revenue growth and an earnings increase of CA$362.3 million from the current CA$446.0 million.

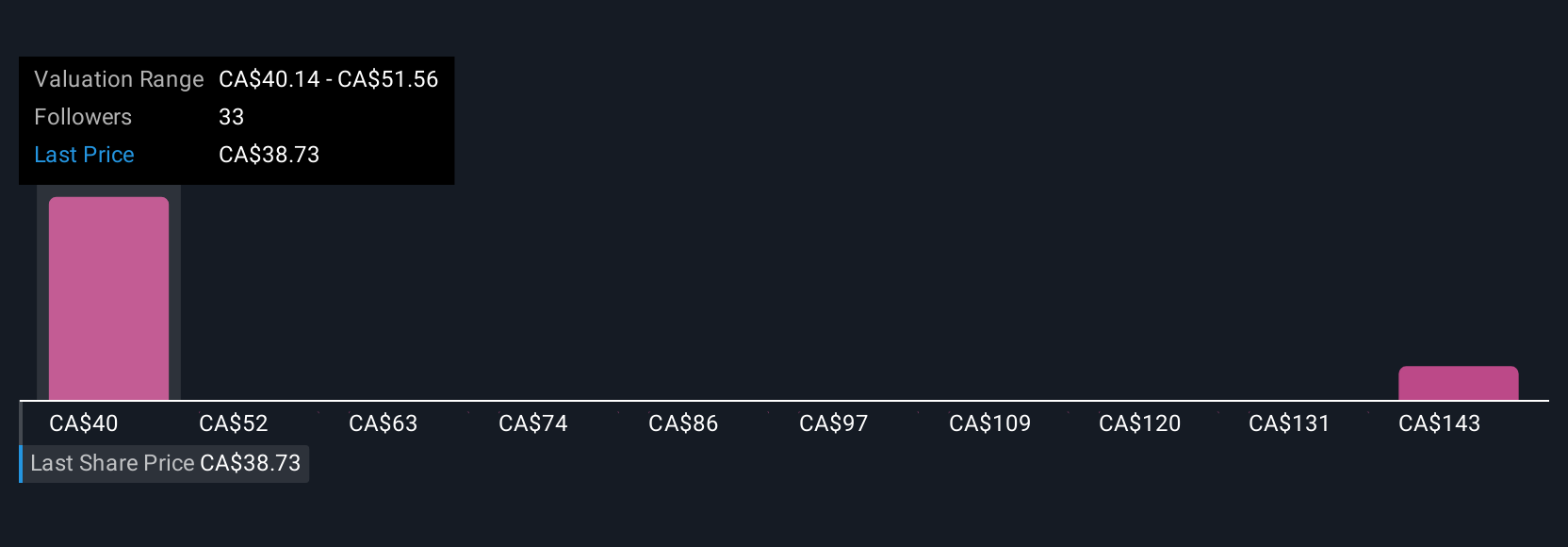

Uncover how Canadian Utilities' forecasts yield a CA$40.14 fair value, in line with its current price.

Exploring Other Perspectives

Based on three estimates from the Simply Wall St Community, Canadian Utilities’ fair value spans a broad CA$34.75 to CA$149.79. While some see deep upside, others assign far less, especially as regulatory hurdles and evolving provincial policy could shape future returns.

Explore 3 other fair value estimates on Canadian Utilities - why the stock might be worth 15% less than the current price!

Build Your Own Canadian Utilities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Utilities research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Canadian Utilities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Utilities' overall financial health at a glance.

No Opportunity In Canadian Utilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives