- Canada

- /

- Other Utilities

- /

- TSX:CU

A Rising Share Price Has Us Looking Closely At Canadian Utilities Limited's (TSE:CU) P/E Ratio

Those holding Canadian Utilities (TSE:CU) shares must be pleased that the share price has rebounded 32% in the last thirty days. But unfortunately, the stock is still down by 17% over a quarter. But that gain wasn't enough to make shareholders whole, as the share price is still down 8.1% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for Canadian Utilities

Does Canadian Utilities Have A Relatively High Or Low P/E For Its Industry?

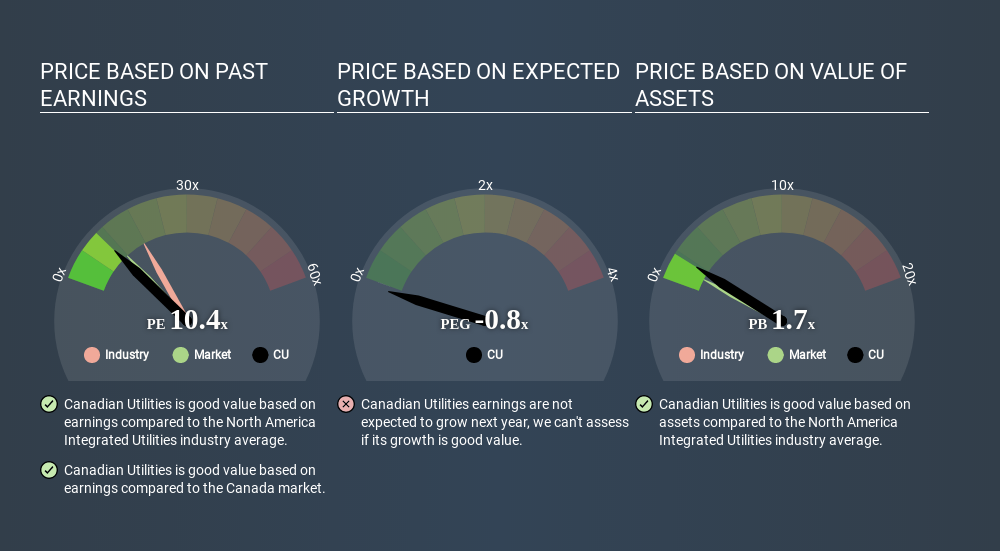

We can tell from its P/E ratio of 10.37 that sentiment around Canadian Utilities isn't particularly high. The image below shows that Canadian Utilities has a lower P/E than the average (16.4) P/E for companies in the integrated utilities industry.

Its relatively low P/E ratio indicates that Canadian Utilities shareholders think it will struggle to do as well as other companies in its industry classification. Since the market seems unimpressed with Canadian Utilities, it's quite possible it could surprise on the upside. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. And in that case, the P/E ratio itself will drop rather quickly. Then, a lower P/E should attract more buyers, pushing the share price up.

Canadian Utilities's 55% EPS improvement over the last year was like bamboo growth after rain; rapid and impressive. And earnings per share have improved by 16% annually, over the last three years. So we'd absolutely expect it to have a relatively high P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

How Does Canadian Utilities's Debt Impact Its P/E Ratio?

Canadian Utilities has net debt worth 86% of its market capitalization. This is enough debt that you'd have to make some adjustments before using the P/E ratio to compare it to a company with net cash.

The Bottom Line On Canadian Utilities's P/E Ratio

Canadian Utilities's P/E is 10.4 which is below average (11.5) in the CA market. While the EPS growth last year was strong, the significant debt levels reduce the number of options available to management. If it continues to grow, then the current low P/E may prove to be unjustified. What is very clear is that the market has become more optimistic about Canadian Utilities over the last month, with the P/E ratio rising from 7.9 back then to 10.4 today. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Canadian Utilities may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives